Missouri EEO Contractor Agreement

Description

How to fill out EEO Contractor Agreement?

Locating the appropriate legal document template can be challenging. Naturally, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Missouri EEO Contractor Agreement, which can be utilized for both business and personal purposes.

All of the forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the Missouri EEO Contractor Agreement. Use your account to browse the legal forms you have previously obtained. Visit the My documents tab in your account to download another copy of the document you need.

Complete, modify, print, and sign the acquired Missouri EEO Contractor Agreement. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Utilize the service to download properly designed documents that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

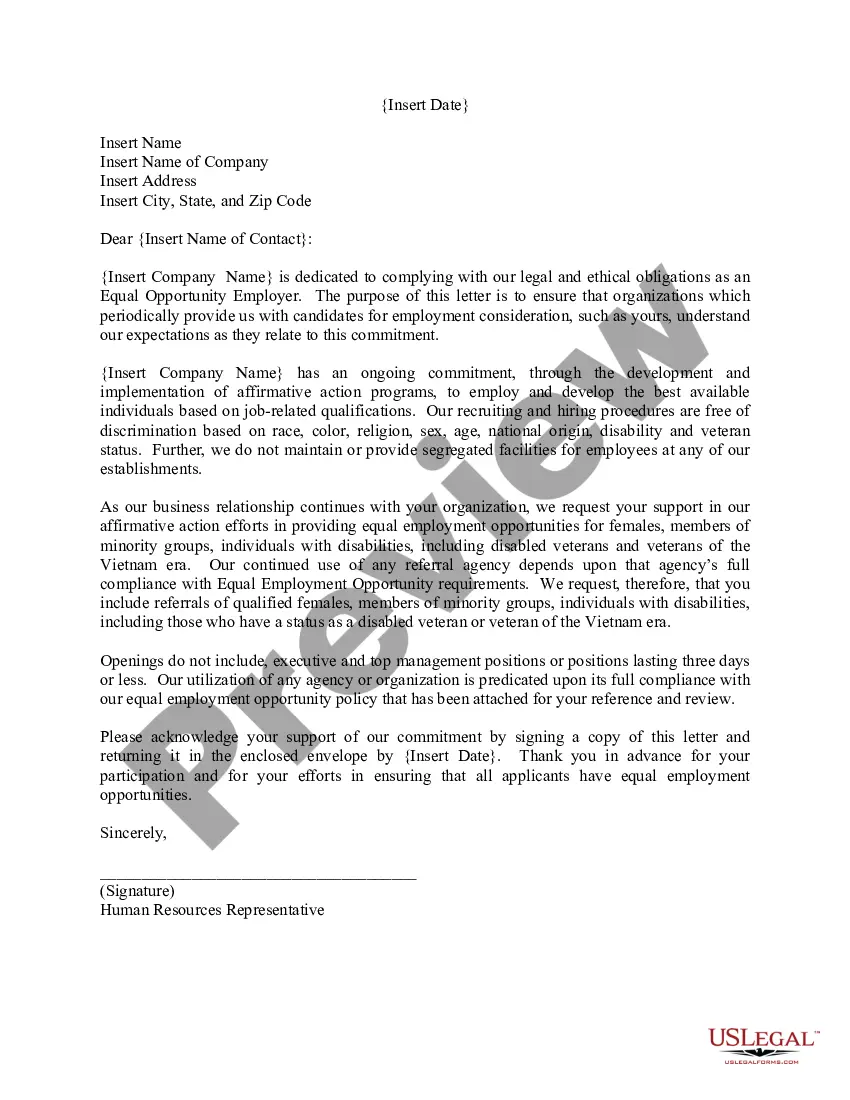

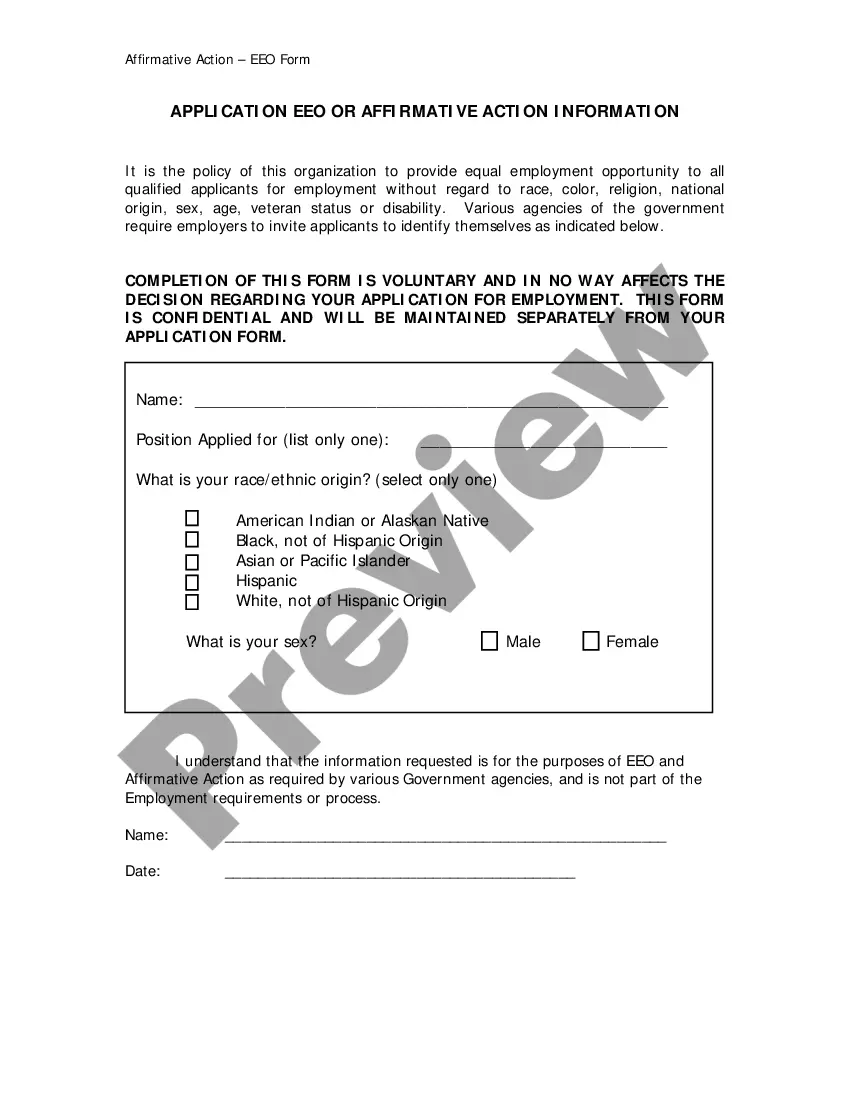

- First, ensure you have selected the correct form for your city/county. You can preview the form using the Review button and read the form description to confirm it is the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are sure that the form is suitable, go through the Purchase now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and process the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

The Missouri Supreme Court has defined an independent contractor as "one who, exercising an independent employment, contracts to do a piece of work according to his own methods, without being subject to the control of his employer, except as to the result of his work" (Vaseleou v. St.

And in fact, under the law, employers cannot be held liable for the acts of their independent contractors. However, just because an employer asserts that a negligent worker is an independent contractor does not shut down the question of employer liability.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

To qualify, individuals must 1) have earned at least $5,000 in self-employment income in the most recent taxable year before they applied for regular unemployment, 2) submit documentation substantiating their self-employment income, and 3) must be receiving benefits from regular unemployment, Pandemic Emergency

Employees at businesses with fewer than two employees. Employees at businesses that have an annual revenue of less than $500,000 and who do not engage in interstate commercei Railroad workers (covered instead by the Railway Labor Act) Truck drivers (covered instead by the Motor Carriers Act)

But in a strict sense, self-employed contractors do not have the rights and protections afforded to employees and workers. However, even if someone is described as being self-employed in their contract and pays tax as a self-employed person, they may in fact have 'worker' or, in some cases, 'employee' status.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

Generally, the FLSA applies to employees of enterprises that have an annual gross volume of sales made or business done totaling $500,000 or more, and to employees individually covered by the law because they are engaged in interstate commerce or in the production of goods for commerce.

FEHA typically protects independent contractors as well as employees.

Unemployment compensation under the PUA program provides for up to 39 weeks of benefits for individuals who are self-employed (including independent contractors).