Missouri Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

You might invest ample time online looking for the legal document template that meets the requirements of federal and state regulations you require.

US Legal Forms offers a vast array of legal documents that have been assessed by professionals.

It’s easy to obtain or create the Missouri Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase through our service.

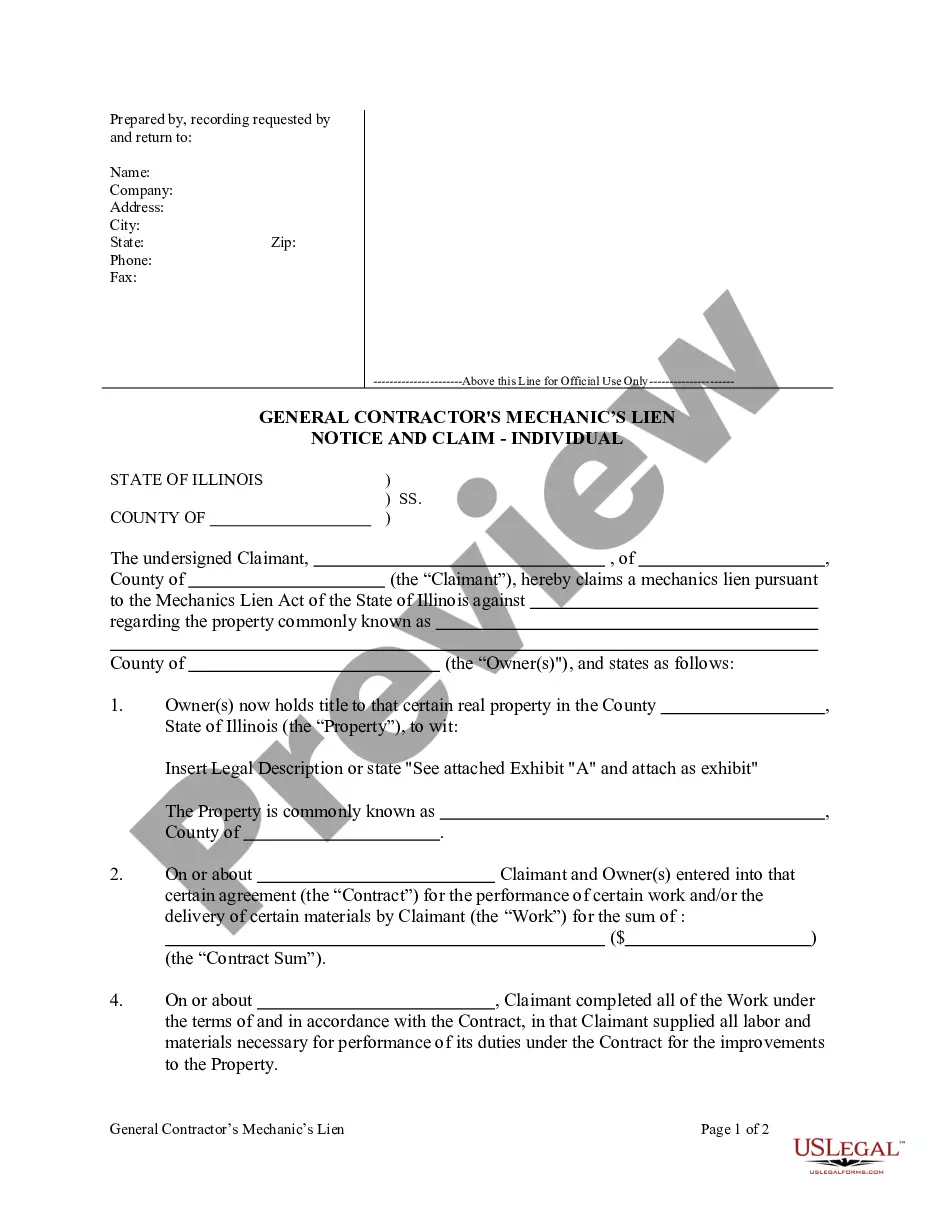

If available, utilize the Review option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, edit, print, or sign the Missouri Net Lease of Equipment (Personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- Every legal document template you obtain is your property indefinitely.

- To get another copy of any acquired document, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- Firstly, ensure that you have selected the appropriate document template for the county/area of your choice.

- Check the document details to make sure you have chosen the correct template.

Form popularity

FAQ

To obtain a Missouri tax exempt letter, you typically need to complete an application form provided by the Missouri Department of Revenue. You'll need to demonstrate your eligibility based on the type of exempt use, which includes criteria like educational or charitable purposes. Engaging with professional legal services or platforms like uslegalforms can guide you through the process effectively, especially if you are managing a Missouri Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase.

In Missouri, certain services are classified as non-taxable. For instance, many personal services, such as consulting or staffing services, do not incur sales tax. Additionally, if you're utilizing a Missouri Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it may also help clarify your tax obligations since leasing equipment is often treated differently under state law.

Most equipment leases will provide that if a default exists and the lessee has not yet filed for bankruptcy, the lessor is permitted to terminate the lease and recover its equipment.

Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate. In addition to triple net leases, the other types of net leases are single net leases and double net leases.

Gross leases are commonly used for commercial properties, such as office buildings and retail spaces. Modified leases and fully service leases are the two types of gross leases. Gross leases are different from net leases, which require the tenant to pay one or more of the costs associated with the property.

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

The three main types of leasing are finance leasing, operating leasing and contract hire.

Key takeaway: With an operating lease, you have access to the equipment for a time but don't own it. The lease period tends to be shorter than the life of the equipment. With a finance lease, you own the equipment at the end of the term. Big companies typically use this type of lease.