An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement

Description

How to fill out Sprinkling Trust For Children During Grantor's Life, And For Surviving Spouse And Children After Grantor's Death - Crummey Trust Agreement?

If you need to finish, acquire, or create sanctioned document templates, utilize US Legal Forms, the foremost collection of legal forms, available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase Now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to retrieve the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement.

- You can also find forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct state/region.

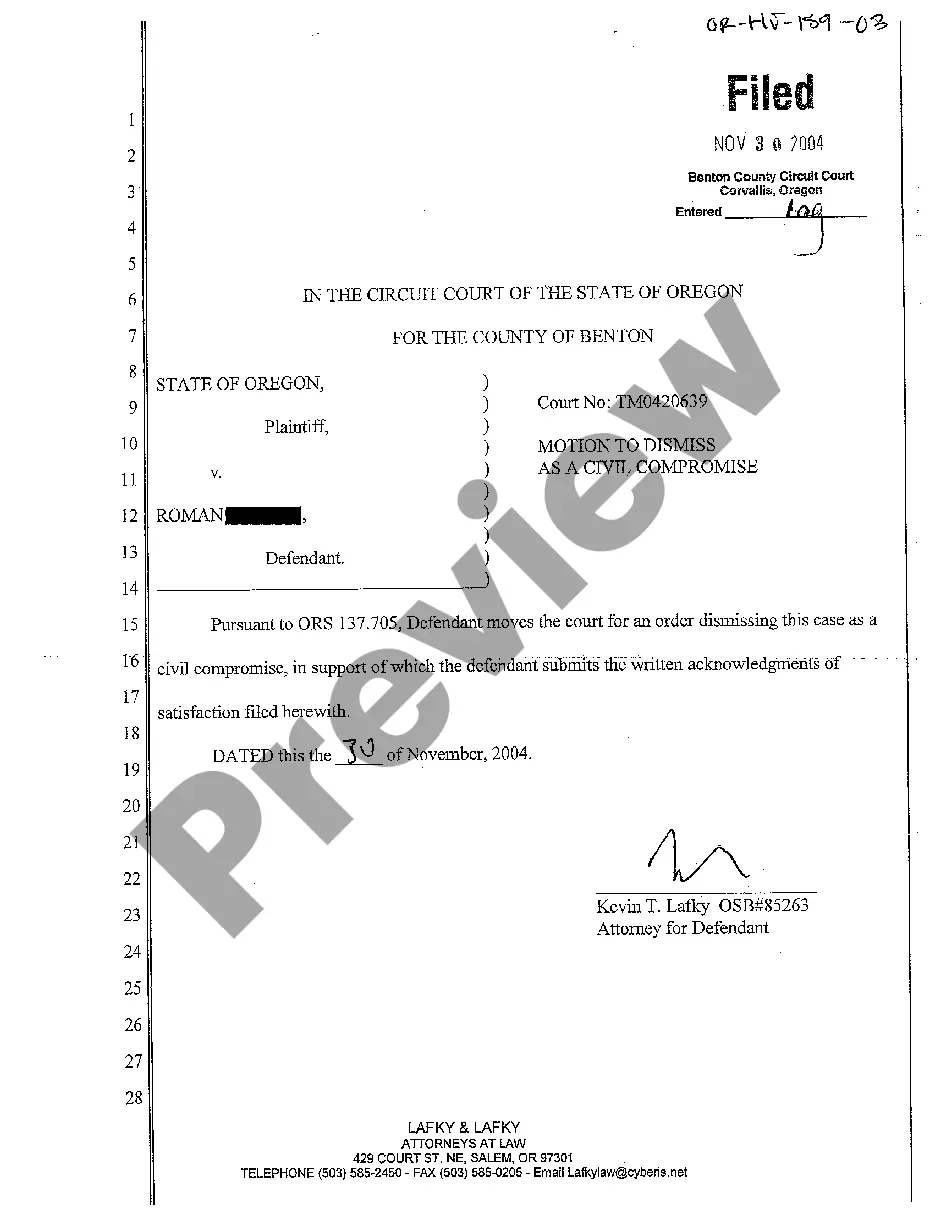

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

To set up a living trust in Missouri, begin by deciding on the terms of the trust, including the assets to include and the beneficiaries you choose. It is essential to work with a professional who understands the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. After drafting the trust document, you must fund the trust by transferring your assets into it. Using a platform like USLegalForms can simplify this process and provide templates specifically for Missouri trusts.

Failing to send a Crummey letter can jeopardize the tax benefits associated with the Crummey Trust. These letters notify beneficiaries of their withdrawal rights, ensuring annual exclusions remain valid. Without these communications, the advantages of the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement may be significantly reduced.

Crummey Trusts can require meticulous management to ensure beneficiaries receive their withdrawal rights at the appropriate times. They may also expose trust assets to potential creditors if not structured correctly. Nevertheless, with careful planning, the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement can mitigate such risks.

Trust funds, while beneficial, can also present challenges such as ongoing administrative fees and complexity in management. Additionally, beneficiaries may face restrictions that limit their access to funds, causing frustration. When considering a trust fund like the Missouri Sprinkling Trust for Children During Grantor's Life, it's crucial to assess how such limitations could impact beneficiaries' needs.

Yes, a Crummey Trust can be structured as a grantor trust, which allows the grantor to retain some control over the trust assets. This structure often leads to tax advantages, as the income generated by the trust may be taxed to the grantor. Families utilizing the Missouri Sprinkling Trust for Children During Grantor's Life may consider this option for maintaining flexibility and control.

Withdrawals from a Crummey Trust depend on the stipulations set within the trust agreement. Generally, appropriate withdrawals align with the 5 by 5 rule, allowing specific annual limits. By clearly outlining these limits, the Missouri Sprinkling Trust for Children During Grantor's Life and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement can effectively meet the beneficiaries' needs.

Bypass trusts can complicate the estate settlement process, making it more burdensome for surviving spouses. They might limit access to trust assets during the grantor's lifetime. When using a bypass trust in conjunction with the Missouri Sprinkling Trust for Children, families should consider how both trusts will function together to avoid misunderstandings.

The 5 by 5 rule allows beneficiaries to withdraw up to $5,000 or 5% of the trust's value each year from a Crummey Trust. This feature promotes annual gifting without triggering gift taxes. However, ensuring compliance with this rule is essential to maintain the tax benefits of the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement.

Bloodline trusts, such as the Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, can limit flexibility in distributing assets. These trusts often restrict beneficiaries to specific groups, which may not suit changing family dynamics. Additionally, some may find that such trusts can complicate the estate planning process.

When the grantor dies, the irrevocable trust in Missouri continues to operate according to its terms. The trustee must follow the instructions laid out in the trust document, ensuring that distributions to beneficiaries occur as intended. The Missouri Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement ensures that care and financial support remain intact for the beneficiaries after the grantor's passing.