No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Missouri Collection Agency's Return of Claim as Uncollectible

Description

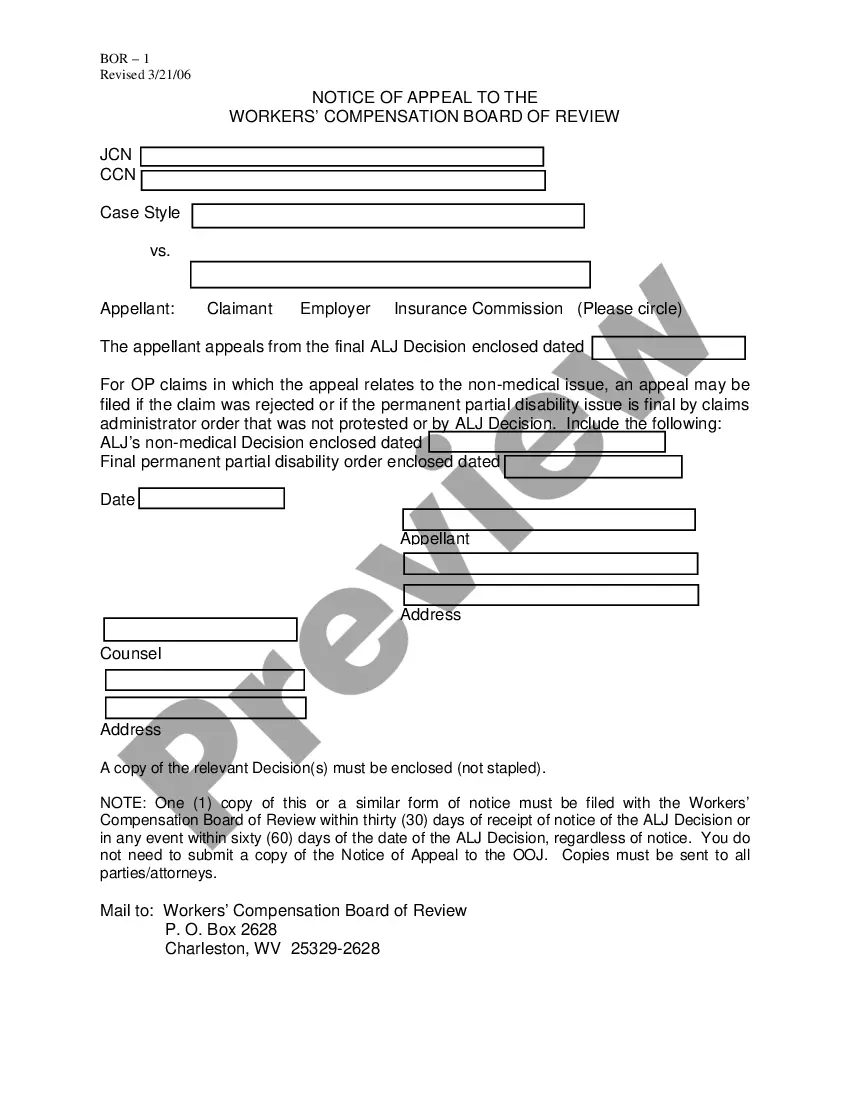

How to fill out Collection Agency's Return Of Claim As Uncollectible?

Are you presently in a situation where you require documents for either professional or personal purposes almost constantly.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Missouri Collection Agency's Return of Claim as Uncollectible, designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Select the payment plan you prefer, complete the necessary information to create your account, and finalize the transaction using PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Collection Agency's Return of Claim as Uncollectible template.

- If you do not possess an account and wish to use US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct region/county.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you're looking for, use the Search bar to find the form that meets your needs.

Form popularity

FAQ

In Missouri, the statute of limitations varies depending on the type of debt. Unsecured debt. This is a type of debt without collateral, e.g., credit cards and personal loans. The statute of limitations of unsecured debt with a written contract is ten years, while that of a verbal contract is five years.

In Missouri, there is a five-year statute of limitations for personal injury claims; but fraud and debt collection claims have a ten-year limit. For criminal charges, there is no limit for murder charges but a one-year statute of limitations for misdemeanors. Choose a link below to learn more.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

If you don't pay a debt, a creditor or its debt collector generally can sue you to collect. If they go to court and win, the court will enter a judgment against you.

Reviving Judgments in Missouri Judgment Creditors Need to Pay Close Attention to the 10-year Statute. Under Missouri law, a judgment is considered active (collectible) for ten years. This includes a monetary judgment as well as any real property liens resulting from that judgment.

It's possible in some cases to negotiate with a lender to repay a debt after it's already been sent to collections. Working with the original creditor, rather than dealing with debt collectors, can be beneficial.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Contact the creditor's customer service department. You may be able to explain your situation and negotiate a payment plan. The creditor can reclaim the debt from the collector and you can work with them directly. However, there's no law requiring the original creditor to accept your proposal.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Depending on the type of debt, Missouri statute of limitations on debt range between five to 10 years. After that period has passed, the debt becomes time-barred, which means collectors no longer have the right to sue you.