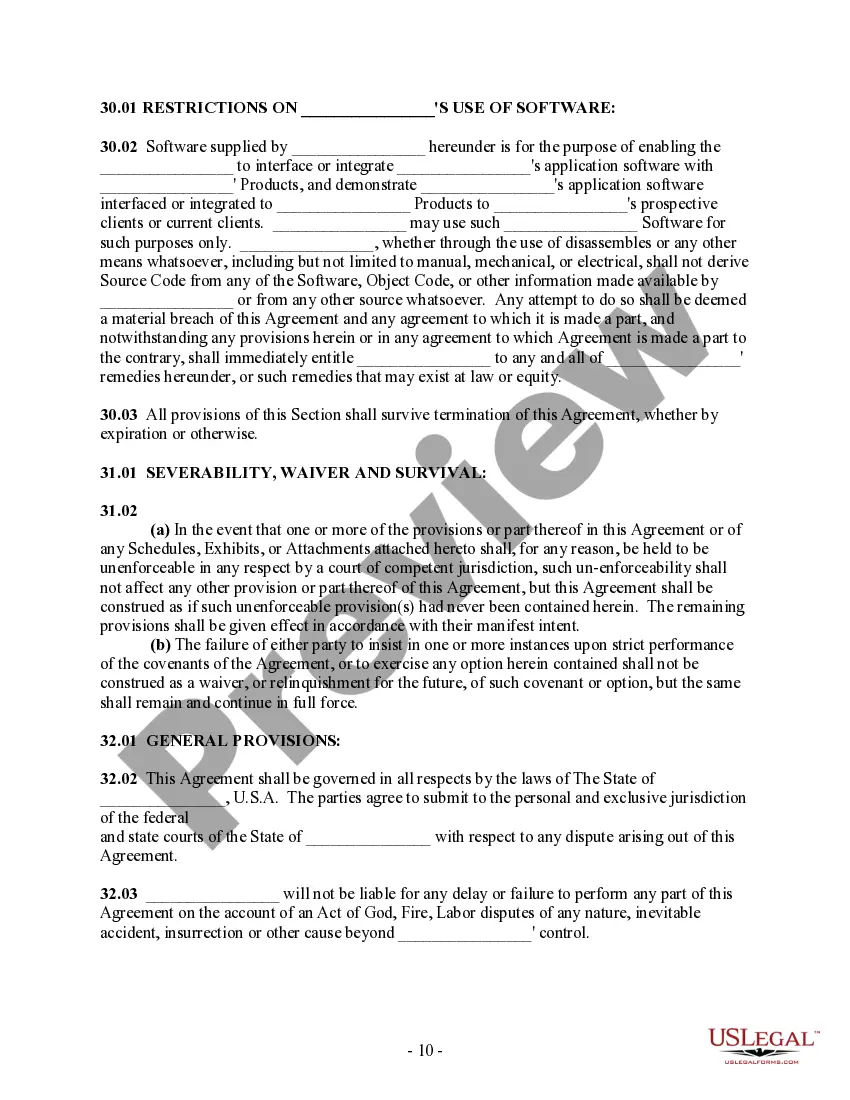

Minnesota Software Program License Agreement

Description

How to fill out Software Program License Agreement?

Finding the appropriate legal document template can be challenging. Naturally, there are numerous formats accessible online, but how do you obtain the legal document you desire? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the Minnesota Software Program License Agreement, which can be utilized for both business and personal needs. All forms are reviewed by experts and meet federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Minnesota Software Program License Agreement. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account to access another copy of the document you require.

Complete, modify, print, and sign the received Minnesota Software Program License Agreement. US Legal Forms is the largest collection of legal documents where you can find various document formats. Utilize the service to acquire professionally crafted paperwork that complies with state regulations.

- If you are a first-time user of US Legal Forms, here are simple instructions to follow.

- First, ensure you select the correct document for your region/state. You can review the form using the Preview button and check the form summary to confirm it is suitable for you.

- If the document does not meet your needs, utilize the Search area to find the appropriate form.

- Once you are certain that the form is correct, click the Buy now button to obtain the document.

- Choose the pricing plan you prefer and provide the required details. Create your account and complete the purchase using your PayPal account or credit/debit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Examples of licensing agreements range from music licensing in the entertainment industry to franchises like McDonald's. Each agreement typically defines how the licensed material can be used and any associated fees. By understanding these examples, you can better appreciate the relevance of a Minnesota Software Program License Agreement in your business dealings.

When reviewing a software license agreement, look for details such as the scope of the license, usage restrictions, and renewal terms. It is also important to check for clauses on support and maintenance and how disputes will be handled. A well-articulated Minnesota Software Program License Agreement can help protect your interests and clarify obligations.

Yes, Coca-Cola uses licensing as part of its business strategy. The company allows various bottlers and distributors to produce and sell its beverages under a licensing agreement. This approach helps expand their brand presence, similar to how a Minnesota Software Program License Agreement can enhance software distribution and usage for businesses.

Common types of license agreements include exclusive licenses, non-exclusive licenses, and sole licenses. An exclusive license allows only one licensee to use the software, while a non-exclusive license permits multiple users. A sole license falls somewhere in between. Understanding these distinctions is essential when considering a Minnesota Software Program License Agreement.

In Minnesota, an operating agreement is not legally required for all business entities. However, having a clear Minnesota Software Program License Agreement can help define the roles and responsibilities of members in a Limited Liability Company (LLC). This document serves as an internal guideline, promoting transparency among partners. It is always beneficial to consult with a legal expert to ensure your agreement meets all necessary requirements.

The key elements of a licensing agreement include the scope of the license, the duration of the agreement, payment terms, and any restrictions on usage. It's also crucial to detail the liability clauses and provisions for termination. A well-drafted Minnesota Software Program License Agreement will encompass these elements to provide clarity and protection for both parties.

To agree to the Apple Developer Program License Agreement, you must review the terms carefully and ensure you understand your rights and responsibilities. Once you've read through the agreement, you can accept it through the Apple Developer portal. Always consider having a legal professional review the agreement to align it with your current Minnesota Software Program License Agreement.

When drafting a license agreement, include restrictions on unauthorized copying, distribution, and modification of the software. It's also important to set requirements for the termination of the license, support availability, and liability limitations. A thorough Minnesota Software Program License Agreement will help safeguard your software from misuse.

In Minnesota, an operating agreement is not legally required for LLCs, but it is highly recommended. An operating agreement can clarify the management structure and operating procedures of the business. Having a solid operating agreement complements your other legal documents, including the Minnesota Software Program License Agreement.

One of the primary requirements of a software license agreement is to provide clear guidelines on how the software may be used. This includes details regarding the number of users, geographic restrictions, and types of permissible modifications. Ensuring these requirements are met in your Minnesota Software Program License Agreement minimizes potential legal disputes.