Missouri Sample Letter for Debt Collection for Client

Description

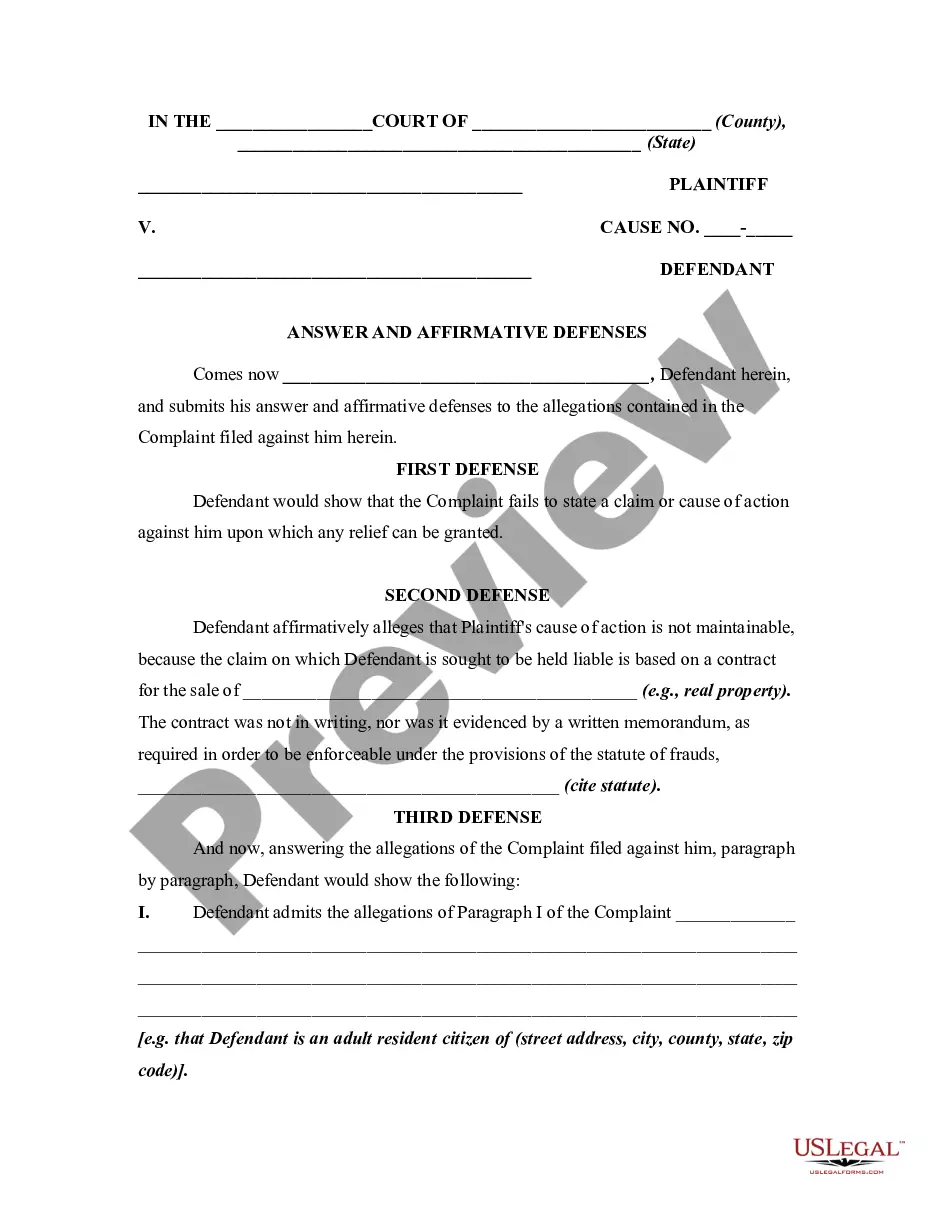

How to fill out Sample Letter For Debt Collection For Client?

You might devote hours online trying to locate the official document template that meets the federal and state requirements you seek. US Legal Forms offers thousands of legal forms that are vetted by experts. You can download or print the Missouri Sample Letter for Debt Collection for Client from my services.

If you possess a US Legal Forms account, you can sign in and click on the Get button. Then, you can fill out, edit, print, or sign the Missouri Sample Letter for Debt Collection for Client. Each legal document template you purchase is yours indefinitely. To obtain another copy of a purchased form, visit the My documents section and click on the relevant button.

If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for the region/city you choose. Review the form description to confirm you have selected the right form. If available, use the Preview button to examine the document template as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have found the template you need, click Purchase now to continue.

- Select the pricing plan you want, enter your details, and create a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to buy the legal form.

- Choose the format of your document and download it to your device.

- Make modifications to your document if necessary. You can fill out, edit, sign, and print the Missouri Sample Letter for Debt Collection for Client.

- Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

This first collection letter should contain the following information: Days past due. Amount due. Note previous attempts to collect. Summary of account. Instructions- what would you like them to do next? Due date for payment- it is important to use an actually date, not ?in the next 7 business days? as this can be vague.

How to write demand letters Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment. Description of the nature of the agreement and breach of contract.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

This is a reminder of the past-due balance on your account for _______________ in the amount of ______________________. At the present time, your balance is ____(days)___ overdue. We will appreciate payment in full immediately. We have not received your payment on this past-due account.

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

Dear [Client name], We're sending you this letter as a friendly reminder that your account in the amount of [amount due to you] is past due. Your invoice was due on [month, day and year their payment was originally due as stated in their invoice]. This payment is now [number of days since the due date] past due.

Summary: A "creditor" is not required to inform their clients before passing an account to collections. A debt collection agency is responsible for sending an initial demand letter, also known as a ?validation notice,? to notify your debtor about their account being assigned to the agency.