Minnesota Public Relations Agreement - Self-Employed Independent Contractor

Description

How to fill out Public Relations Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

Through the platform, you can locate thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can obtain the latest documents like the Minnesota Public Relations Agreement - Self-Employed Independent Contractor within moments.

If you already possess an account, Log In and download the Minnesota Public Relations Agreement - Self-Employed Independent Contractor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

Then, select your preferred pricing plan and provide your details to create an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Minnesota Public Relations Agreement - Self-Employed Independent Contractor.

Every document you save in your account does not have an expiration date and belongs to you permanently. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you require.

Access the Minnesota Public Relations Agreement - Self-Employed Independent Contractor through US Legal Forms, one of the most comprehensive repositories of legal document templates. Utilize thousands of expert and state-specific templates that meet your business or personal requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have chosen the right form for your city/state.

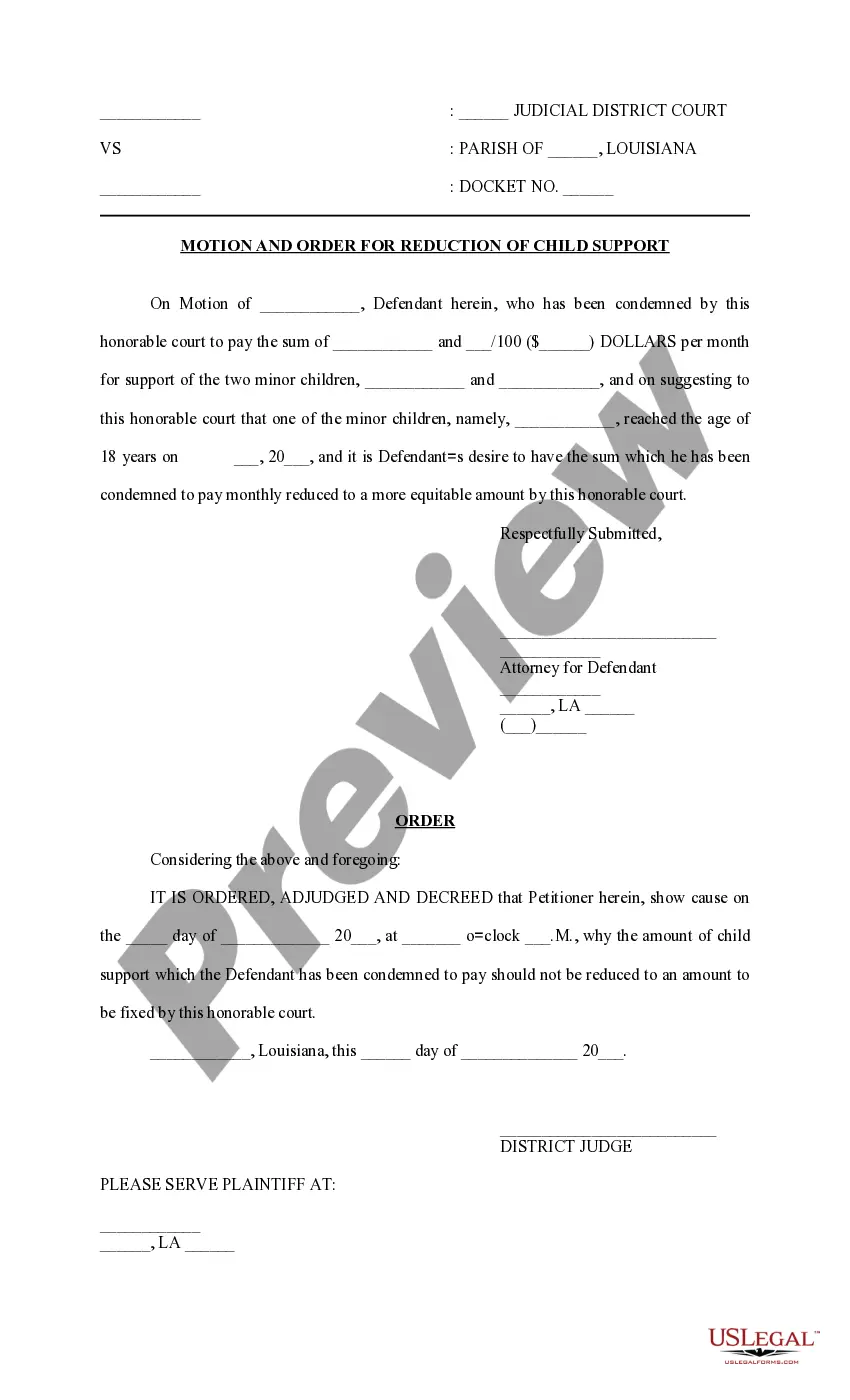

- Click the Review button to examine the contents of the form.

- Read the form description to ensure you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search box located at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

Form popularity

FAQ

A basic independent contractor agreement outlines crucial details such as payment terms, scope of work, project deadlines, and confidentiality. This document serves to protect both the contractor and the client, minimizing misunderstandings. Including specific terms in a Minnesota Public Relations Agreement - Self-Employed Independent Contractor can enhance clarity and facilitate a successful working arrangement.

Legal requirements for independent contractors include having a clear contract that defines the terms of work, maintaining tax compliance, and ensuring that the contractor operates independently. In Minnesota, an effective Minnesota Public Relations Agreement - Self-Employed Independent Contractor explicitly covers these requirements and details the rights and responsibilities of both parties. This ensures a smoother working relationship.

The new federal rule, introduced by the U.S. Department of Labor, aims to clarify the classification of independent contractors. This regulation focuses on the nature of the worker's relationship with the business, potentially affecting their classification. It’s important for businesses to review their agreements, such as the Minnesota Public Relations Agreement - Self-Employed Independent Contractor, to ensure compliance with these new guidelines.

An independent contractor agreement in Minnesota is a legal document that outlines the terms and conditions of a working relationship between a contractor and a client. This agreement details payment, work scope, deadlines, and confidentiality provisions. Utilizing a Minnesota Public Relations Agreement - Self-Employed Independent Contractor can be beneficial in ensuring both parties are protected.

When employing an independent contractor, essential paperwork includes a written independent contractor agreement and tax forms such as the W-9. This documentation clarifies the relationship and ensures compliance with IRS regulations. Additionally, incorporating a Minnesota Public Relations Agreement - Self-Employed Independent Contractor can help establish clear expectations.

Yes, Non-Disclosure Agreements (NDAs) can apply to independent contractors, including those involved in a Minnesota Public Relations Agreement - Self-Employed Independent Contractor. These agreements protect sensitive information shared during the course of a project. It's essential to outline the terms clearly to ensure both parties understand their responsibilities regarding confidentiality.

Filling out an independent contractor agreement involves completing sections that outline the project specifics, payment arrangements, and timelines. Be sure to accurately provide the contractor's information and outline their responsibilities. Including the phrases relevant to a Minnesota Public Relations Agreement - Self-Employed Independent Contractor will help clarify the legal context. If you're unsure, USLegalForms offers guidance and resources to assist you in accurately completing the agreement.

To write an independent contractor agreement, start by clearly defining the services the contractor will provide. Include details such as payment terms, deadlines, and specific obligations. Make sure to mention the relationship between the parties, indicating that this is a Minnesota Public Relations Agreement - Self-Employed Independent Contractor. You can use platforms like USLegalForms to find templates that simplify the drafting process and ensure compliance with local laws.