Missouri Employment Application for Waiting Staff

Description

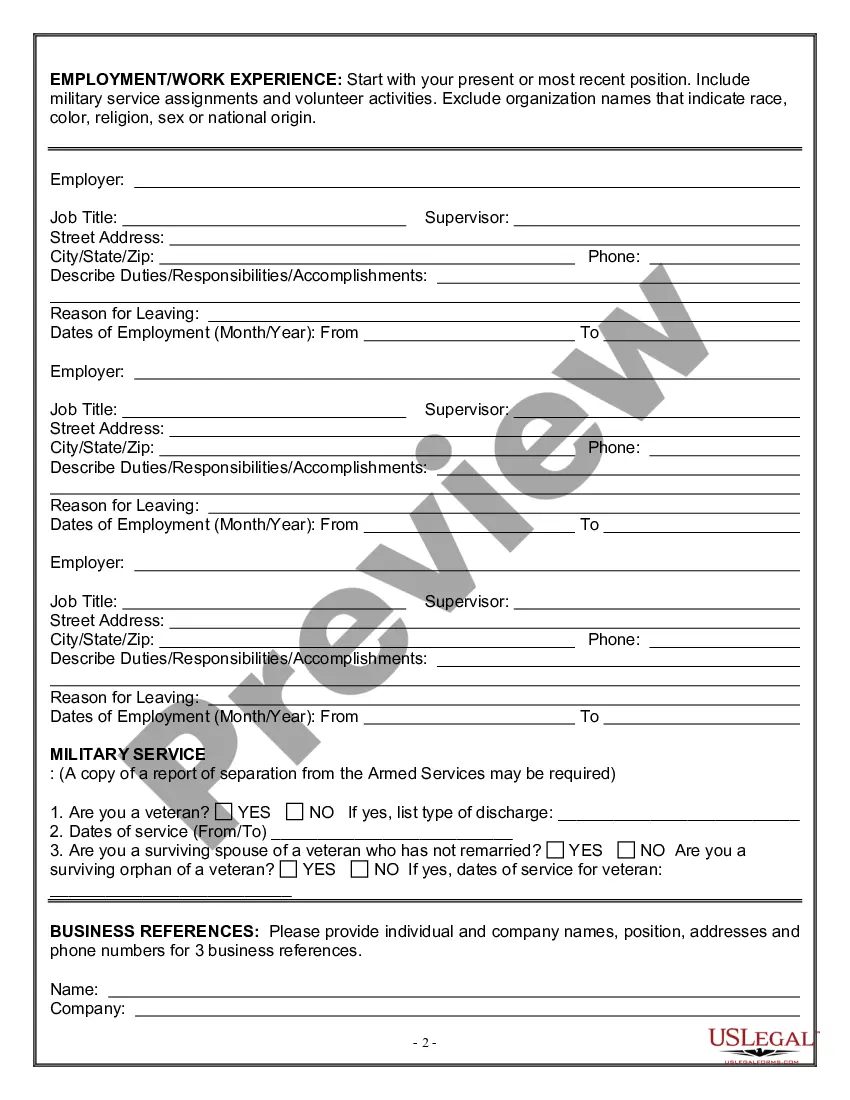

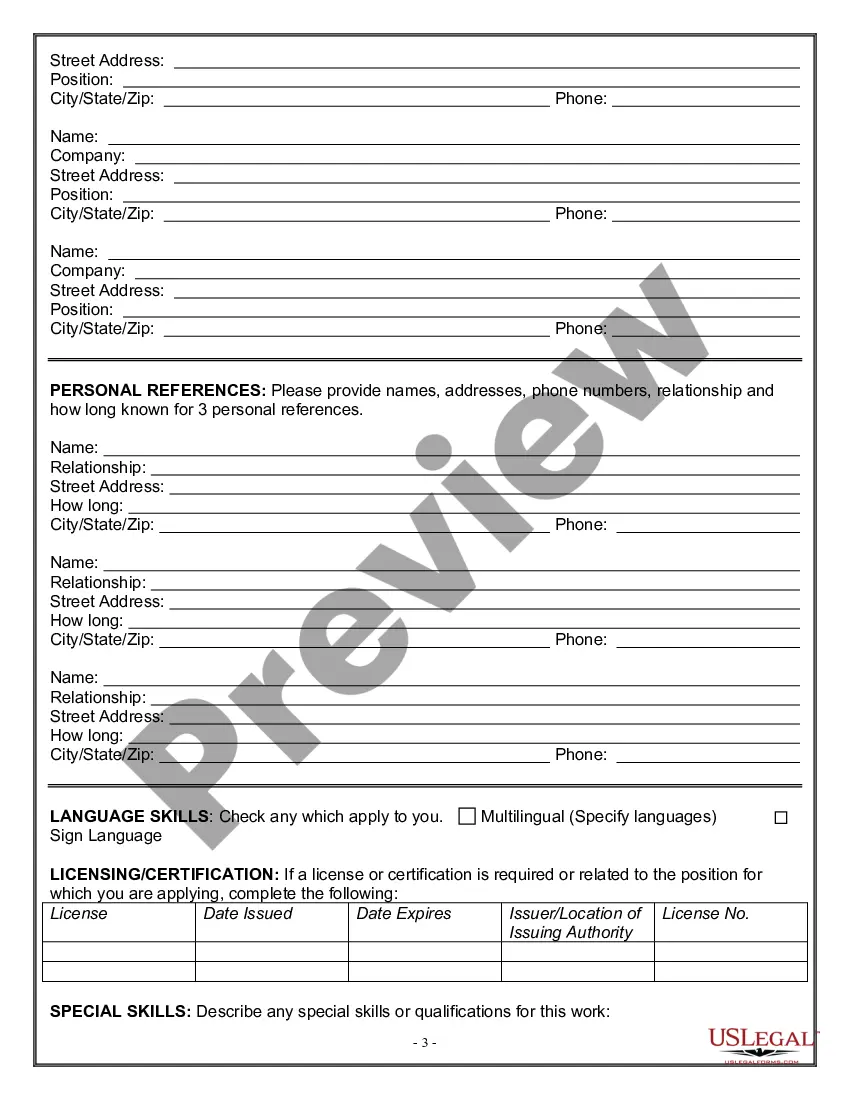

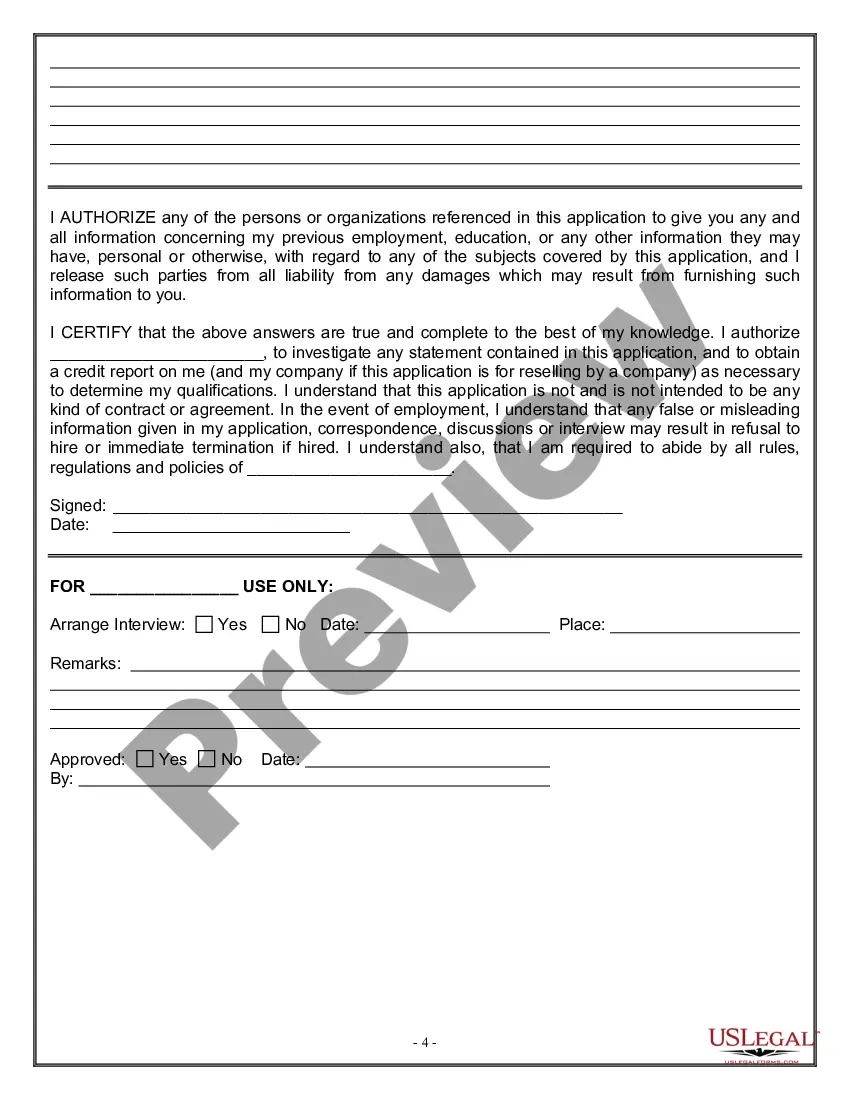

How to fill out Employment Application For Waiting Staff?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates for you to download or print.

By using the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms like the Missouri Employment Application for Waitstaff in just seconds.

If you already have a subscription, Log In and download the Missouri Employment Application for Waitstaff from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Make changes. Complete, edit, print, and sign the saved Missouri Employment Application for Waitstaff.

Every template you add to your account has no expiration date and is yours forever. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you need. Access the Missouri Employment Application for Waitstaff with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To utilize US Legal Forms for the first time, here are simple instructions to get you started.

- Make sure you have selected the correct form for your city/area. Click the Preview button to review the form's content. Check the form description to confirm that you have selected the correct one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Get Now button. Then, choose the pricing plan you want and provide your credentials to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Beginning on the Sunday after you file your initial or renewed claim, you should file your first weekly request. Continue to file each week until you return back to work. You must file your weekly request for payment within 14 days from the end of the week (Saturday) you are claiming. Visit uinteract.labor.mo.gov.

If an employee is required to fill out a W-4 form, that employee must be reported. New hire reporting is mandated by federal law under Title 42 of U.S. Code, Section 653a of the Personal Responsibility and Work Opportunity Reconciliation Act and by the Revised Statutes of Missouri, Sections 285.300 to 285.308.

The waiting week is the first week of your claim for which you are eligible for UI benefits, but not paid. You must file a weekly request for payment for this week. You may receive compensation for the waiting week as the last payment on your regular UI claim.

D83edd14 Understanding a furlough During a furlough, employees are effectively forced to take a leave of absence or to reduce their hours. Generally, they cannot work for the employer and will not receive pay, but they are not considered unemployed.

PUA provides benefits to qualifying individuals who are otherwise able to work and available for work within the meaning of state law, except that they are unemployed, partially unemployed, or unable or unavailable to work due to COVID-19 related reasons, as defined in the CARES Act.

An individual must be able and available for work. Question: If an individual is ill because of the coronavirus, will they be eligible for unemployment benefits? No. An individual must be able and available for work.

The waiting week is the first week of a claim for which the individual is eligible for unemployment benefits but during this week, such individual is not paid benefits. Individuals who are approved for benefits may receive compensation for the waiting week as the last payment on the regular unemployment claim.

If a worker is put in a temporary layoff status or furlough, then declines their employer's request to come back to work, the worker is not eligible for unemployment benefits.

If your employer furloughs you because it does not have enough work for you, you are not entitled to take paid sick leave or paid expanded family and medical leave. However, you may be eligible for unemployment insurance benefits.