Minnesota Royalty Owner's Statement of Ownership

Description

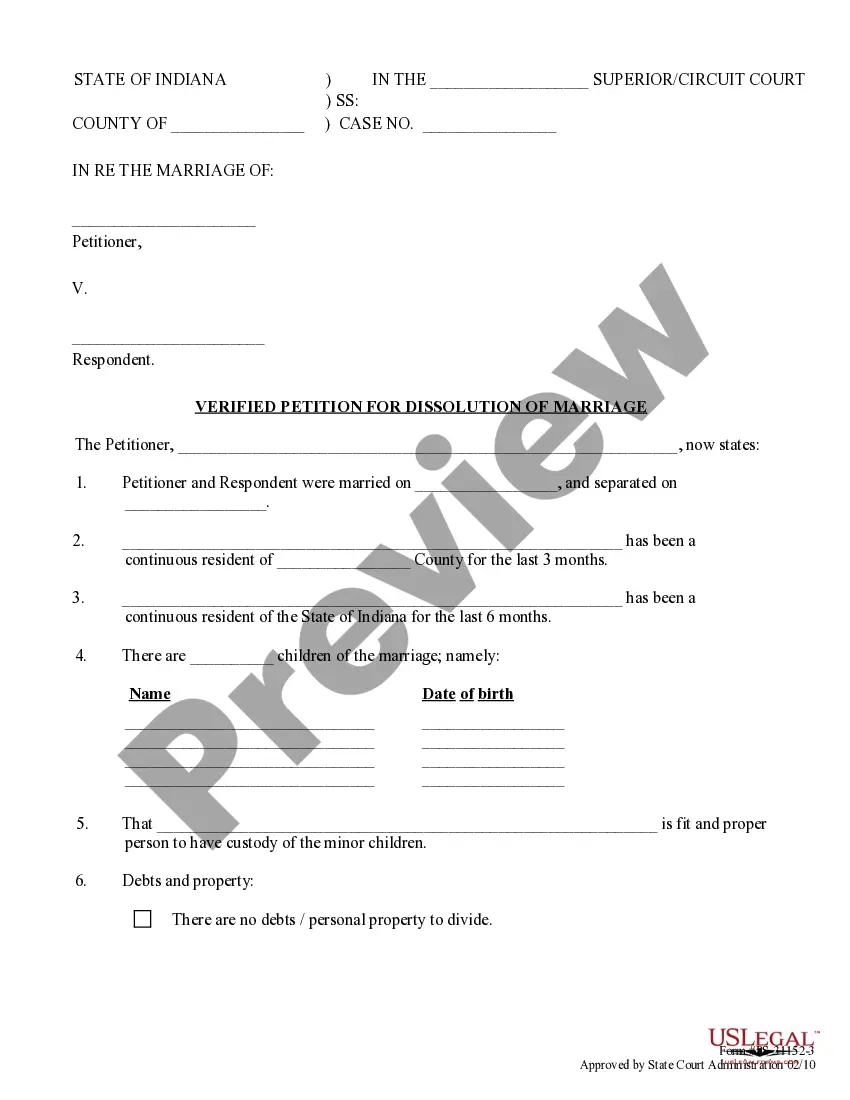

How to fill out Royalty Owner's Statement Of Ownership?

If you have to total, acquire, or print out lawful record themes, use US Legal Forms, the most important assortment of lawful varieties, which can be found on-line. Utilize the site`s basic and convenient search to discover the paperwork you will need. Various themes for business and individual reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Minnesota Royalty Owner's Statement of Ownership in just a few mouse clicks.

When you are already a US Legal Forms customer, log in for your accounts and click the Acquire switch to find the Minnesota Royalty Owner's Statement of Ownership. You may also accessibility varieties you previously acquired within the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape to the correct metropolis/region.

- Step 2. Use the Review option to look through the form`s content material. Never overlook to learn the information.

- Step 3. When you are not happy with the kind, take advantage of the Look for industry at the top of the monitor to locate other versions from the lawful kind web template.

- Step 4. After you have found the shape you will need, select the Acquire now switch. Select the pricing strategy you choose and put your qualifications to register on an accounts.

- Step 5. Procedure the purchase. You can utilize your bank card or PayPal accounts to complete the purchase.

- Step 6. Select the file format from the lawful kind and acquire it on your own gadget.

- Step 7. Full, change and print out or indication the Minnesota Royalty Owner's Statement of Ownership.

Each lawful record web template you acquire is the one you have eternally. You may have acces to every kind you acquired inside your acccount. Click on the My Forms portion and select a kind to print out or acquire again.

Compete and acquire, and print out the Minnesota Royalty Owner's Statement of Ownership with US Legal Forms. There are many expert and condition-distinct varieties you can utilize for your personal business or individual requirements.

Form popularity

FAQ

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

There are two types of rights that may be included in land ownership: surface rights and mineral rights. A landowner may own the rights to everything on the surface, but not the rights to underground resources such as oil, gas, and minerals.

Minnesota State - 6.25% (MN residents only. If you are a non-Minnesota resident, contact your state for tax withholding requirements.).

Ownership types Surface rights owners own the surface and substances such as sand and gravel, but not the minerals. The company or individual who owns the mineral rights owns all mineral substances found on and under the property. There are often different surface and mineral owners on the same land.

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

The majority of mineral rights in Minnesota are owned by corporations and individuals. Some of the larger owners tie back to the early railroads, timber companies, and land and mineral speculators.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.