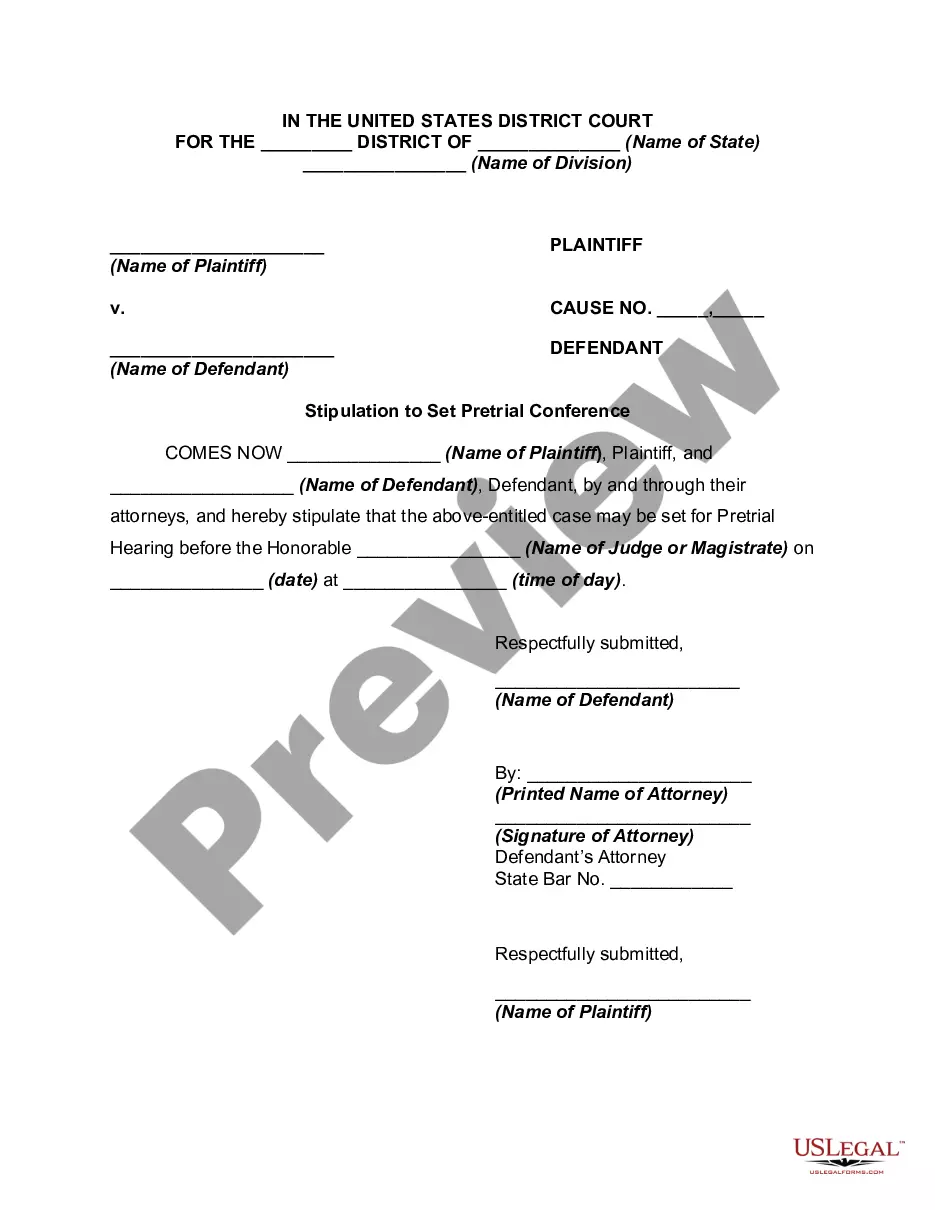

Missouri Response Letters

Description

How to fill out Response Letters?

If you need to complete, acquire, or printing lawful papers themes, use US Legal Forms, the most important selection of lawful varieties, which can be found on the web. Make use of the site`s basic and practical research to obtain the paperwork you will need. Various themes for enterprise and personal uses are sorted by types and states, or key phrases. Use US Legal Forms to obtain the Missouri Response Letters in just a couple of clicks.

If you are already a US Legal Forms consumer, log in for your profile and click on the Acquire button to obtain the Missouri Response Letters. You can also entry varieties you formerly delivered electronically within the My Forms tab of the profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for your right town/region.

- Step 2. Utilize the Preview choice to look over the form`s content. Don`t overlook to read through the description.

- Step 3. If you are unhappy with all the form, make use of the Research field on top of the display to discover other versions in the lawful form web template.

- Step 4. Upon having discovered the form you will need, click the Buy now button. Choose the pricing strategy you prefer and add your references to register for an profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Choose the file format in the lawful form and acquire it on your system.

- Step 7. Comprehensive, modify and printing or indication the Missouri Response Letters.

Every lawful papers web template you purchase is your own for a long time. You possess acces to every form you delivered electronically within your acccount. Select the My Forms area and select a form to printing or acquire yet again.

Remain competitive and acquire, and printing the Missouri Response Letters with US Legal Forms. There are thousands of professional and express-specific varieties you can use for the enterprise or personal requirements.

Form popularity

FAQ

Hear this out loud PausePrivate Letter Rulings are written decisions by the Internal Revenue Service (IRS) in response to a Taxpayer's requests for guidance. A Private Letter Ruling binds only the IRS and the requesting Taxpayer. Thus, a Private Ruling may not be cited or relied upon as precedent.

Hear this out loud PauseA Notice of Balance Due has been issued because of an outstanding tax delinquency. Failure to resolve the tax issue, within the stated time limits on the notice, will result in the suspension of your professional license or the loss of employment with the State of Missouri.

A Satisfaction/Discharge of Tax Lien will be issued within 45-60 days from the date that the debt was resolved. You may resolve the debt by either making payment in full or submitting documentation showing you do not owe the debt.

If you would like to receive a binding determination concerning the specific facts of your situation, submit a Request for Letter Ruling (Form 5859 Document). Any taxpayer may request a binding letter ruling. You must follow specific rules when making your request.

A Notice of Balance Due has been issued because of an outstanding tax delinquency. Failure to resolve the tax issue, within the stated time limits on the notice, will result in the suspension of your professional license or the loss of employment with the State of Missouri.

Hear this out loud PauseA private letter ruling (PLR) is a written decision by the Internal Revenue Service (IRS) that is sent in response to a taxpayer's request for guidance on unusual circumstances or complex questions about their specific tax situation. For certain transactions involving large amounts of money, the tax law may be unclear.

Hear this out loud Pauseing to Letter Ruling 7233, an out-of-state business that uses a Missouri supplier may use an out-of-state resale certificate to purchase items for resale tax free.