Minnesota Affidavit of Heirship - Descent

Description

How to fill out Affidavit Of Heirship - Descent?

Choosing the right authorized document design could be a battle. Naturally, there are plenty of web templates available online, but how would you obtain the authorized form you require? Make use of the US Legal Forms site. The services gives a large number of web templates, such as the Minnesota Affidavit of Heirship - Descent, which can be used for company and personal demands. All of the types are examined by experts and meet up with state and federal requirements.

If you are currently listed, log in in your account and click the Obtain key to get the Minnesota Affidavit of Heirship - Descent. Make use of account to check from the authorized types you may have purchased previously. Go to the My Forms tab of your respective account and get another duplicate in the document you require.

If you are a whole new customer of US Legal Forms, allow me to share straightforward recommendations for you to adhere to:

- First, ensure you have chosen the correct form for your personal city/state. You can examine the shape utilizing the Review key and look at the shape information to guarantee this is basically the best for you.

- When the form fails to meet up with your preferences, use the Seach area to discover the correct form.

- When you are positive that the shape is suitable, select the Get now key to get the form.

- Select the rates prepare you need and enter in the required details. Build your account and purchase the order using your PayPal account or credit card.

- Pick the submit format and obtain the authorized document design in your gadget.

- Total, change and produce and indication the attained Minnesota Affidavit of Heirship - Descent.

US Legal Forms is the most significant catalogue of authorized types in which you can find various document web templates. Make use of the company to obtain expertly-created documents that adhere to status requirements.

Form popularity

FAQ

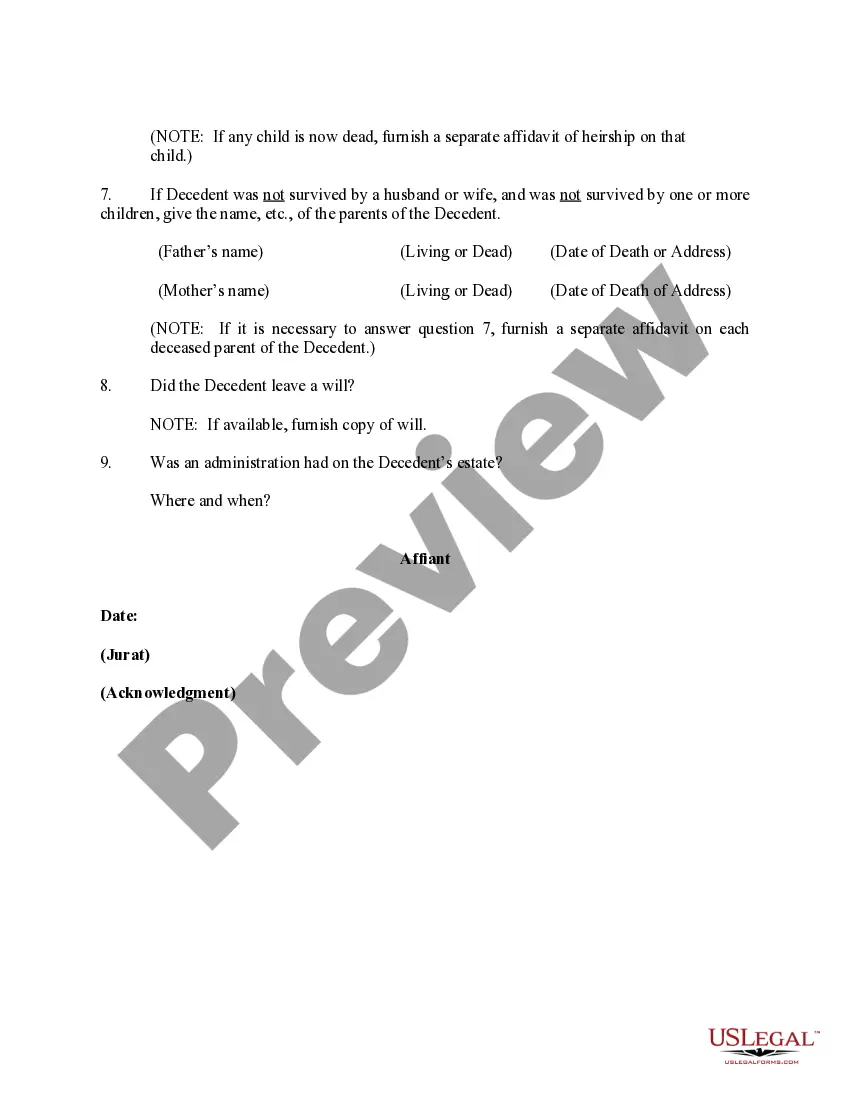

How to Write (1) Name Of Minnesota Deceased. ... (2) County Of Minnesota Deceased. ... (3) Name of Minnesota Petitioner. ... (4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death. ... (6) Basis For Minnesota Petitioner Claim. ... (7) Minnesota Decedent Estate Assets. ... (8) Signature Date Of Minnesota Petitioner.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate.

Minnesota law does not set a specific timeline for settling an estate, but it generally should be done as "expeditiously and efficiently as is compatible with the best interests of the estate." Delays can result in additional expenses and even legal repercussions for the executor.

Minnesota law allows people to establish living trusts to avoid probate for most every asset that you own. This includes real estate, vehicles, bank accounts, art collections, and more. In order to create a living trust, a trust document needs to be established. This is similar to a will.

MN Probate Accounting Not only are heirs of the estate entitled to know that probate is happening, but they can also demand to know how the estate was handled. It might even be that the executor was required by the state to administer the accountings of the estate to the beneficiaries. Beneficiary Rights in a Minnesota Probate - Flanders Law Firm flanderslawfirm.com ? minnesota-probate-law ? b... flanderslawfirm.com ? minnesota-probate-law ? b...

The Estate Settlement Timeline: While there is no specific deadline for this in Minnesota law, it is generally best to do so within a month to prevent unnecessary delays in the probate process. How Long Does an Executor Have to Settle an Estate ... - Snug getsnug.com ? post ? how-long-does-an-e... getsnug.com ? post ? how-long-does-an-e...

The seller must submit evidence of death with the transfer, such as a certified copy of a death certificate, a memorial card, or an obituary notice for the deceased owner. The seller must complete the date of sale, and if applicable complete the odometer, damage, and pollution system disclosures on the title.

A given executor's compensation, depending on how state law regulates things, may range from two to five percent of the total estate's value. Who Pays for Probate in Minnesota? - Flanders Law Firm flanderslawfirm.com ? who-pays-for-probate-in-... flanderslawfirm.com ? who-pays-for-probate-in-...

Non-Probate Assets bank or brokerage accounts that are held jointly or with a payable-on-death beneficiary designation to a surviving person; investment or retirement accounts or insurance policies that have a designated beneficiary other than the decedent that survives the decedent; or. property held in a trust.

Living Trusts In Minnesota, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on.