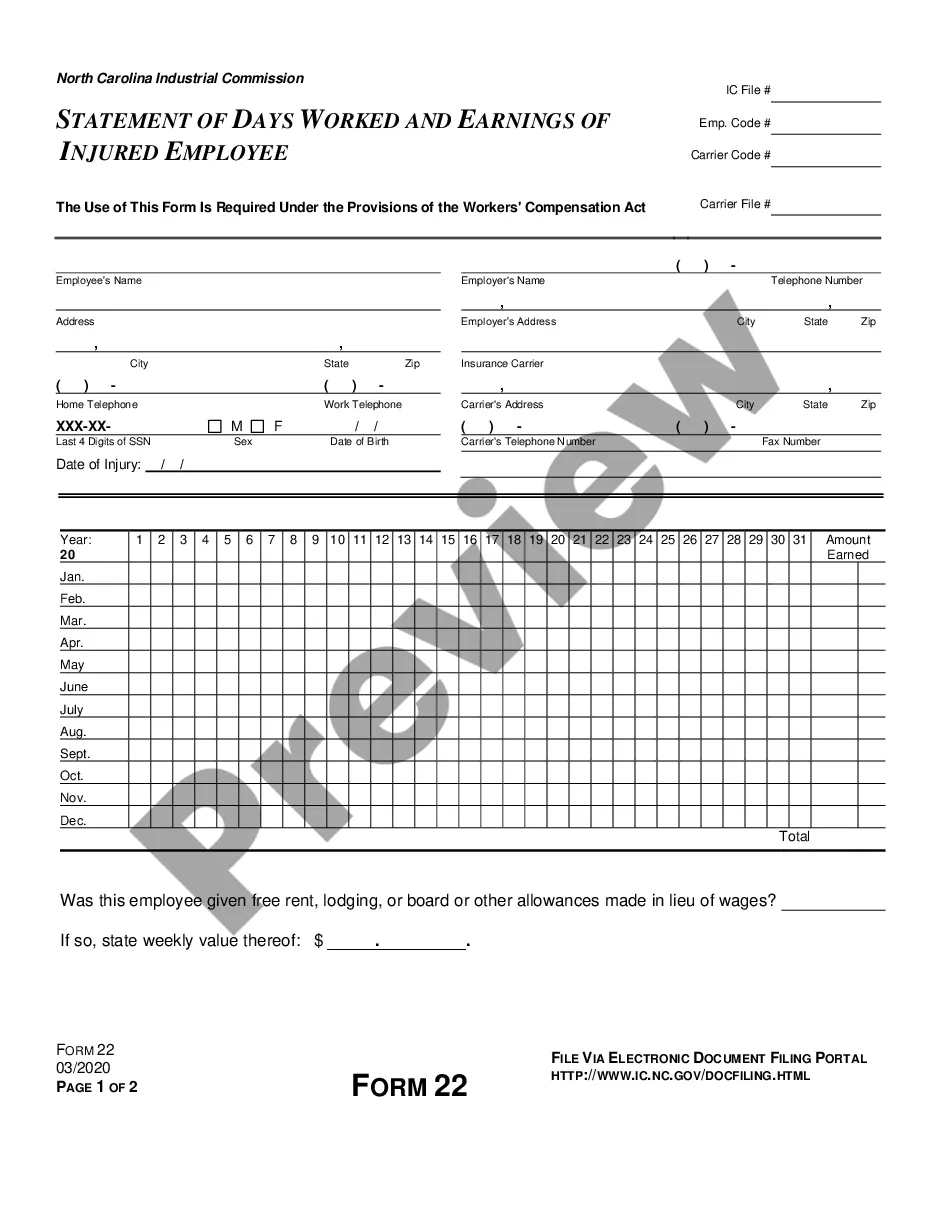

This Depreciation Worksheet is a template used by companies for creating a worksheet to evaluate depreciation expenses. The Depreciation Worksheet organizes and outlines a company's depreciation expenses and can be customized for a company's specific usage.

Missouri Depreciation Worksheet

Description

How to fill out Depreciation Worksheet?

US Legal Forms - among the largest collections of legal documents in the United States - offers a wide range of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can discover the latest forms such as the Missouri Depreciation Worksheet within moments.

If you already possess a subscription, Log In and download the Missouri Depreciation Worksheet from the US Legal Forms catalog. The Download button will be visible on each form you view.

Once you are content with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you wish and provide your credentials to register for the account.

Process the payment. Use your credit card or PayPal account to complete the purchase. Choose the format and download the form to your device. Make modifications. Fill out, modify, print, and sign the downloaded Missouri Depreciation Worksheet. Each template you added to your account does not have an expiration date and is permanently yours. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

- You have access to all previously acquired forms in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to review the form’s content.

- Examine the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

You can get a depreciation schedule from various sources, including accounting software and online templates. A Missouri Depreciation Worksheet is an excellent option for those needing a more structured approach. Consider using platforms like USLegalForms, which offer ready-to-use worksheets tailored for different states. This way, you ensure compliance and ease of use in your financial planning.

Your depreciation schedule can typically be found on IRS Form 4562, which details depreciation and amortization. If you're using a Missouri Depreciation Worksheet, it may also assist you in compiling the necessary information for your tax return. Look for section listings that correspond with your asset categories. This organization makes it easier to ensure you have accurately reported your depreciation.

To obtain a depreciation schedule, you can use a Missouri Depreciation Worksheet available online. You can find templates or software that generate these documents automatically. If you prefer professional help, consider consulting an accountant who understands depreciation methods. This way, you ensure accuracy and compliance with tax regulations.

Yes, you can create your own depreciation schedule, provided you follow accounting principles. To make it more manageable, you might want to use a Missouri Depreciation Worksheet as a template or guide. US Legal Forms offers an easy-to-use platform to help you build and customize your schedule according to your specific needs.

Yes, depreciation does affect state taxes, as it can reduce your taxable income. The impact can vary based on how the state views depreciation compared to federal guidelines. It's crucial to use the Missouri Depreciation Worksheet to understand how your depreciation will influence your overall state tax liability.

In most cases, Missouri aligns with federal depreciation rules. However, certain state-specific adjustments may apply, so review the details closely. By using the Missouri Depreciation Worksheet, you can easily compare state and federal rules and ensure accurate reporting.

The federal deduction for Missouri generally consists of standard deductions, itemized deductions, and specific credits you may qualify for. Your allowable deductions may change based on your filing status and the deductions you can claim from the Missouri Depreciation Worksheet. Be detailed in your calculations to maximize your tax benefits.

Missouri does conform to the federal net operating loss (NOL) rules but with certain modifications. Ensure you understand how these differences may impact your tax situation. Using the Missouri Depreciation Worksheet can assist you in accurately reporting your losses and understanding their implications.

Yes, Missouri generally follows federal bonus depreciation rules. However, there may be specific state adjustments, so it is essential to verify your eligibility. The Missouri Depreciation Worksheet can help clarify your calculation and ensure you take full advantage of available deductions.

To file depreciation, report it on your tax return using the appropriate forms, such as Form 4562 for federal taxes. Be sure to include the details of your depreciation calculations from the Missouri Depreciation Worksheet. This worksheet can ensure that you have all necessary information organized and ready for filing.