Missouri Sample Letter for Explanation of Bankruptcy

Description

How to fill out Sample Letter For Explanation Of Bankruptcy?

If you need to acquire comprehensive, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

A range of templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the necessary form, click the Buy now button. Choose your preferred pricing plan and provide your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Missouri Sample Letter for Explanation of Bankruptcy with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Missouri Sample Letter for Explanation of Bankruptcy.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, please follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

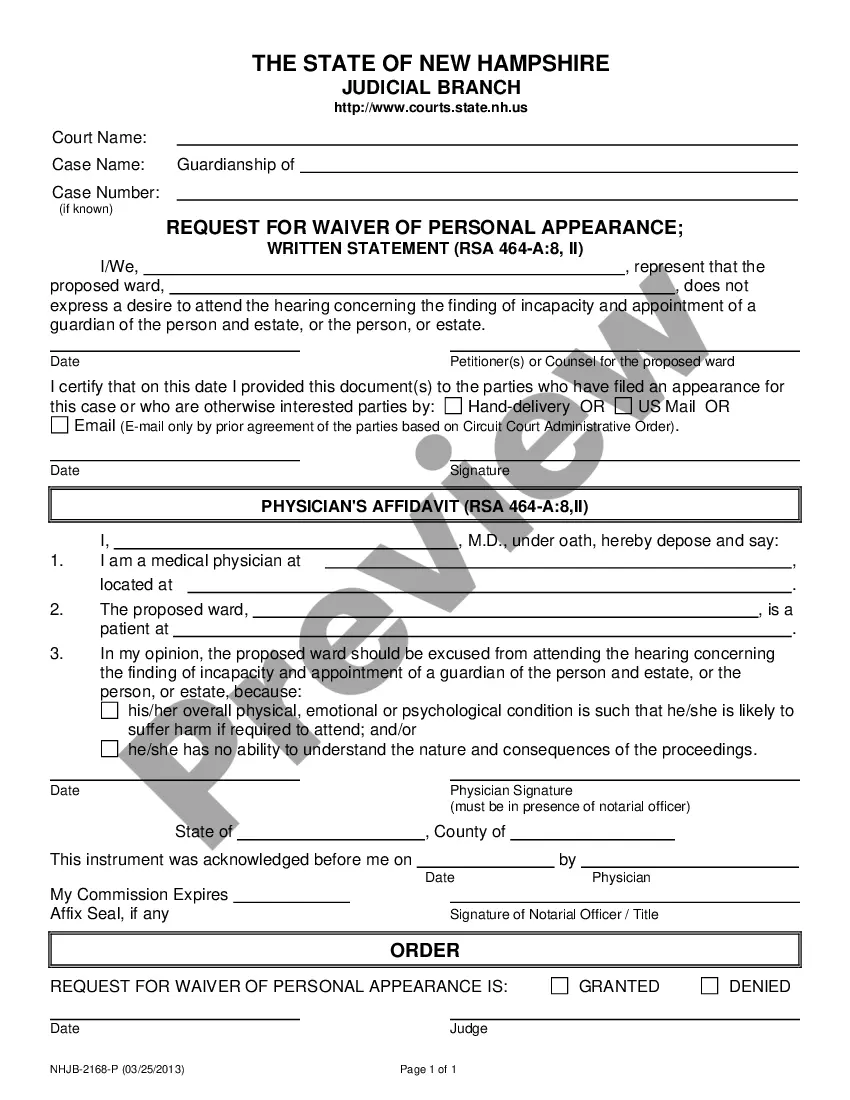

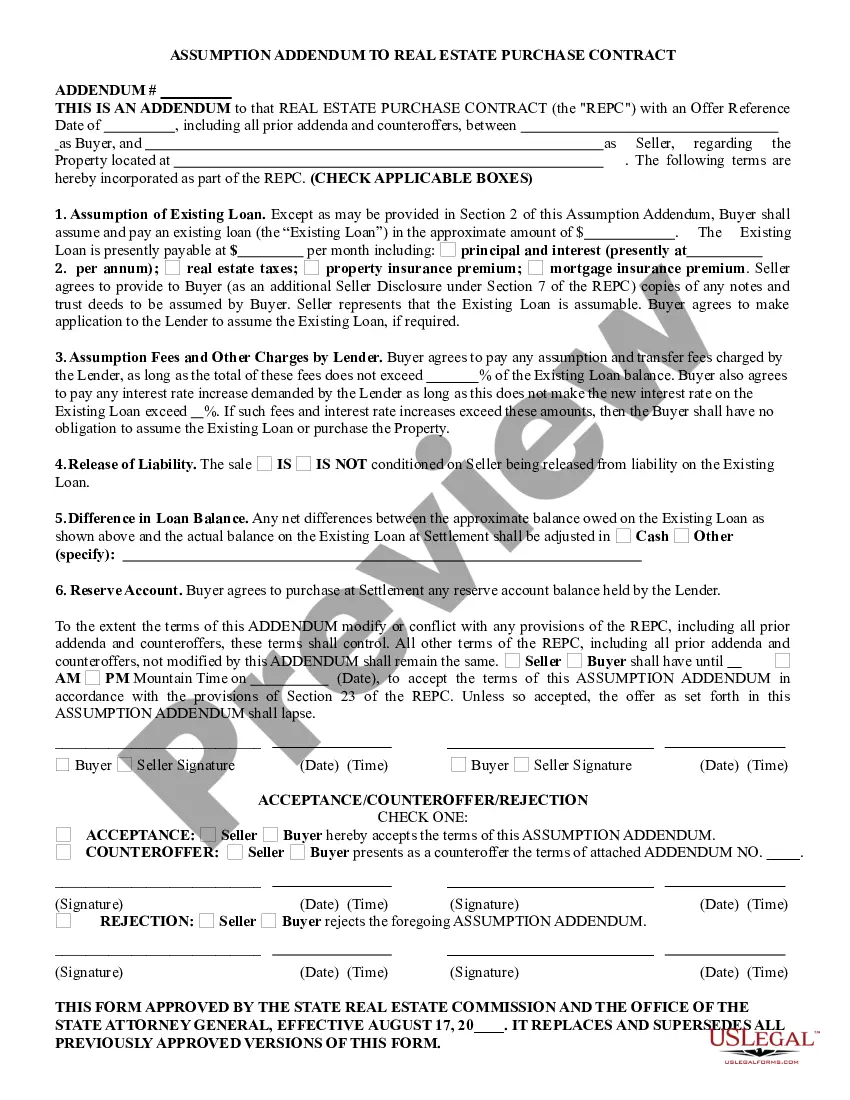

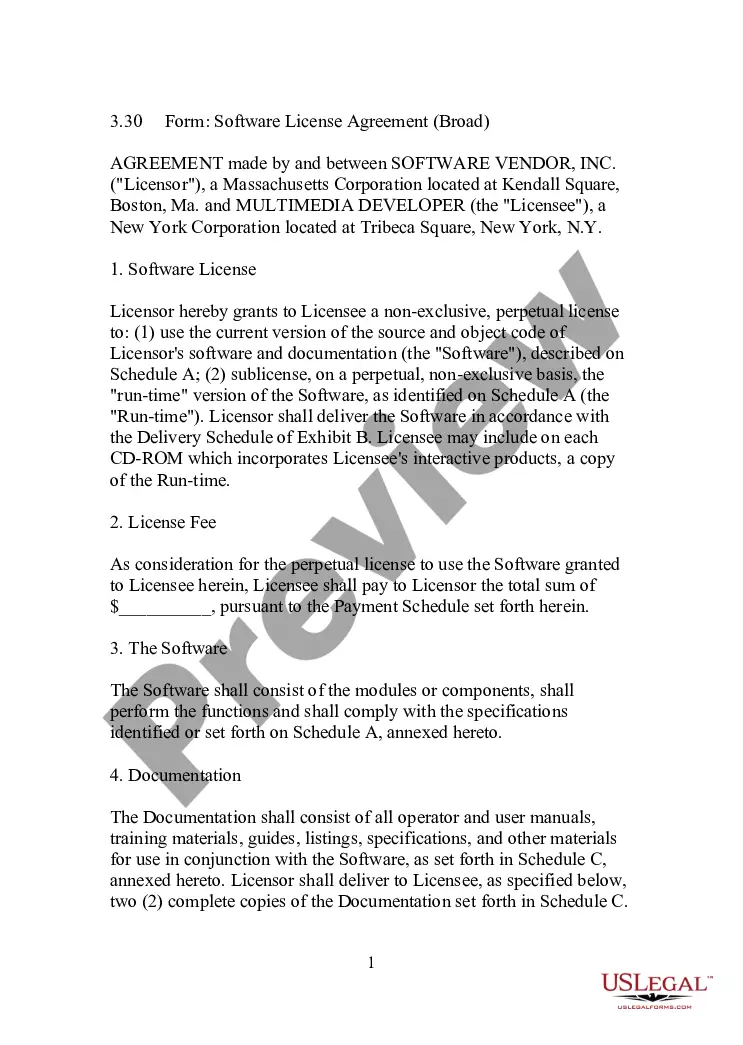

- Step 2. Use the Preview option to review the form's details. Remember to read the information thoroughly.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy.

Most explanation letters are just used as a way to connect the dots, and when that's done the underwriter is satisfied with the information provided. Then they can move forward with underwriting and approving the loan, and the borrower can get the home they were hoping to buy.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

An underwriter's job is to assess your financials and decide whether you're a good candidate for a home loan. The information the underwriter sees doesn't always tell your entire financial story. An underwriter may request a letter of explanation from you if they're unsure about something they see.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledge. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledgment. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

In other words, a letter of explanation is exactly what it sounds like. The lender and their underwriter are asking the borrower to explain something. That could be a change in jobs, a gap in employment, a large deposit into their bank account, a source of self-employed income, or just about anything else.