Minnesota Headhunter Agreement - Self-Employed Independent Contractor

Description

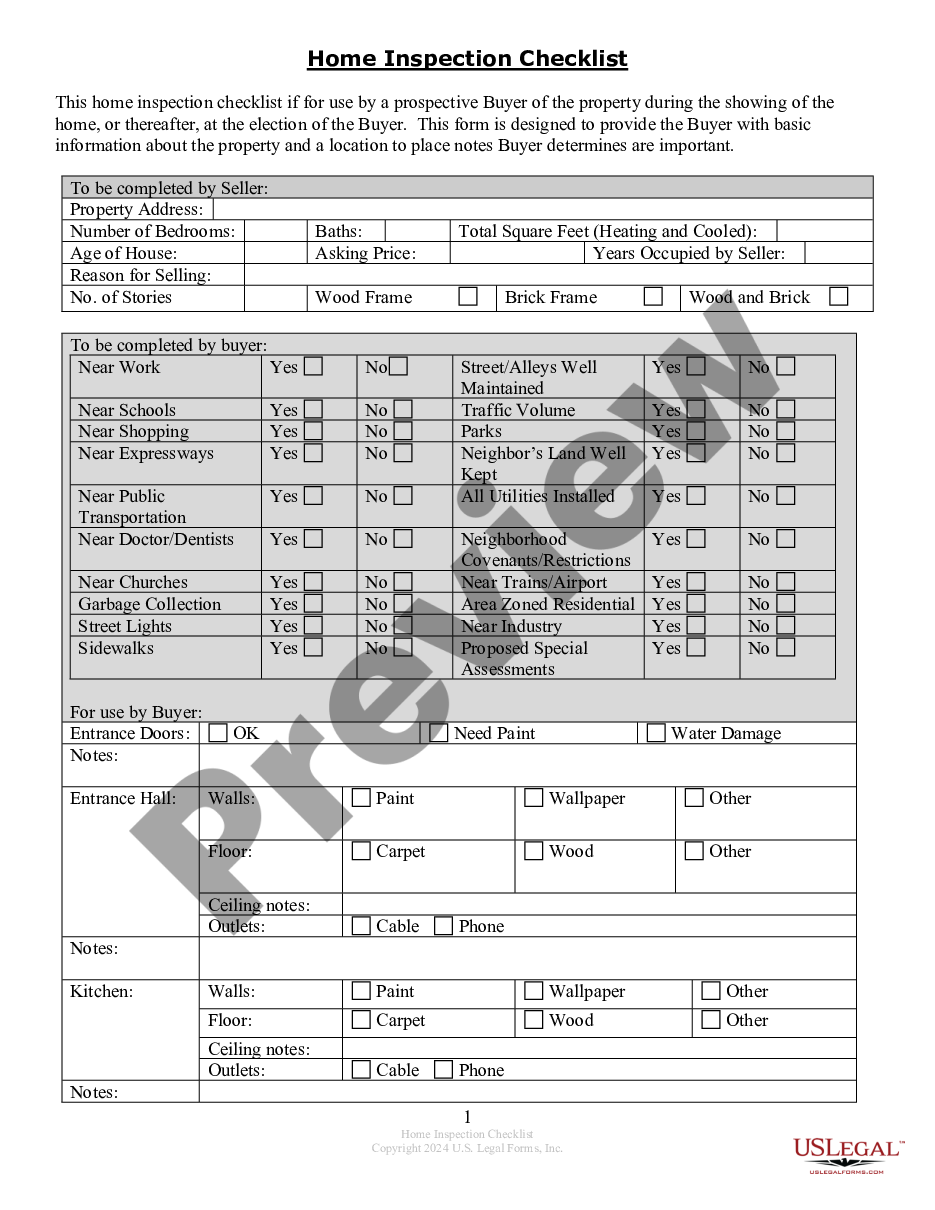

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

It is feasible to spend hours online searching for the legal document template that satisfies the federal and state standards you require.

US Legal Forms offers numerous legal forms that are evaluated by experts.

You can easily download or print the Minnesota Headhunter Agreement - Self-Employed Independent Contractor from the service.

If available, use the Review button to browse through the document template as well. If you wish to find another version of your form, use the Search field to locate the template that meets your needs and preferences. Once you have found the template you want, click Acquire now to proceed. Choose the pricing plan you need, enter your credentials, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Select the format of your document and download it to your device. Make adjustments to your document if necessary. You can fill out, modify, and sign and print the Minnesota Headhunter Agreement - Self-Employed Independent Contractor. Obtain and print numerous document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Minnesota Headhunter Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours to keep permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Check the form details to confirm you have chosen the right form.

Form popularity

FAQ

Yes, an independent contractor can have a non-compete agreement, but its enforceability may vary by state. It's important to review the terms carefully, as they could restrict your ability to work with other clients in your field. A Minnesota Headhunter Agreement - Self-Employed Independent Contractor can include clauses regarding non-competition, helping to protect both you and your clients while clarifying your rights.

You qualify as an independent contractor when you control the way you perform your work and operate as a separate business entity. The Minnesota Headhunter Agreement - Self-Employed Independent Contractor outlines your rights and obligations, reinforcing your independent status. Key factors include setting your own hours, providing your own tools, and having the freedom to work with multiple clients.

Proving you are an independent contractor involves gathering several key documents. You can present your Minnesota Headhunter Agreement - Self-Employed Independent Contractor, along with records of payments received from clients. Other helpful materials include a business license, client contracts, or any correspondence that confirms your independent status and the services you provide.

To show proof of self-employment, you can provide documents such as tax returns, bank statements, and invoices that detail your work. Additionally, a Minnesota Headhunter Agreement - Self-Employed Independent Contractor can serve as a formal record of your business activities. These documents help demonstrate that you manage your own business and income, which is essential for various purposes, including applying for loans or filing taxes.

Writing an independent contractor agreement starts with defining the parties involved and the scope of work to be done. Next, include payment details, timelines, and any relevant clauses from the Minnesota Headhunter Agreement - Self-Employed Independent Contractor. Ensure that both parties sign the agreement to establish a clear understanding of the terms. If you need assistance, uslegalforms offers comprehensive resources and templates that can guide you through this process.

To fill out an independent contractor agreement, begin by including your name, the client's name, and the date of the agreement. Clearly outline the services you will provide, the payment terms, and any deadlines. It is crucial to incorporate elements from the Minnesota Headhunter Agreement - Self-Employed Independent Contractor to ensure both you and the client understand your rights and responsibilities. Utilizing uslegalforms can streamline this process with ready-to-use templates.

Filling out an independent contractor form requires you to provide essential information about your business and services. Start by entering your name and contact details, followed by a description of the work you will perform. Be sure to reference the Minnesota Headhunter Agreement - Self-Employed Independent Contractor to ensure compliance with all necessary terms and conditions. You can find templates and guidance on platforms like uslegalforms to make this process easier.

To prove that you are an independent contractor under the Minnesota Headhunter Agreement - Self-Employed Independent Contractor, you need to demonstrate that you control the way you perform your work. This could include showing that you set your own hours, use your own tools, and are not under the direct supervision of a client. Keep records of your contracts, invoices, and communications to validate your status.

The primary difference between an employment contract and an independent contractor agreement lies in the nature of the working relationship. Employment contracts typically involve a long-term commitment with benefits, while independent contractor agreements are often project-based and do not include employee benefits. The Minnesota Headhunter Agreement - Self-Employed Independent Contractor clearly outlines this distinction, helping businesses and contractors understand their roles.

The independent contractor agreement in Minnesota is a legal document that defines the relationship between a business and its self-employed contractors. This agreement clarifies payment terms, project scope, and other essential details. By using the Minnesota Headhunter Agreement - Self-Employed Independent Contractor, you ensure that both parties have a clear understanding of their obligations and rights.