Missouri Employment Contract Between an Employee and an Employer in the Technology Business

Description

How to fill out Employment Contract Between An Employee And An Employer In The Technology Business?

You might spend hours online searching for the appropriate legal document template that meets the federal and state requirements that you need.

US Legal Forms offers a vast array of legal templates that are reviewed by experts.

You can download or print the Missouri Employment Agreement Between an Employee and an Employer in the Technology Sector from this service.

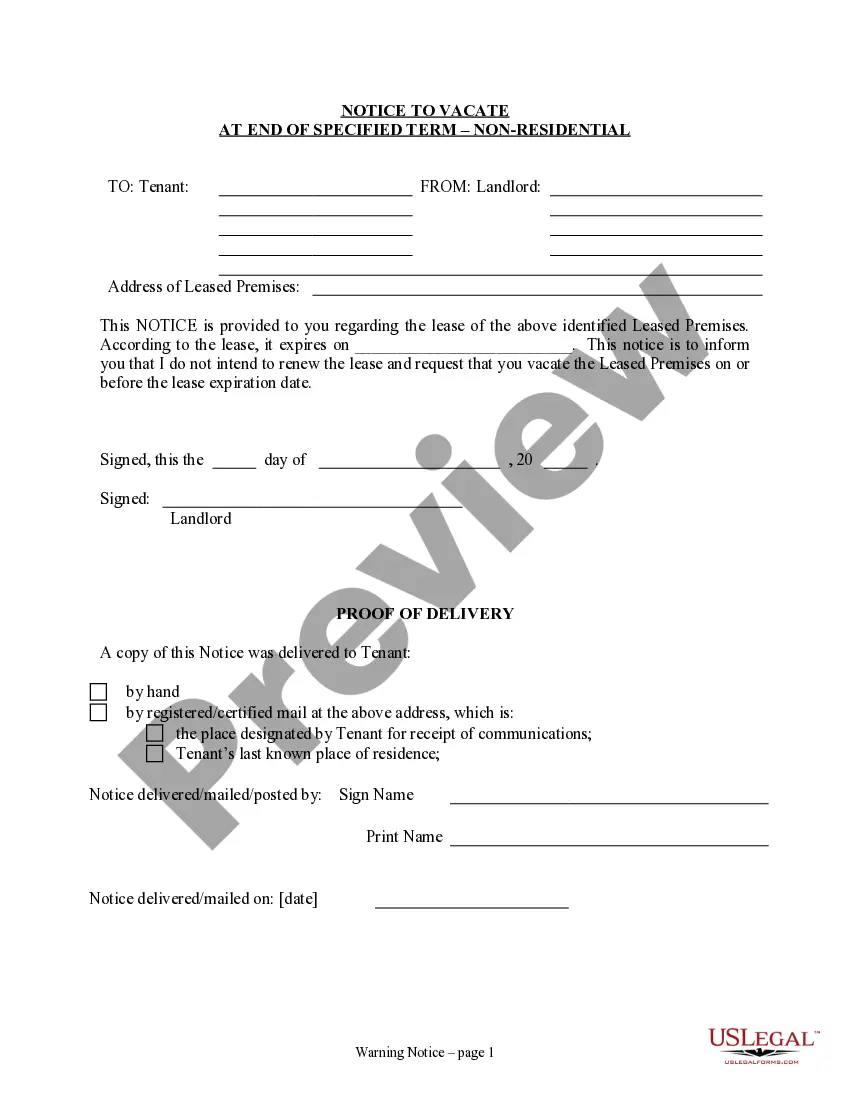

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the Missouri Employment Agreement Between an Employee and an Employer in the Technology Sector.

- Every legal document template you download is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Check the form outline to confirm that you have selected the appropriate template.

Form popularity

FAQ

In Missouri, there is no law mandating 15-minute breaks for employees, although employers often provide such breaks as a common practice. When discussing a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, it’s beneficial to clarify break policies during contract negotiations. Open communication helps ensure both parties understand their rights and responsibilities regarding breaks.

As an independent contractor, you typically do not have a traditional boss like a W2 employee would. Instead, you have clients who hire you for specific tasks or projects, as outlined in a Missouri Employment Contract Between an Employee and an Employer in the Technology Business. This arrangement grants you flexibility and autonomy over your work schedule and methods.

A misclassification employee in Missouri refers to a situation where an employer incorrectly labels a worker as an independent contractor instead of an employee. This misclassification can lead to legal consequences and financial liabilities. When establishing a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, employers should ensure they classify their workers correctly to avoid potential issues.

A 1099 employee, or independent contractor, in Missouri receives payments without taxes withheld by the employer, while a W2 employee has taxes deducted from their paychecks. When considering a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, it is essential to understand this distinction, as it affects tax liabilities and benefits. Employers must document their relationships appropriately to comply with tax regulations.

An independent contractor in Missouri is an individual who provides services to a client under a specific agreement, without being considered an employee. In the context of a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, independent contractors retain control over how they complete their work. This relationship typically involves a defined project or service, rather than ongoing employment.

To write a short-term contract, begin by clearly stating the parties involved, the nature of the work, and the duration of the contract. Be sure to detail compensation, responsibilities, and any provisions for ending the agreement. Utilizing templates from a reliable platform like uslegalforms can streamline the process of creating a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, ensuring that all necessary elements are covered.

The contract between an employer and an employee is a formal agreement that outlines the terms of employment. This includes details such as job duties, compensation, and duration of employment. A well-crafted Missouri Employment Contract Between an Employee and an Employer in the Technology Business serves to protect both parties and ensures transparency throughout the employment period.

A mutual agreement between an employer and an employee signifies both parties' commitment to shared expectations and responsibilities. This agreement may include aspects like salary, job duties, and company policies. In the context of a Missouri Employment Contract Between an Employee and an Employer in the Technology Business, ensuring both parties are on the same page fosters a positive working relationship.

Yes, the relationship between an employer and an employee typically forms a contract. This relationship outlines the terms of employment, including responsibilities, compensation, and working conditions. A Missouri Employment Contract Between an Employee and an Employer in the Technology Business can detail specific obligations and expectations, providing clarity for both parties.

Salaried employees in Missouri are subject to both state and federal labor laws regarding wages, overtime, and workplace protections. Employers must comply with the Fair Labor Standards Act while also adhering to local regulations. Drafting a clear Missouri Employment Contract Between an Employee and an Employer in the Technology Business is crucial to outline salary terms and related obligations, ensuring both parties are well-informed.