A limited partnership is a modified partnership. It has characteristics of both a corporation and a general partnership. In a limited partnership, certain members contribute capital, but do not have liability for the debts of the partnership beyond the amount of their investment. These members are known as limited partners. The partners who manage the business and who are personally liable for the debts of the business are the general partners. Limited partners have the right to share in the profits of the business and, if the partnership is dissolved, will be entitled to a percentage of the assets of the partnership. A limited partner may lose his limited liability status if he participates in the control of the business.

Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership

Description

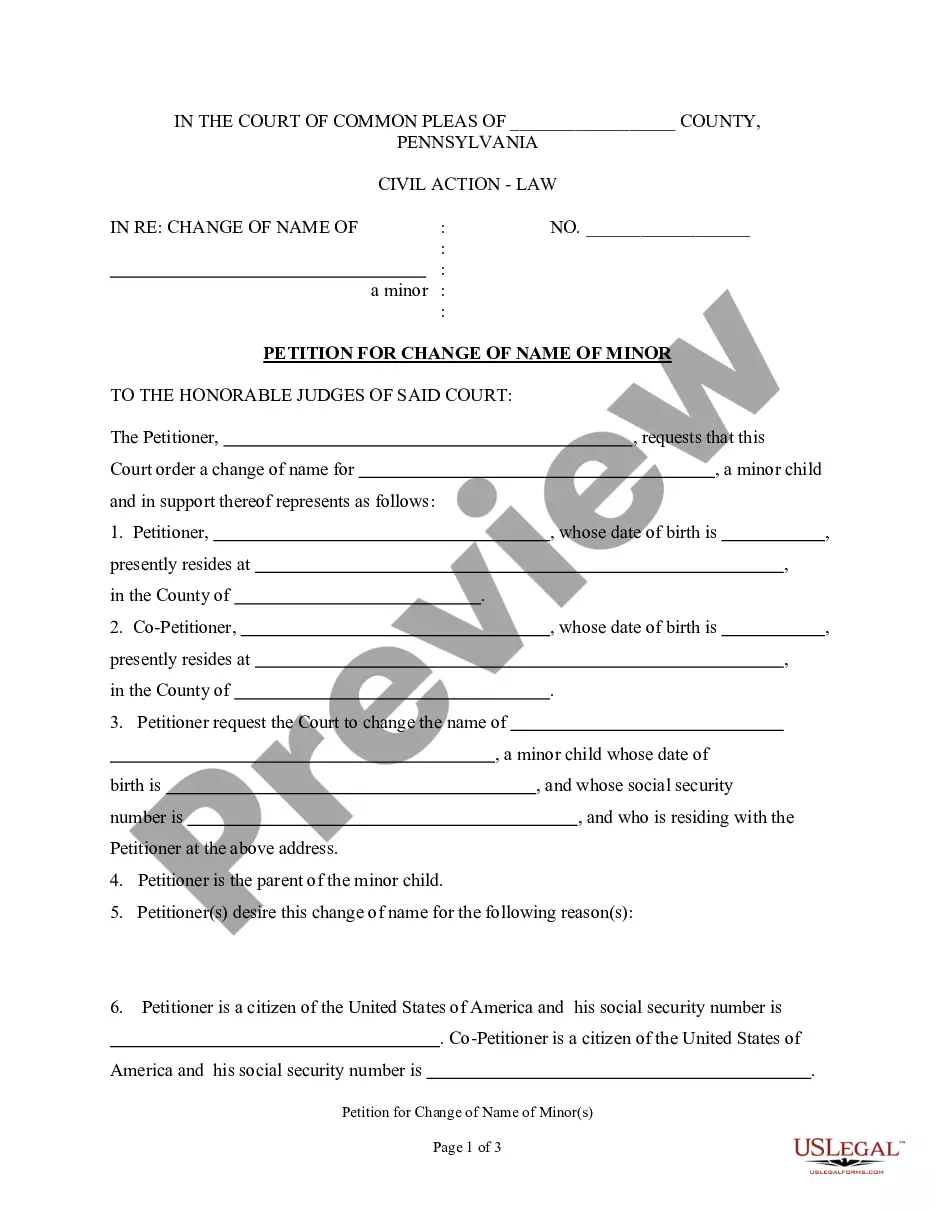

How to fill out Guaranty Of Payment By Limited Partners Of Notes Made By General Partner On Behalf Of Limited Partnership?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal paper templates that can be downloaded or printed.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent iterations of forms such as the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership in moments.

If you already have a monthly membership, Log In and download the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership from the US Legal Forms library. The Acquire button will appear on every document you view.

When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select the pricing plan you prefer and enter your information to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the purchase. Select the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership.

Every template you added to your account has no expiration date and is yours forever. Therefore, to download or print another copy, simply go to the My documents section and click on the form you need.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the form’s content.

- Check the form description to confirm you have chosen the correct document.

- If the form does not meet your requirements, utilize the Search bar at the top of the screen to find one that does.

Form popularity

FAQ

Absolutely, partners are personally liable for the debts of the partnership firm. This personal liability can extend to all debts and obligations acquired while operating the partnership. The Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership outlines these liabilities effectively. By being aware of these responsibilities, partners can take necessary precautions to protect their personal assets.

Yes, individual partners are personally liable for partnership debts in a general partnership. This means that your personal assets might be at risk if the partnership fails to meet its obligations. The Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership highlights the importance of understanding personal liability. To safeguard against this risk, consider crafting agreements that clearly outline these responsibilities.

A general partner is indeed responsible for the debts incurred by the partnership. This responsibility encompasses all obligations, including loans and agreements made under the partnership’s name. Understanding the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership can help clarify the extent of this liability. By doing so, you can ensure compliance and effective management of partnership obligations.

Yes, each partner in a general partnership is personally liable for the debts and obligations of the partnership. This liability extends to actions taken on behalf of the partnership. Therefore, if you engage in a Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, it is crucial to recognize the implications of individual liability for financial decisions. Being informed can help you plan better and safeguard your finances.

In a general partnership, all partners typically share liability for the debts of the business. This means that, yes, a single partner can be held personally accountable for the contract debts of the general partnership. The Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership further clarifies these responsibilities. Understanding this can help partners take informed steps in managing risks.

No, a general partner is not the same as one with limited liability. General partners manage the partnership and hold personal liability for its debts, while limited partners enjoy protection on liability up to their investment amount. Understanding the differences is crucial, especially with regard to Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, as it outlines how these responsibilities are managed within a partnership. Uslegalforms can assist you in navigating these complex structures effectively.

A general limited partner typically has the same liability as any general partner. They are responsible for the full extent of the partnership's debts. However, under certain structured arrangements, the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership might provide protections that limit this exposure, making clear the roles and responsibilities. Always consult legal resources to fully grasp these implications.

In most situations, general partners are not solely liable up to their capital contributions. They generally have unlimited personal liability for the debts and obligations of the partnership. This means that if the partnership cannot meet its obligations, creditors may pursue the personal assets of general partners. It’s important to understand the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership, as this document can clarify and potentially limit liability for limited partners.

Yes, a general partner possesses unlimited personal liability for the debts of the limited partnership. This means that if the partnership cannot cover its debts, creditors may seek repayment from the general partner’s personal assets. Understanding the implications of the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership is crucial for anyone considering the role of a general partner.

Limited partners are typically the type of partners who are not liable for the debts of the partnership beyond their investment. They can participate in the partnership without the fear of personal financial exposure. It's crucial to understand how the Missouri Guaranty of Payment by Limited Partners of Notes Made by General Partner on Behalf of Limited Partnership distinguishes the roles and protections given to each partner.