Minnesota Affidavit of Heirship for Small Estates

Description

How to fill out Affidavit Of Heirship For Small Estates?

Finding the right authorized papers design can be a struggle. Of course, there are plenty of themes available on the net, but how will you get the authorized kind you want? Use the US Legal Forms website. The services delivers 1000s of themes, including the Minnesota Affidavit of Heirship for Small Estates, which you can use for business and personal needs. Each of the varieties are checked out by experts and meet federal and state requirements.

If you are currently registered, log in for your account and then click the Down load key to find the Minnesota Affidavit of Heirship for Small Estates. Make use of your account to search from the authorized varieties you may have purchased formerly. Proceed to the My Forms tab of your own account and get an additional backup of the papers you want.

If you are a whole new user of US Legal Forms, listed below are easy recommendations for you to stick to:

- Initially, make certain you have chosen the correct kind for your city/area. You can look over the form making use of the Review key and look at the form outline to ensure it will be the best for you.

- If the kind does not meet your preferences, utilize the Seach discipline to find the appropriate kind.

- Once you are certain that the form is proper, select the Buy now key to find the kind.

- Pick the rates plan you need and enter the required information and facts. Create your account and pay money for an order using your PayPal account or charge card.

- Choose the document format and obtain the authorized papers design for your system.

- Total, revise and printing and signal the received Minnesota Affidavit of Heirship for Small Estates.

US Legal Forms is definitely the greatest catalogue of authorized varieties that you will find a variety of papers themes. Use the service to obtain skillfully-manufactured documents that stick to status requirements.

Form popularity

FAQ

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

How to Complete a Small Estate Affidavit in Minnesota Gather Necessary Documents. Prepare all the required legal documents, such as the death certificate, a list of assets, and information about debts and beneficiaries. Fill Out the Form. ... Distribute Assets.

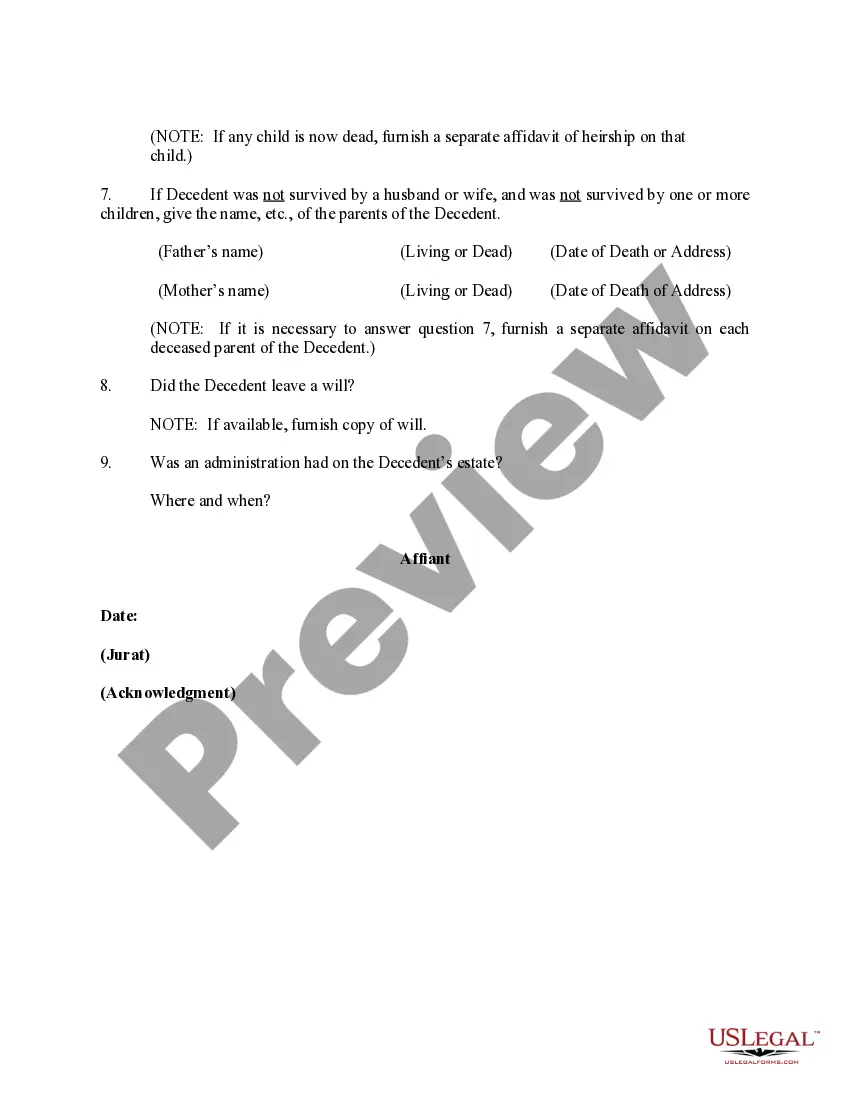

How to Write (1) Name Of Minnesota Deceased. ... (2) County Of Minnesota Deceased. ... (3) Name of Minnesota Petitioner. ... (4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death. ... (6) Basis For Minnesota Petitioner Claim. ... (7) Minnesota Decedent Estate Assets. ... (8) Signature Date Of Minnesota Petitioner.

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

How to fill out a small estate affidavit in Illinois Fill in your name and information in #1. Complete the information about the decedent in #2-4. Mark either #7a or #7b depending on what is true. ... Complete #9a to indicate the names of the spouse and children if any.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.