Missouri Form 1695-Request For Writ of Garnishment is a form issued by the court in the state of Missouri to enforce a creditor's claim against a debtor. The writ of garnishment is a court order that allows a creditor to take a portion of a debtor's income, property, or money in a bank account to satisfy the debt. This form is used to obtain a court order authorizing the garnishment of the debtor's wages, bank accounts, or other assets to satisfy the debt. There are two types of Missouri Form 1695-Request For Writ of Garnishment: (1) Wage Garnishment and (2) Bank Levy. Wage garnishment allows the creditor to take a portion of the debtor's wages from their employer in order to satisfy the debt. Bank levy permits the creditor to take money from the debtor's bank accounts to pay off the debt.

Missouri Form 1695-Request For Writ of Garnishment

Description

Key Concepts & Definitions

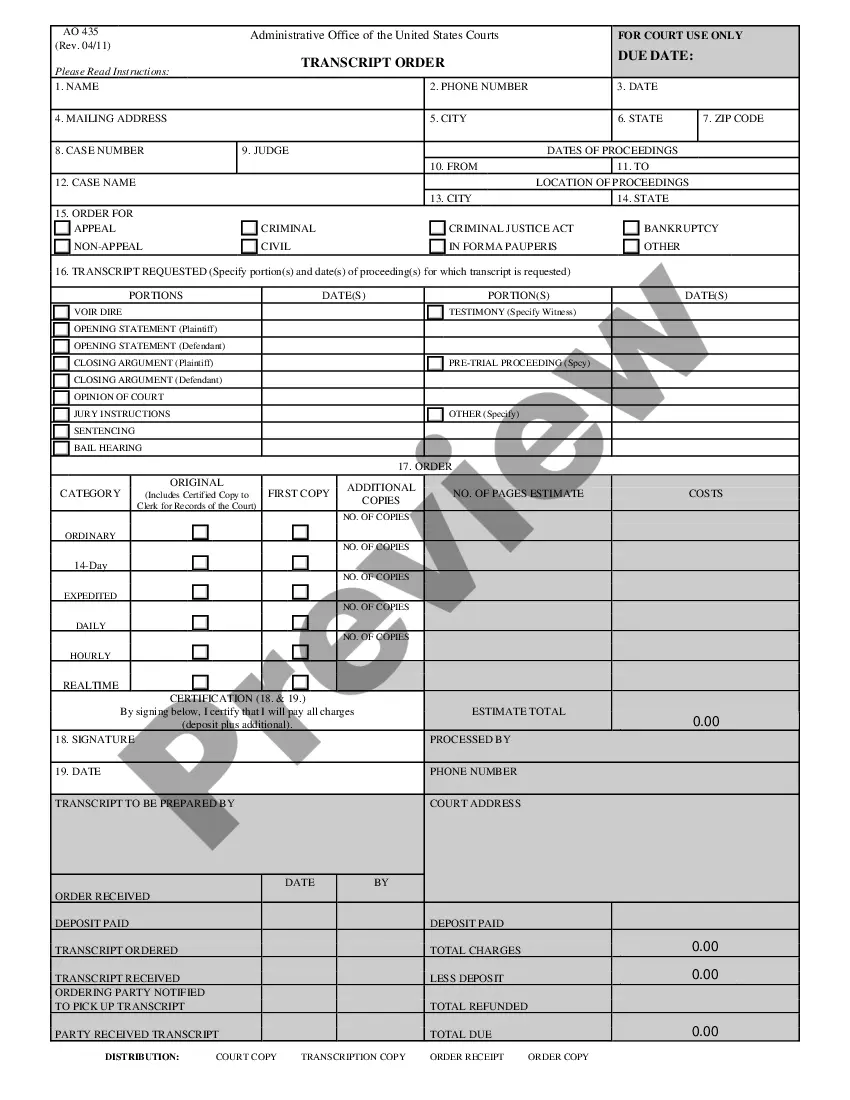

Form 1695 Request for Writ of Garnishment is a legal document used in the United States to request the court to issue a writ of garnishment. A writ of garnishment is a court order directed at a third party who holds assets of a debtor, commonly known as the garnishee, requiring them to set aside a portion of the debtor's assets to satisfy a creditor's judgment.

Step-by-Step Guide

- Identify the Need for Garnishment: Determine if garnishment is required to satisfy a financial judgment against a debtor.

- Obtain Form 1695: Access the form via court websites or local court offices.

- Complete the Form: Fill out the form accurately, providing details about the creditor, debtor, and the specific judgment.

- File the Form: Submit the completed form to the appropriate court.

- Serve the Writ: Once issued by the court, serve the writ to the garnishee.

- Comply with Legal Requirements: Follow all local, state, and federal laws regarding the garnishment process.

Risk Analysis

- Legal Compliance: Failure to comply with garnishment laws can result in penalties or legal action against the creditor or its representatives.

- Incorrect Information: Providing inaccurate information on Form 1695 can lead to delays or dismissal of the garnishment request.

- Financial Impact on Debtors: Garnishment may significantly impact a debtor's financial situation, potentially leading to further financial distress.

Best Practices

- Verify Debtor Information: Ensure all debtor information is correct to avoid processing errors.

- Consult Legal Experts: Seek advice from legal professionals to navigate the complexities of garnishment laws.

- Maintain Records: Keep detailed records of all actions taken in the garnishment process for legal and administrative purposes.

Common Mistakes & How to Avoid Them

- Incomplete Forms: Double-check all fields on Form 1695 to ensure completeness before submission.

- Understanding Jurisdiction: Confirm that the court where the form is being submitted has jurisdiction over the garnishee's location.

- Lack of Follow-Up: Regularly follow up on the status of the garnishment proceedings to address any issues promptly.

How to fill out Missouri Form 1695-Request For Writ Of Garnishment?

US Legal Forms is the most easy and cost-effective way to locate suitable formal templates. It’s the most extensive web-based library of business and personal legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Missouri Form 1695-Request For Writ of Garnishment.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Missouri Form 1695-Request For Writ of Garnishment if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make sure you’ve found the one corresponding to your needs, or find another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Register for an account with our service, sign in, and purchase your subscription using PayPal or you credit card.

- Decide on the preferred file format for your Missouri Form 1695-Request For Writ of Garnishment and save it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reputable assistant in obtaining the corresponding formal documentation. Give it a try!

Form popularity

FAQ

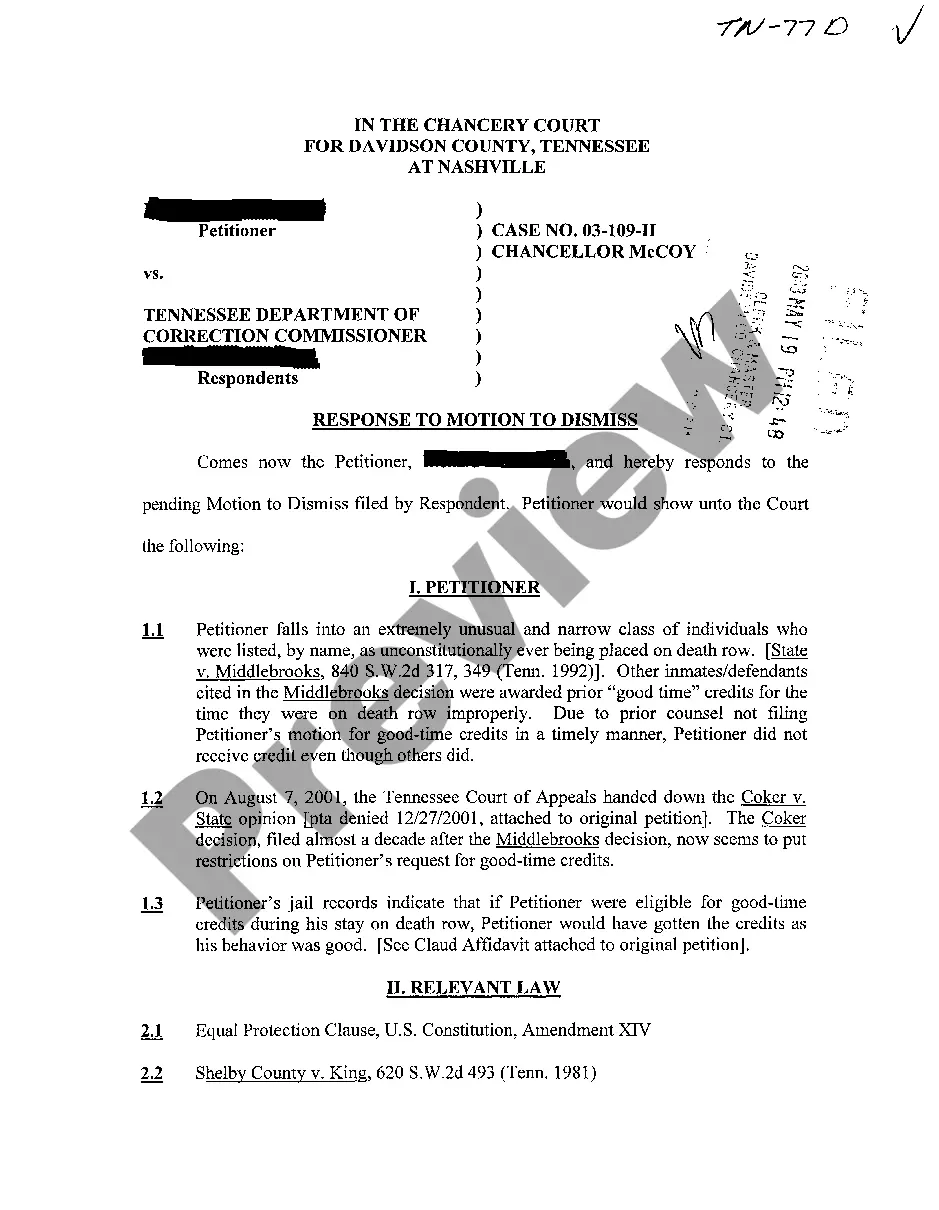

Most often, a creditor does so by petitioning a court to issue an order (or ?writ of garnishment?) to an employer (or ?garnishee?) that instructs the employer to pay or deliver a certain amount of an employee's wages or other income to the creditor.

If you lose, the Judge will enter a judgment against you. Then your creditor may try to collect its judgment by ?attaching? your property or ?garnishing? your wages or bank account. However, both Missouri and federal law protect some of your property and income from creditors.

Under Missouri law, for any workweek, a creditor can garnish the lesser of: 25% of your disposable earnings, or 10% of your disposable earnings if you're the head of a family and a resident of the state, or. the amount by which your weekly disposable earnings exceed 30 times the federal hourly minimum wage. (Mo.

The bank garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment creditor (plaintiff). The expiration date of the bank garnishment is called the "return date."

You can also stop the garnishment by filing for bankruptcy. When you file a bankruptcy petition, the automatic stay rule takes effect immediately. This stops all collection actions against you, including wage garnishments.

To claim the head of family exemption, you must complete the affidavit on page one. Return the completed affidavit to your employer for computing the garnishment percentage. NOTE: When you receive notice of a garnishment, you should immediately check with your employer.

Missouri Wage Garnishment Process Step 1: The Creditor Gets a Judgment Against You.Step 2: The Creditor Gets a Garnishment Order & Delivers It to Your Employer.Step 3: You Get a Copy of the Garnishment Order & Can Claim Exemptions and Make Objections.Step 4: The Garnishment Begins.

For instance, if you're behind on credit card payments or owe a doctor's bill, those creditors can't garnish your wages unless they sue you and get a judgment. Some creditors, though, like those you owe taxes, federal student loans, child support, or alimony, don't have to file a suit to get a wage garnishment.