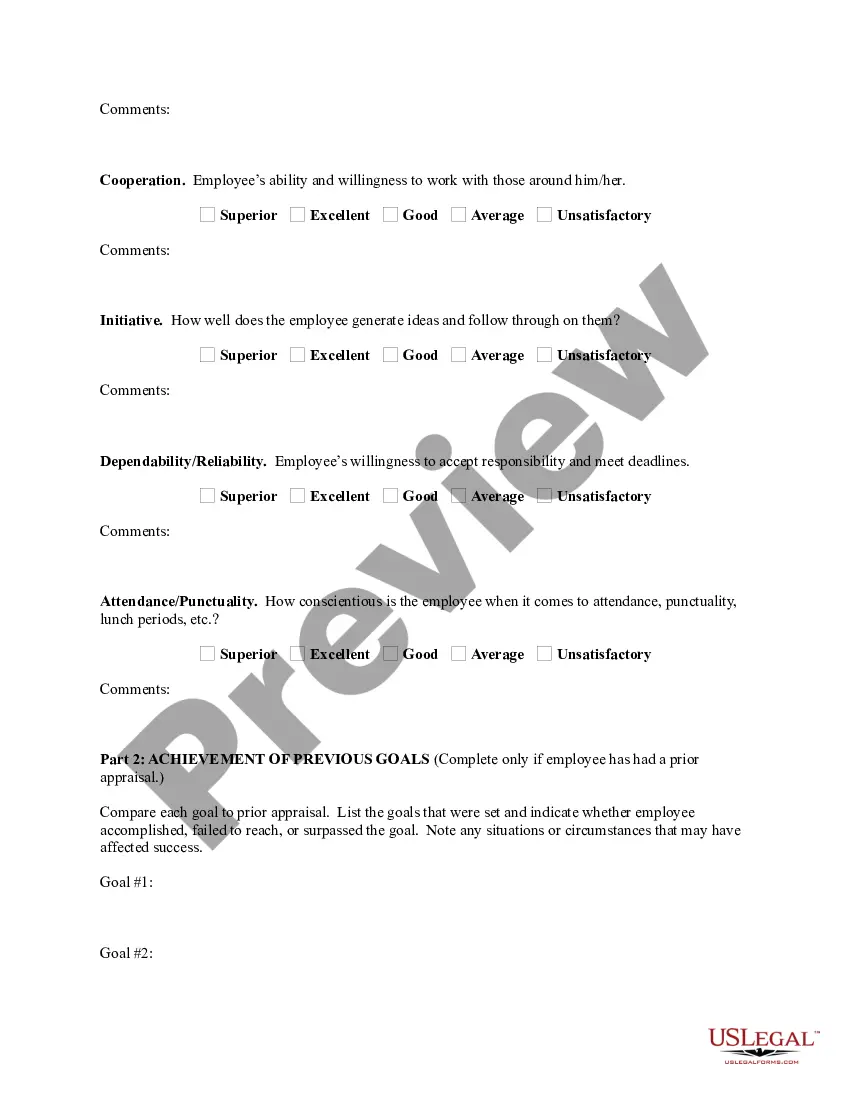

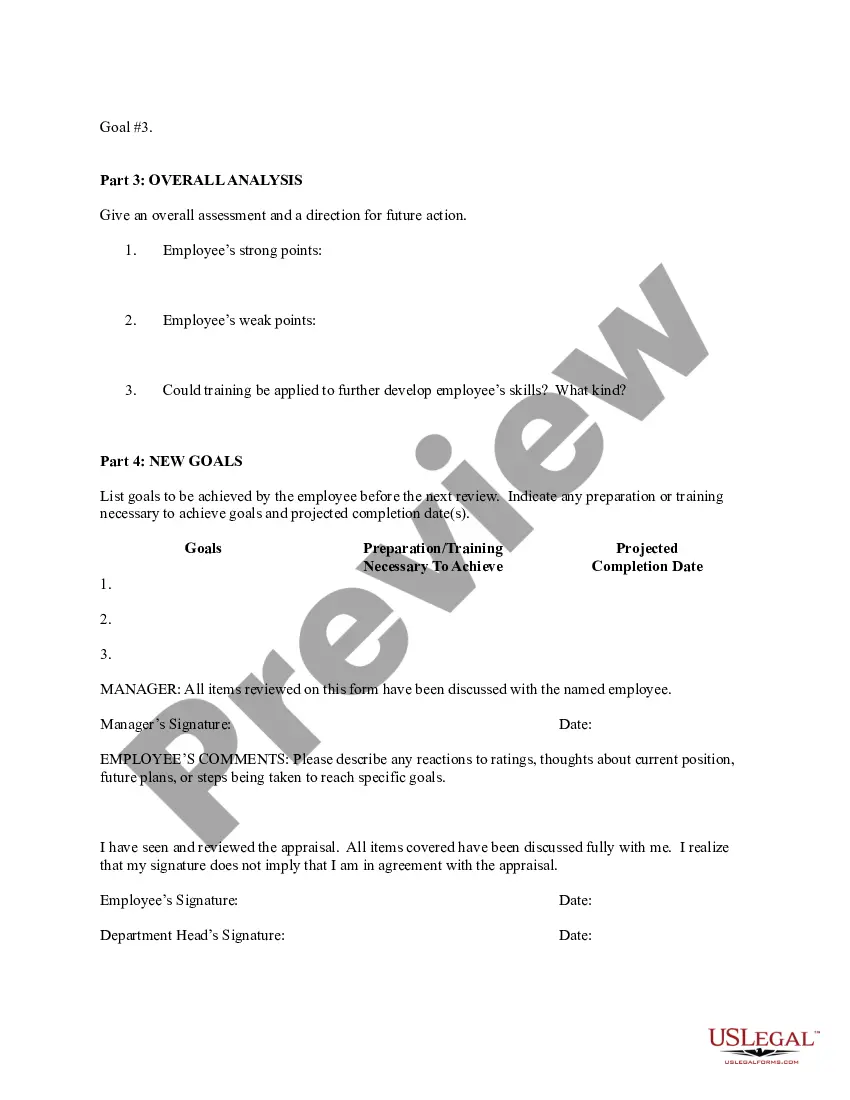

Missouri Employee Evaluation Form for Mechanic

Description

How to fill out Employee Evaluation Form For Mechanic?

Selecting the optimal valid document format can be fairly challenging.

Of course, there are numerous templates available on the internet, but how can you find the correct legitimate form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions that you should follow: First, ensure you have chosen the right form for your city/state. You can view the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not fit your requirements, use the Search field to find the appropriate form. Once you are confident that the form works for you, click on the Get now button to procure the form. Select the pricing plan you want and provide the required details. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the purchased Missouri Employee Evaluation Form for Mechanic. US Legal Forms is the largest collection of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- The service offers a vast array of templates, such as the Missouri Employee Evaluation Form for Mechanic, which can be utilized for both business and personal needs.

- All forms are reviewed by professionals and conform to federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to download the Missouri Employee Evaluation Form for Mechanic.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

Form popularity

FAQ

Corporation Income Tax: Every corporation, as defined in Chapter 143, RSMo, is required to file a return of income in Missouri for each year it is required to file a federal income tax return and the corporation's gross income from sources within Missouri are $100 or more.

Louis Refund? It is a Form used when part of the previous year's state refund is in your federal income. So if you entered a 1099-G in your federal 1040 for a state refund you received last year, this forms subtracts it out for the state return.

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.

Form MO-1040A Missouri Individual Income Tax Short Form.

How Income Taxes Are CalculatedFirst, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k).Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.More items...?01-Jan-2021

Form MO-1040A Missouri Individual Income Tax Short Form.

MO-1040A 2021 Individual Income Tax Return Single/Married (One Income)

Form MO-1040A Missouri Individual Income Tax Short Form.

Form MO-A, Part 1, computes Missouri modifications to federal adjusted gross income. Modifications on Lines 1, 2, 3, 4 and 5 include income that is exempt from federal tax, but taxable for state tax purposes.

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.