Missouri Disclosure and Consent for a Consumer Investigative Report and Release Authorization

Description

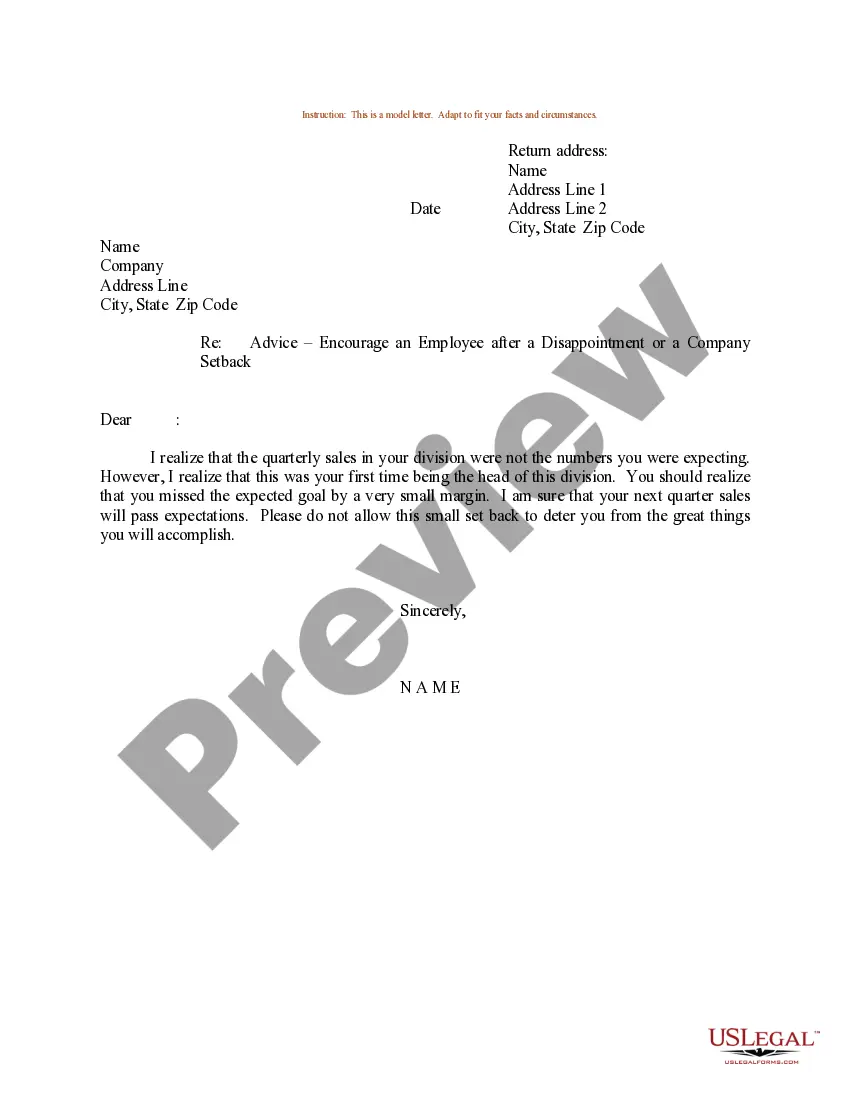

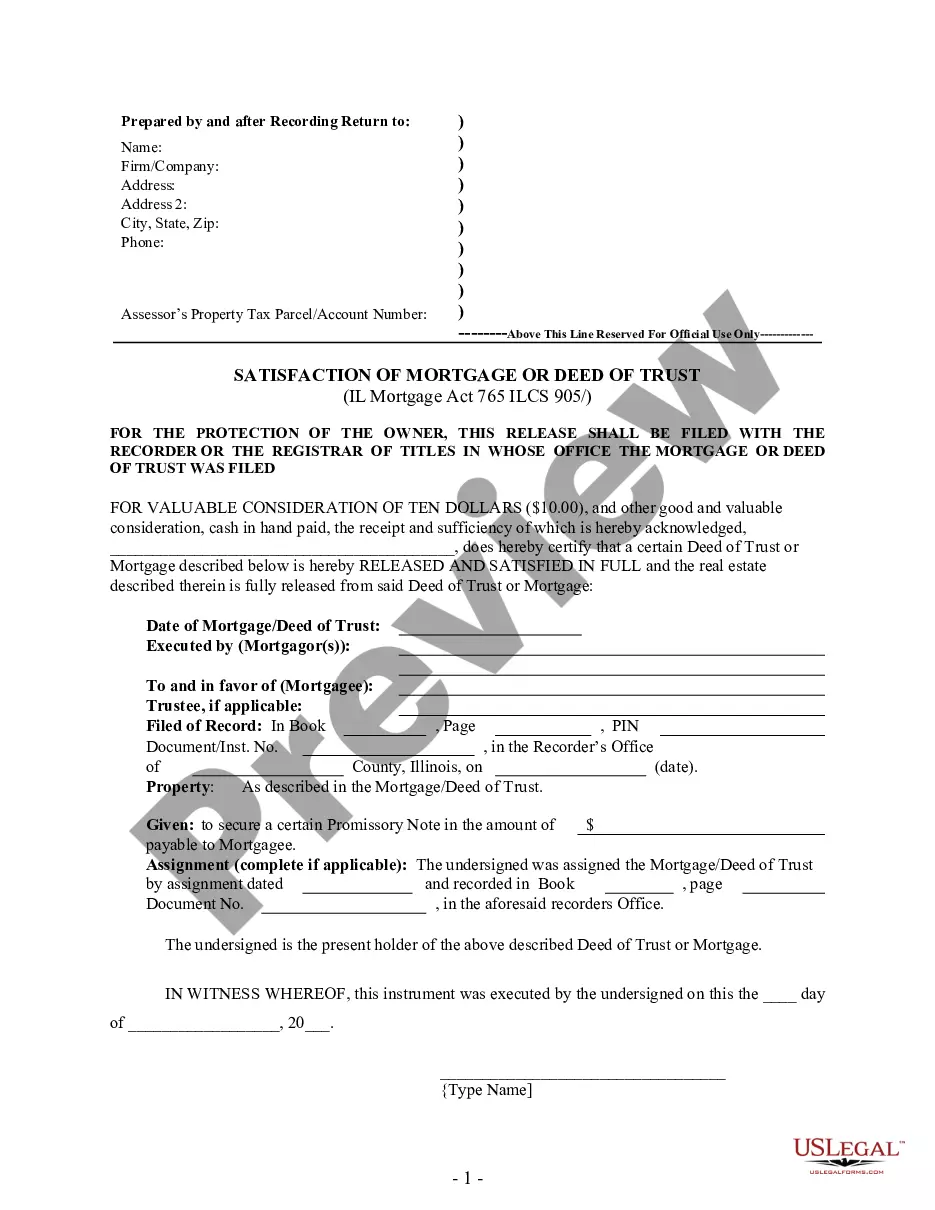

How to fill out Disclosure And Consent For A Consumer Investigative Report And Release Authorization?

If you need to finish, obtain, or produce approved document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to locate the documents you need.

Various templates for business and personal use are sorted by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to locate the Missouri Disclosure and Consent for a Consumer and Investigative Report and Release Authorization in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to retrieve the Missouri Disclosure and Consent for a Consumer and Investigative Report and Release Authorization.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, refer to the steps outlined below.

- Step 1. Confirm you have selected the form for the correct region/state.

- Step 2. Use the Review option to browse through the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Unlike federal law, California law also requires new consent each time an investigative report is sought during employment if the report is for purposes other than suspicion of wrongdoing or misconduct. Employers must provide the applicant or employee with the opportunity to request a copy of the report.

Section 1681a of the Fair Credit Reporting Act defines an investigative consumer report as a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.

One important distinction to make is that investigative consumer reports will not include any information about your credit record obtained directly from a creditor or from you. An investigative consumer report cannot and will not be used as part of an application to grant credit.

A credit report is a specific type of consumer report used for lending, while the broader term "consumer report" could be used to describe things like your driving history or criminal record.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

Section 1681a of the Fair Credit Reporting Act defines an investigative consumer report as a consumer report or portion thereof in which information on a consumer's character, general reputation, personal characteristics, or mode of living is obtained through personal interviews with neighbors, friends, or

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

Before requesting a consumer report (such as credit reports and background checks), employers now must: (1) make a clear and conspicuous disclosure in a separate document to the applicant or employee that a report may be requested; and (2) obtain written permission from the applicant or employee.

The general public has limited access to consumer reports, especially your credit report. Under the Fair Credit Reporting Act, a prospective employer has a right to obtain these records, but only with your written permission.