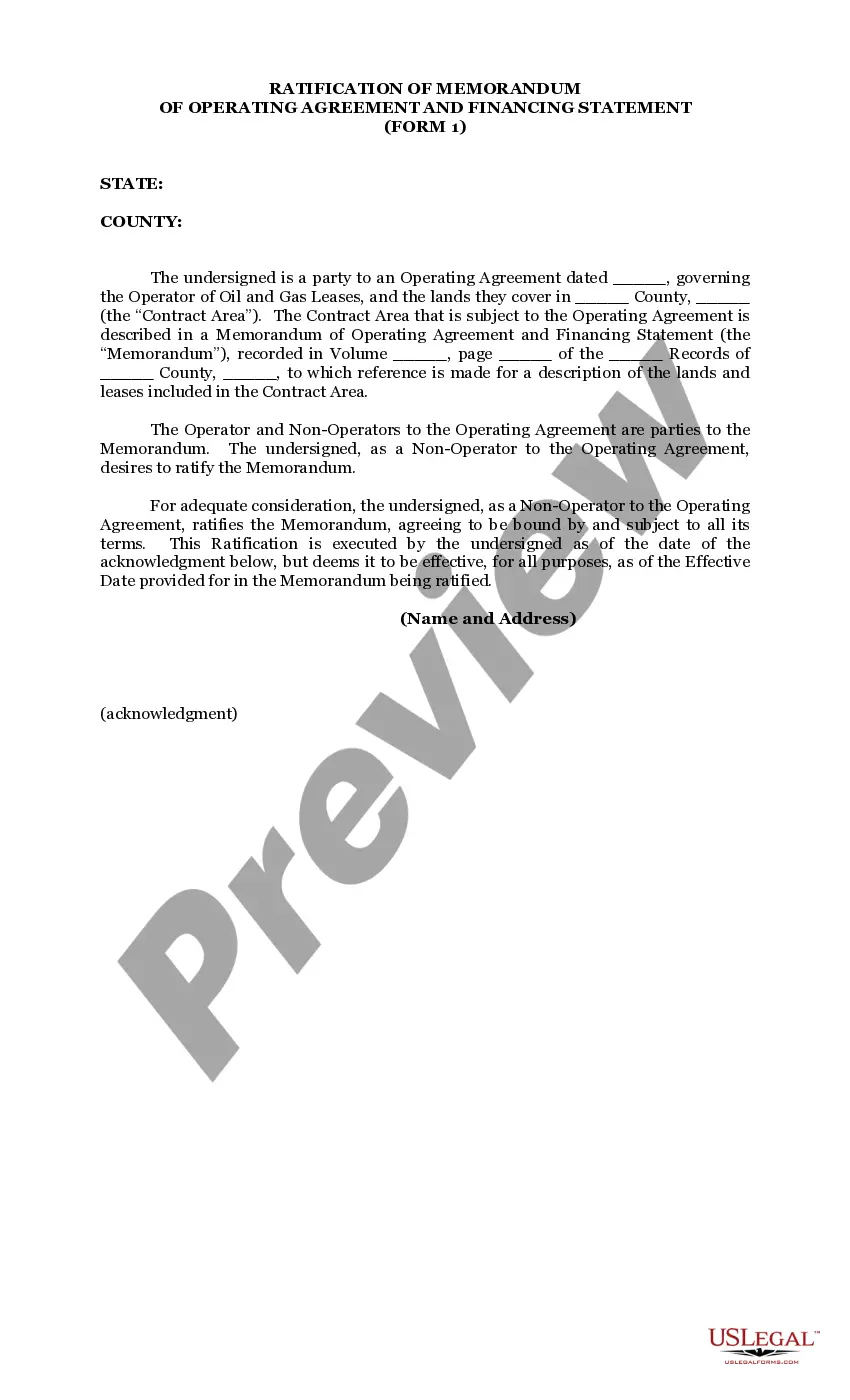

Minnesota Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2

Description

How to fill out Ratification Of Memorandum Of Operating Agreement And Financing Statement - Form 2?

You may spend hours online trying to find the legal file web template that suits the state and federal specifications you need. US Legal Forms provides a huge number of legal varieties which are evaluated by pros. It is possible to obtain or print out the Minnesota Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2 from our support.

If you already have a US Legal Forms accounts, you may log in and click the Obtain key. Next, you may full, edit, print out, or indicator the Minnesota Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2. Each legal file web template you get is the one you have forever. To have another duplicate of the obtained develop, visit the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site for the first time, adhere to the easy instructions below:

- Very first, ensure that you have selected the right file web template for your area/metropolis of your choice. Look at the develop outline to ensure you have selected the appropriate develop. If offered, make use of the Review key to check through the file web template at the same time.

- If you wish to find another model of the develop, make use of the Lookup industry to discover the web template that fits your needs and specifications.

- Upon having located the web template you need, click on Acquire now to continue.

- Select the costs program you need, type your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can use your bank card or PayPal accounts to pay for the legal develop.

- Select the format of the file and obtain it to your system.

- Make adjustments to your file if possible. You may full, edit and indicator and print out Minnesota Ratification of Memorandum of Operating Agreement and Financing Statement - Form 2.

Obtain and print out a huge number of file themes making use of the US Legal Forms website, that provides the largest assortment of legal varieties. Use expert and express-distinct themes to deal with your company or individual requires.

Form popularity

FAQ

In general, a UCC filing is not bad for your business ? it simply serves as an official notice to other creditors that your lender has a security interest in one or all of your assets. However, UCC filings can impact your business credit, risk your company's assets and/or hinder your ability to get future financing.

The Uniform Commercial Code ( UCC ) applies to any transaction intended to create a security interest in personal property. This interest can be viewed as a lien on personal property. Information is provided on these records to the lending community for the purpose of determining loan agreements.

It's possible to avoid a UCC filing by taking out an unsecured business loan rather than a secured one. For example, many online and alternative lenders offer unsecured loans, and you can get an SBA 7(a) loan of up to $25,000 without collateral.

The UCC Financing Statement (UCC1) form is filed by a creditor to give notice that it has or may have an interest in the personal property of a debtor (person who owes a debt to the creditor as typically specified in the agreement creating the debt).

UCC financing statements ? also known as liens ? are filed in connection with secured transactions and can be filed against any personal property located within the state, with some exceptions. You'd usually file a financing statement to secure payment of a business loan (or occasionally a debt).

If the borrower defaults on the loan, the lender has a legally recognized priority claim to the collateral over other creditors. Once the loan is paid off, the lender should file a UCC-3 termination statement. This removes the UCC lien and indicates that the lender no longer has an interest in the collateral.

First, the debtor must send an authenticated demand to the secured party. The demand should be sent to the name/address of the secured party as indicated on the financing statement. The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file.