Missouri Post Bankruptcy Petition Discharge Letter

Description

How to fill out Post Bankruptcy Petition Discharge Letter?

If you need to complete, down load, or print out lawful document web templates, use US Legal Forms, the most important assortment of lawful kinds, which can be found on the Internet. Take advantage of the site`s simple and handy research to get the papers you require. Different web templates for business and individual uses are categorized by categories and states, or key phrases. Use US Legal Forms to get the Missouri Post Bankruptcy Petition Discharge Letter with a number of mouse clicks.

Should you be previously a US Legal Forms customer, log in to the bank account and click on the Download button to get the Missouri Post Bankruptcy Petition Discharge Letter. Also you can access kinds you previously saved from the My Forms tab of your own bank account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape to the correct town/region.

- Step 2. Use the Preview method to look through the form`s content. Do not neglect to read through the information.

- Step 3. Should you be not satisfied with all the develop, use the Look for area towards the top of the display screen to find other models of your lawful develop design.

- Step 4. After you have located the shape you require, click on the Acquire now button. Select the costs plan you choose and put your qualifications to register for the bank account.

- Step 5. Process the purchase. You can utilize your bank card or PayPal bank account to complete the purchase.

- Step 6. Select the format of your lawful develop and down load it on your gadget.

- Step 7. Total, edit and print out or sign the Missouri Post Bankruptcy Petition Discharge Letter.

Every lawful document design you buy is yours permanently. You might have acces to each develop you saved with your acccount. Click the My Forms section and choose a develop to print out or down load again.

Remain competitive and down load, and print out the Missouri Post Bankruptcy Petition Discharge Letter with US Legal Forms. There are thousands of expert and state-particular kinds you may use to your business or individual needs.

Form popularity

FAQ

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

It merely means you have filed a petition under Chapter 7 of the Bankruptcy Code. It does not indicate the disposition of the petition, which could have been dismissed or could have produced a discharge of some debts.

Closing a Chapter 7 Bankruptcy After DischargeA Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

Protection from your creditors begins immediately after filing for Chapter 7 or Chapter 13 bankruptcy. This is called the automatic stay. Once you file and the automatic stay takes effect, your creditors are not allowed to take collection action against you.

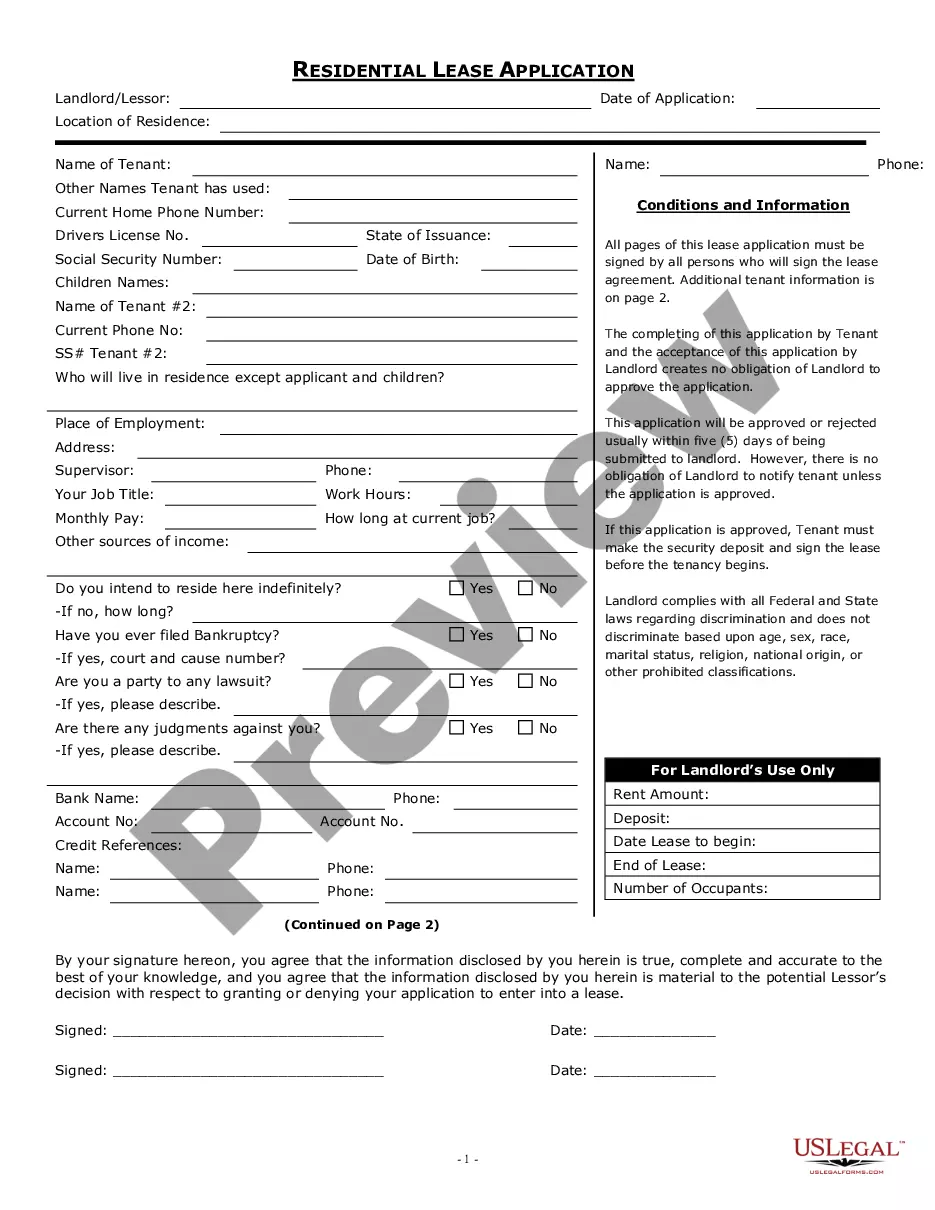

A Bankruptcy petition is a collection of forms also known as schedules that disclose all of your financial information to the Bankruptcy Court. These forms will list all of your assets (real and personal property), monthly income and expenses and most importantly the liabilities and debts you wish to eliminate.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.