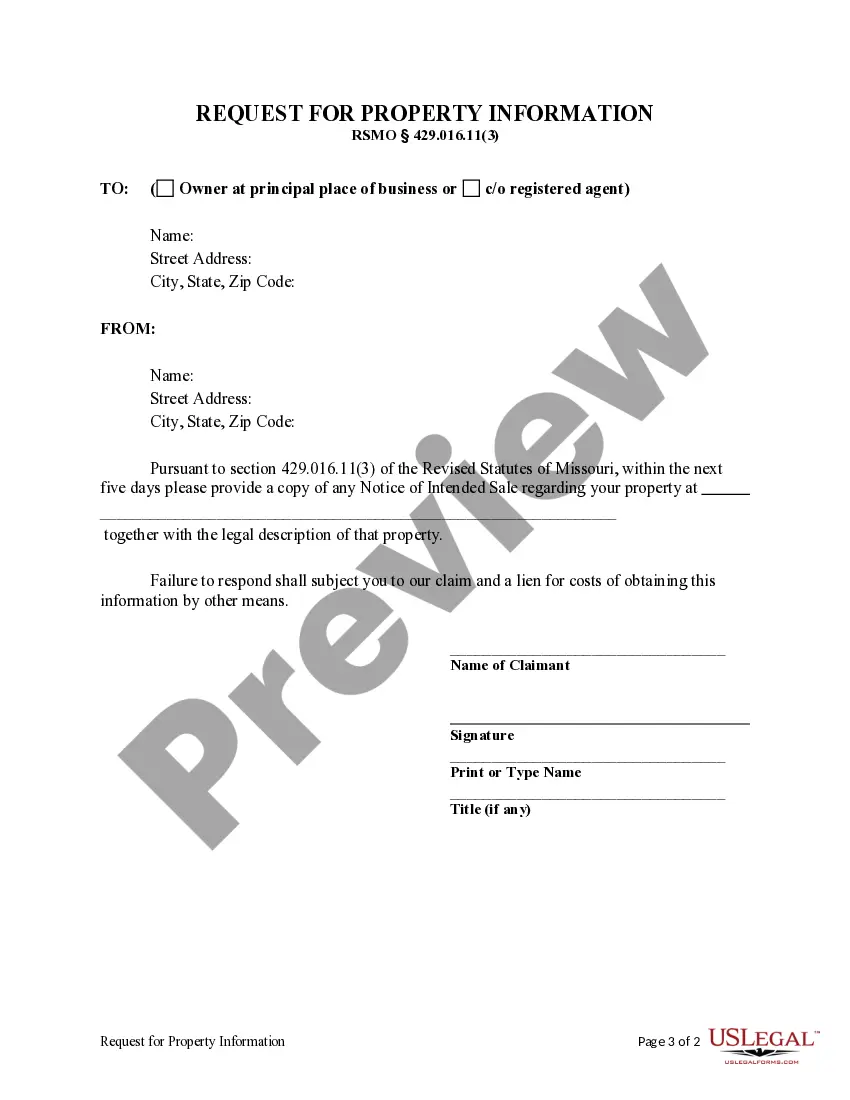

This form is used by an individual claimant to request property information (legal description) from the Owner or the Owners registered agent.

This form is used by an individual claimant to request property information (legal description) from the Owner or the Owners registered agent.

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Obtain any variety from 85,000 legal documents including Missouri Request for Property Information from Owner - Individual Claimant online with US Legal Forms. Each template is crafted and refreshed by state-authorized attorneys.

If you already possess a subscription, sign in. When you are on the document’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the guidelines listed below.

With US Legal Forms, you will consistently have immediate access to the correct downloadable sample. The service will provide you with access to forms and categorizes them to enhance your search. Utilize US Legal Forms to acquire your Missouri Request for Property Information from Owner - Individual Claimant swiftly and effortlessly.

How to Apply for a Tax Waiver (Statement of Non-Assessment) Application for a tax waiver can be made in person, by mail, fax, or email. If applying by fax or email, please allow 24 hour process time.

In Missouri, the assessed value of property may not exceed 33.3 percent of its true value in money.Most personal property is assessed at 33.3 percent of its true value in money. Assessment Date or Tax Date January 1st of each year. Real property is assessed as of January 1st of each odd-numbered year.

A Tax Waiver can normally only be obtained in person at the Assessor's Office. In light of the COVID-19 emergency, the Assessor's Office has implemented a procedure to request it online.

A Tax Waiver can normally only be obtained in person at the Assessor's Office. In light of the COVID-19 emergency, the Assessor's Office has implemented a procedure to request it online.

Personal property tax is a tax based upon the value of taxable personal property.The Market Value of an item is established by the County Assessor using a standard rate book provided by the Missouri State Tax Commission. The Assessed Value is a percentage of the Market Value.

Personal property tax is a tax which is based upon the value of taxable personal property.Your tax is calculated by dividing the assessed value of your property by 100 and then multiplying that result by the tax levy.

When a homeowner doesn't pay the property taxes, the overdue amount becomes a lien on the home. In Missouri, all real estate taxes become delinquent on January 1 of the year following their assessment.

Missouri homestead law allows for a $15,000 exemption, which is applicable to "a dwelling house and appurtenances, and the land used in connection therewith." In other words, the state's homestead law is limited to homes, corresponding buildings, and the land on which they stand.