A 401(k) is a type of retirement savings account in the United States, which takes its name from subsection 401(k) of the Internal Revenue Code (Title 26 of the United States Code). A contributor can begin to withdraw funds after reaching the age of 59 1/2 years. 401(k)s were first widely adopted as retirement plans for American workers, beginning in the 1980s. The 401(k) emerged as an alternative to the traditional retirement pension, which was paid by employers. Employer contributions with the 401(k) can vary, but in general the 401(k) had the effect of shifting the burden for retirement savings to workers themselves. In 2011, about 60% of American households nearing retirement age have 401(k)-type accounts .

Employers can help their employees save for retirement while reducing taxable income under this provision, and workers can choose to deposit part of their earnings into a 401(k) account and not pay income tax on it until the money is later withdrawn in retirement. Interest earned on money in a 401(k) account is never taxed before funds are withdrawn. Employers may choose to, and often do, match contributions that workers make. The 401(k) account is typically administered by the employer, while in the usual "participant-directed" plan, the employee may select from different kinds of investment options. Employees choose where their savings will be invested, usually, between a selection of mutual funds that emphasize stocks, bonds, money market investments, or some mix of the above. Many companies' 401(k) plans also offer the option to purchase the company's stock. The employee can generally re-allocate money among these investment choices at any time. In the less common trustee-directed 401(k) plans, the employer appoints trustees who decide how the plan's assets will be invested.

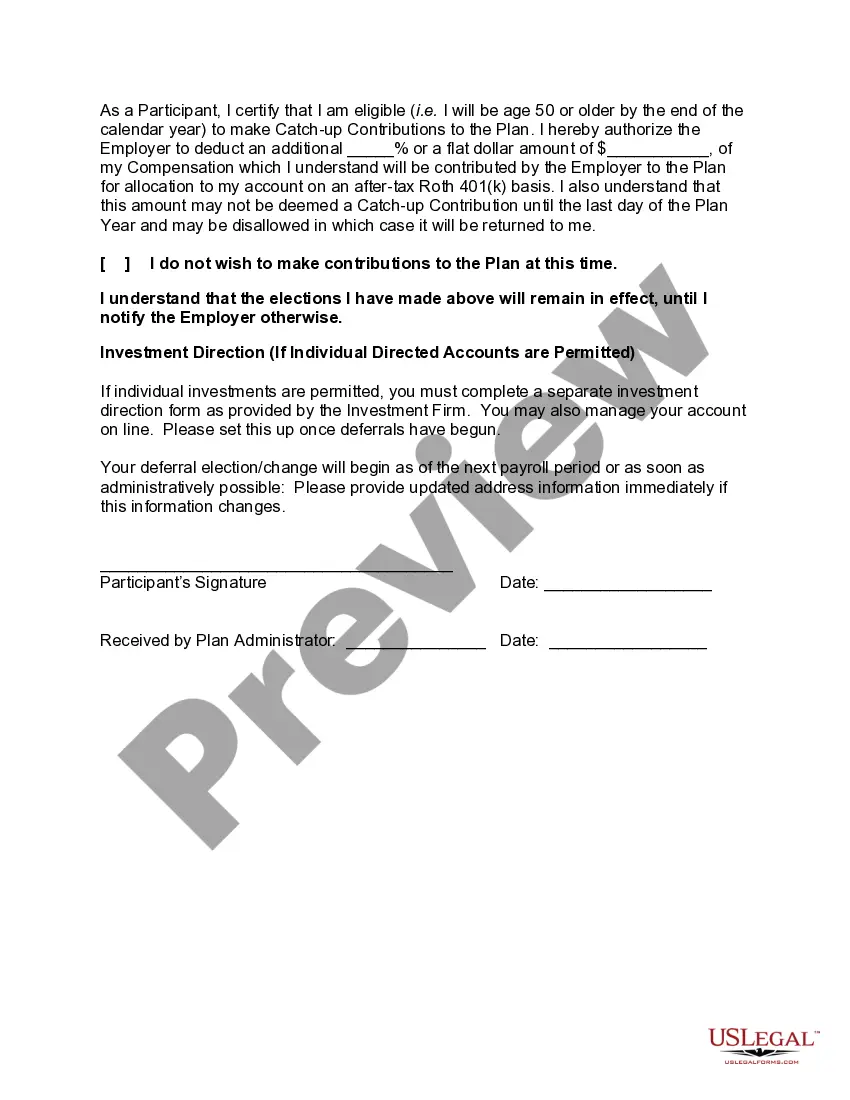

Missouri Enrollment and Salary Deferral Agreement (MESA) is a legal agreement that outlines the terms and conditions of deferring a portion of an employee's salary to be contributed towards a retirement plan or other qualified benefits. It allows employees in the state of Missouri to take advantage of tax benefits and long-term savings options. Under the MESA, employees have the option to defer a percentage of their salary, typically pre-tax, into retirement savings accounts such as 401(k), 403(b), or similar plans. The deferral amount is deducted from the employee's paycheck before taxes are applied, resulting in a lower taxable income. This deferral helps participants in saving for retirement while potentially reducing their annual tax liability. MESA contributes to the financial security of employees by providing a structured approach to saving for retirement. It offers employees the opportunity to grow their savings over time through contributions and potential investment gains. Additionally, employers may offer matching contributions or other incentive programs to further encourage employee participation. Different types of Missouri Enrollment and Salary Deferral Agreement may include variations specific to different retirement plans and employers. Some Mesas may have specific provisions for public sector employees, while others may be offered by private companies or organizations. The agreement may differ in terms of eligibility requirements, contribution limits, vesting schedules, and investment options. Employees are encouraged to review the specific terms and conditions of their respective MESA to understand the unique features and benefits applicable to their retirement savings plan. Overall, the Missouri Enrollment and Salary Deferral Agreement serves as a crucial tool for employees to enhance their retirement savings while enjoying tax advantages. It enables individuals to plan for their financial future by systematically deferring a portion of their earnings into various qualified retirement accounts. The agreement promotes financial literacy and encourages employees to take an active role in securing their retirement through consistent contributions and long-term investment strategies.