Minnesota Release of Agreement of Option to Conduct Seismic and Acquire Oil and Gas Lease

Description

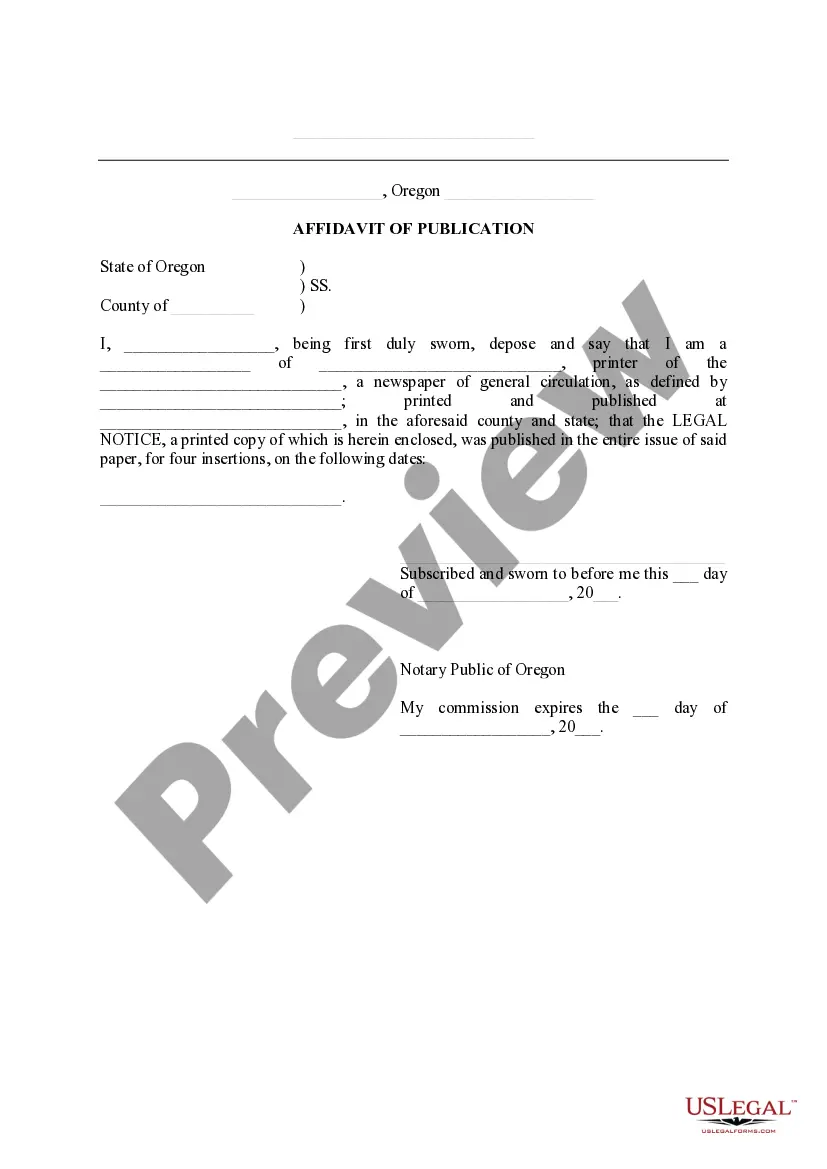

How to fill out Release Of Agreement Of Option To Conduct Seismic And Acquire Oil And Gas Lease?

Choosing the right authorized file web template might be a have difficulties. Obviously, there are a variety of layouts available on the net, but how do you discover the authorized form you require? Take advantage of the US Legal Forms website. The support provides a huge number of layouts, like the Minnesota Release of Agreement of Option to Conduct Seismic and Acquire Oil and Gas Lease, that can be used for organization and private requires. Every one of the types are inspected by professionals and meet federal and state needs.

When you are already signed up, log in for your account and click the Acquire key to find the Minnesota Release of Agreement of Option to Conduct Seismic and Acquire Oil and Gas Lease. Use your account to check through the authorized types you might have ordered formerly. Proceed to the My Forms tab of your account and have another backup of the file you require.

When you are a brand new customer of US Legal Forms, listed below are simple recommendations so that you can stick to:

- Initially, make certain you have chosen the correct form for your personal city/state. It is possible to look over the shape while using Review key and look at the shape description to guarantee this is the best for you.

- When the form fails to meet your preferences, utilize the Seach field to obtain the correct form.

- Once you are sure that the shape is suitable, go through the Get now key to find the form.

- Pick the rates program you would like and enter the required information and facts. Design your account and purchase an order utilizing your PayPal account or Visa or Mastercard.

- Select the document formatting and acquire the authorized file web template for your gadget.

- Total, modify and printing and indication the attained Minnesota Release of Agreement of Option to Conduct Seismic and Acquire Oil and Gas Lease.

US Legal Forms is the biggest catalogue of authorized types in which you can find a variety of file layouts. Take advantage of the company to acquire skillfully-made documents that stick to express needs.

Form popularity

FAQ

In the oil & gas context, a fee simple interest, sometimes called the mineral fee or fee simple mineral estate, is complete ownership of the mineral estate. The fee owner of the mineral estate has the rights to: Receive bonus. Receive delay rentals. Develop the minerals.

An oil or gas lease is a legal document where a landowner grants an individual or company the right to extract oil or gas from beneath the landowner's property. Courts generally find leases to be legally binding, so it is very important that you understand all the terms of a lease before you sign it.

RELEASE: releases of property rights and/or other legal rights that the owner would otherwise be entitled to under law. RELEASE LEASE: releases of oil & gas lease rights that a person would otherwise be entitled to under law.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Historically, mineral owners (?lessors?) and landmen/oil companies (?lessees?) spend most of their time focusing and negotiating the bonus payment, primary term and royalty provisions of an oil and gas lease. These provisions are important, but they represent only a small number of the important elements of the lease.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

An oil & gas lease is considered a fee simple determinable, meaning that it may end when production ceases. For more information on fee simple interests, see Practice Note, Multistate Real Estate Ownership: Overview.