Missouri Annuity as Consideration for Transfer of Securities

Description

How to fill out Annuity As Consideration For Transfer Of Securities?

If you want to aggregate, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to find the documents you require.

A variety of templates for business and personal needs are categorized by types and states, or keywords. Use US Legal Forms to obtain the Missouri Annuity as Consideration for Transfer of Securities with just a few clicks of the mouse.

Each legal document template you purchase is yours permanently. You will have access to every form you saved within your account. Click the My documents section and select a form to print or download again.

Compete and download, and print the Missouri Annuity as Consideration for Transfer of Securities with US Legal Forms. There are millions of professional and state-specific forms available for your personal business or individual needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Missouri Annuity as Consideration for Transfer of Securities.

- You can also access forms you have saved previously in the My documents tab of your account.

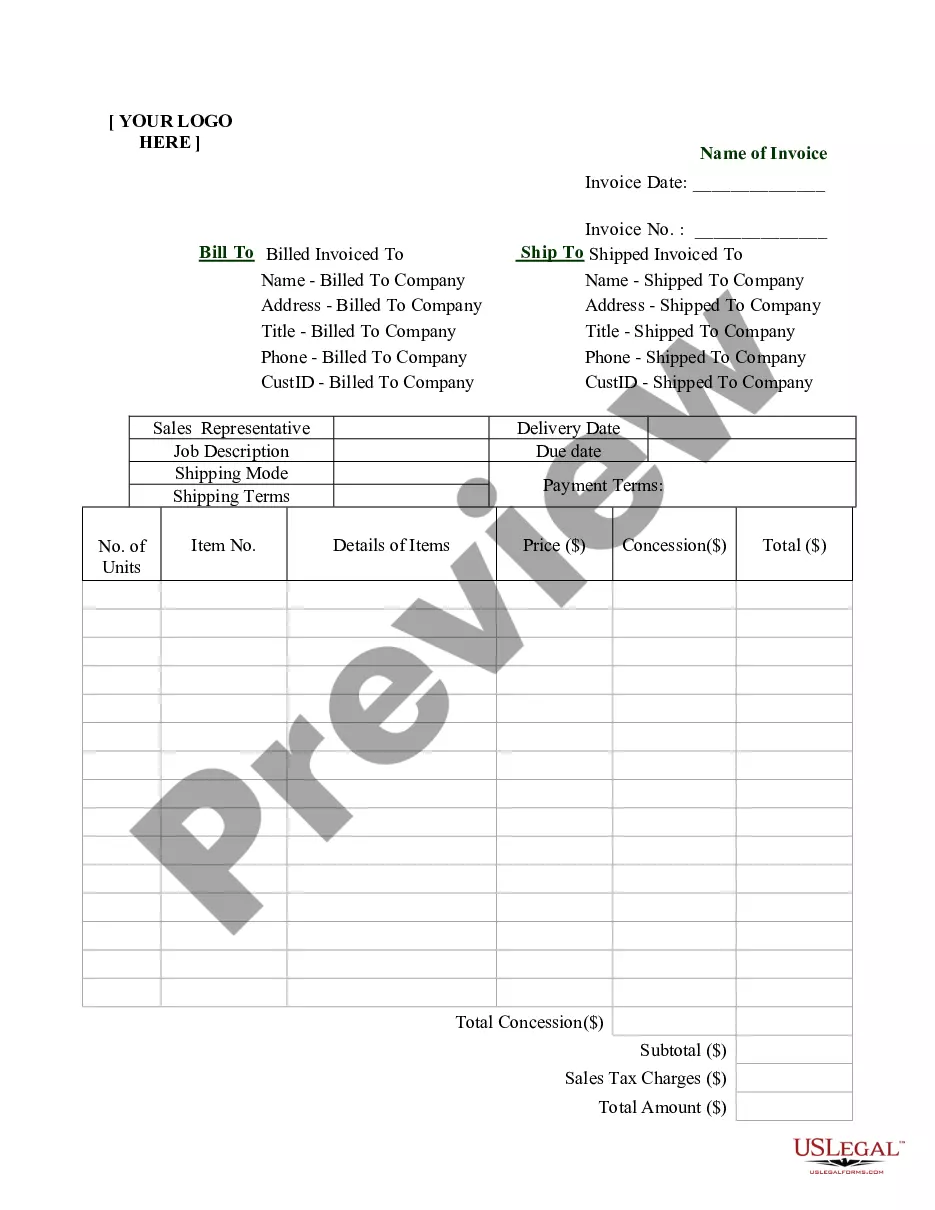

- Step 1. Make sure you have chosen the form for your specific city/state.

- Step 2. Utilize the Preview feature to review the content of the form. Be sure to read the overview.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Missouri Annuity as Consideration for Transfer of Securities.

Form popularity

FAQ

Yes, you can roll over or exchange a fixed annuity for a new annuity. Check to make sure that surrender charges don't apply, however. Typically, a minimum deposit of at least $5,000 will be required.

Annuities outside of an IRA structure can be transferred as a nontaxable event by using the IRS approved 1035 transfer rule. Annuities within an IRA can transfer directly to another IRA with an annuity carrier, and not create any tax consequences as well.

One of the main reasons to annuitize an annuity would be the guarantee yourself a set amount of income over a period of time, or even the rest of your life. Annuitization ensures that, regardless of financial situations are hardships, you will always be guaranteed to have at least some money coming in each month.

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

A 1035 transfer is a tax-free transfer from one insurance company annuity to another. You don't pay taxes or penalties if you transfer the funds this way.

If you outlive the annuity's terms, you and the provider simply part ways. If you die before the annuity's term runs out, the contract isn't canceled, as with a lifetime annuity, but can be passed to heirs. Your heirs may receive a lump-sum payout of the annuity's value rather than continuing to receive your benefits.

In the case of annuities, you can surrender your existing contract for another annuity with a different insurance company without fear of IRS penalties or restrictions.

Annuitization is the process of converting an annuity into periodic income payments. Annuities can be annuitized for a specific amount of time or for the life of the annuitant. Payments can be made only to the annuitant or to the annuitant and second annuitant in a joint-life annuity. Most annuities are not annuitized.

Contact your annuity company and let your account manager know you want to change the owner of your contract. The annuity company will send you a change of ownership form. Fill out the change of ownership form for your annuity.

An annuity consideration or premium is the money an individual pays to an insurance company to fund an annuity or receive a stream of annuity payments. An annuity consideration may be made as a lump sum or as a series of payments, often referred to as contributions.