Minnesota Self-Employed Travel Agent Employment Contract

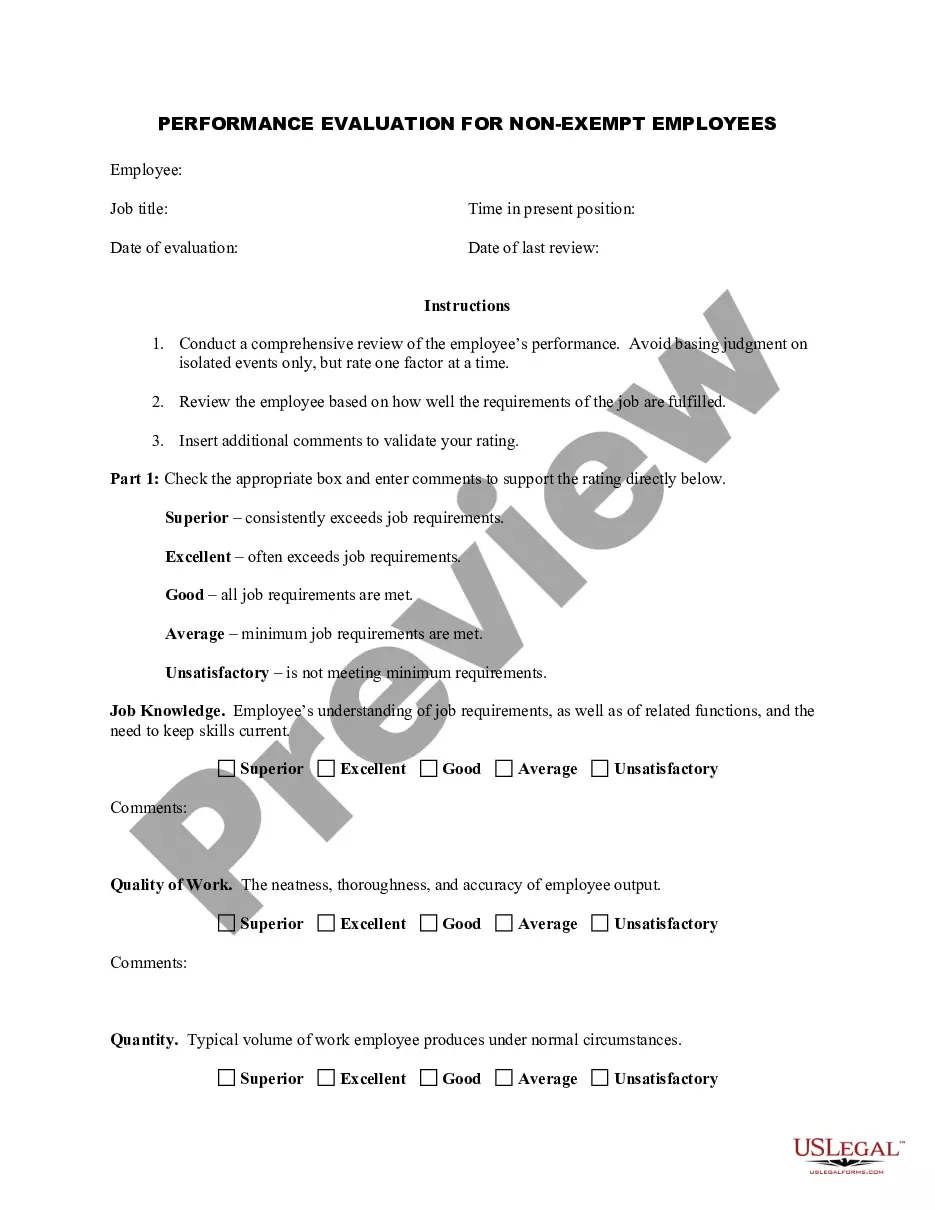

Description

How to fill out Self-Employed Travel Agent Employment Contract?

If you need to full, obtain, or print legitimate file web templates, use US Legal Forms, the greatest variety of legitimate types, that can be found on the web. Utilize the site`s simple and easy handy research to discover the documents you require. Different web templates for company and specific reasons are categorized by groups and suggests, or search phrases. Use US Legal Forms to discover the Minnesota Self-Employed Travel Agent Employment Contract in just a handful of click throughs.

If you are presently a US Legal Forms consumer, log in to the accounts and click the Download switch to find the Minnesota Self-Employed Travel Agent Employment Contract. You can even access types you earlier downloaded within the My Forms tab of your respective accounts.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that right metropolis/nation.

- Step 2. Use the Review method to look over the form`s content. Never neglect to see the explanation.

- Step 3. If you are unhappy with the develop, use the Look for field near the top of the monitor to discover other models of the legitimate develop web template.

- Step 4. Once you have found the form you require, go through the Acquire now switch. Select the rates program you like and include your credentials to sign up for an accounts.

- Step 5. Process the financial transaction. You can utilize your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the file format of the legitimate develop and obtain it on your own device.

- Step 7. Complete, revise and print or sign the Minnesota Self-Employed Travel Agent Employment Contract.

Each legitimate file web template you acquire is your own property permanently. You have acces to every single develop you downloaded in your acccount. Click on the My Forms segment and pick a develop to print or obtain once again.

Compete and obtain, and print the Minnesota Self-Employed Travel Agent Employment Contract with US Legal Forms. There are many specialist and state-particular types you may use for the company or specific demands.

Form popularity

FAQ

To establish yourself as an independent contractor, start by defining your services and identifying your target market. Next, create a Minnesota Self-Employed Travel Agent Employment Contract that outlines your responsibilities and payment terms. Additionally, consider registering your business and obtaining any necessary licenses or permits. Utilizing resources from platforms like US Legal Forms can guide you through these steps effectively.

You can find a Minnesota Self-Employed Travel Agent Employment Contract through various online platforms that specialize in legal documents. Websites like US Legal Forms offer ready-made templates that you can customize to fit your needs. This way, you ensure compliance with Minnesota laws while saving time and effort. Simply visit the site, search for the desired contract, and follow the prompts to obtain your document.

The income of independent contractor travel agents can vary widely based on factors such as experience, client base, and the types of travel they sell. Some agents may earn a significant income, while others may start with lower earnings. A Minnesota Self-Employed Travel Agent Employment Contract can provide a solid foundation for negotiating commissions and setting income expectations.

Not all realtors are classified as 1099 employees; their classification can depend on their working agreements. Many realtors work as independent contractors, but some may be employed under different arrangements. Understanding your employment status is crucial, and a Minnesota Self-Employed Travel Agent Employment Contract can help clarify your situation.

Yes, Minnesota has a self-employment tax that applies to individuals who earn income as self-employed. This tax is calculated based on your net earnings, so it's important to keep track of your income and expenses. A Minnesota Self-Employed Travel Agent Employment Contract can help you manage your finances effectively and ensure compliance with local tax laws.

Travel agents are often classified as 1099 employees, meaning they are considered independent contractors. This classification allows them to receive payment without tax withholdings, which they then report on their taxes. If you're working as a travel agent in Minnesota, having a Minnesota Self-Employed Travel Agent Employment Contract can clarify your status and responsibilities.

To file a 1099 in Minnesota, you need to collect essential information from your clients, such as their name, address, and taxpayer identification number. Additionally, keep accurate records of payments made throughout the year. Utilizing a Minnesota Self-Employed Travel Agent Employment Contract can help ensure you collect and maintain the necessary information for tax reporting.

The terms self-employed and independent contractor are often used interchangeably, but they can imply slightly different arrangements. Self-employed individuals own their business, while independent contractors typically work under a contract for another company. For travel agents in Minnesota, understanding the nuances can help in drafting a Minnesota Self-Employed Travel Agent Employment Contract that fits your needs.

Yes, many travel agents operate as self-employed individuals. This allows them to set their own schedules, choose their clients, and manage their income. As a self-employed travel agent, you can also benefit from a Minnesota Self-Employed Travel Agent Employment Contract, which outlines your working terms and conditions.

To write a simple employment contract, begin with the basic details of the parties involved and the job description. Clearly outline the terms of payment and any important deadlines. A straightforward approach will work well for a Minnesota Self-Employed Travel Agent Employment Contract, ensuring both parties understand their commitments.