Minnesota Skip Tracer Services Contract - Self-Employed

Description

How to fill out Skip Tracer Services Contract - Self-Employed?

Are you in the situation where you require documents for either business or specific purposes almost every working day.

There are numerous legal document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers a vast array of form templates, such as the Minnesota Skip Tracer Services Contract - Self-Employed, that are designed to meet state and federal regulations.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes.

The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Minnesota Skip Tracer Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

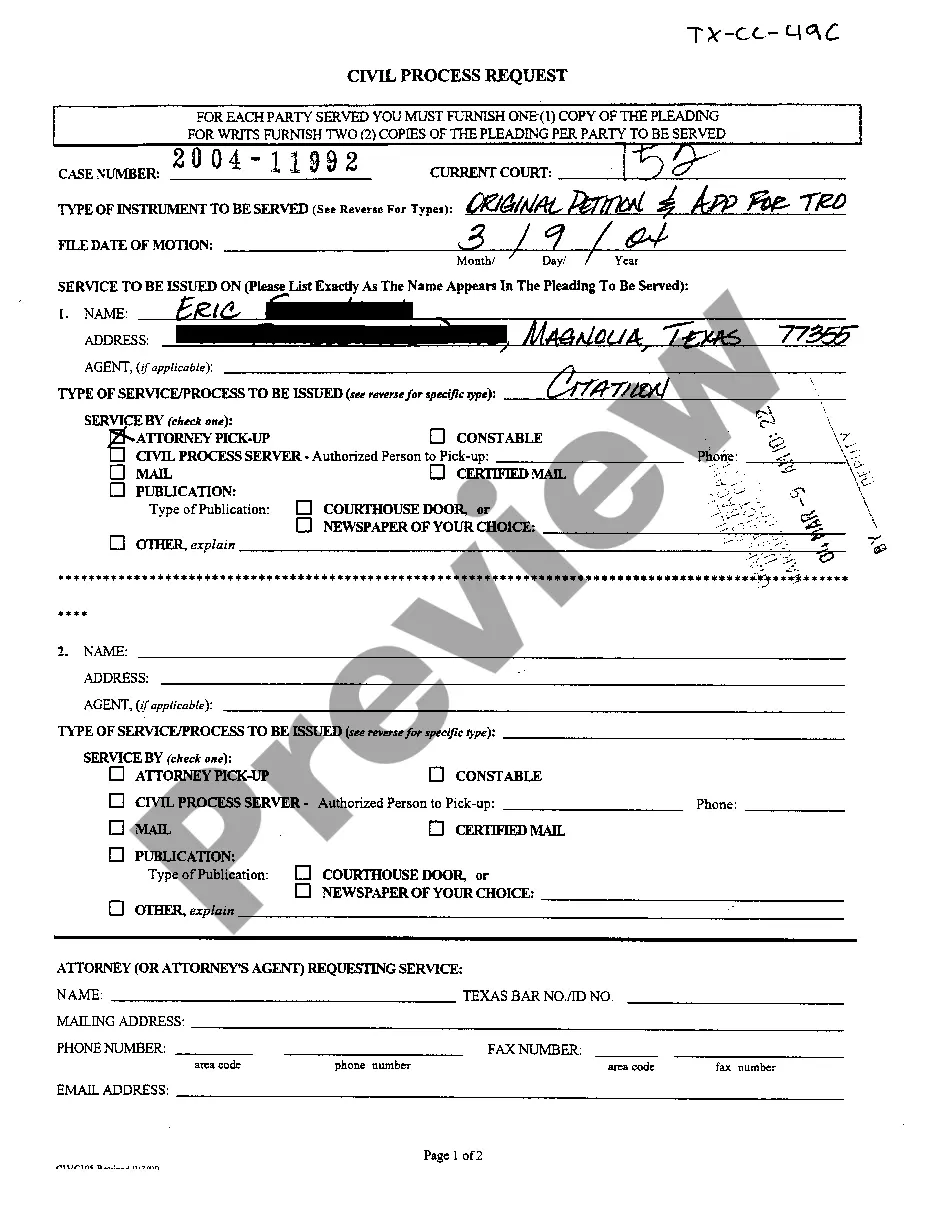

- Utilize the Review button to examine the form.

- Read the description to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Search area to find the form that suits your needs.

- Once you have the correct form, simply click Acquire now.

- Choose the pricing plan you want, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download an additional copy of the Minnesota Skip Tracer Services Contract - Self-Employed at any time if needed. Just click on the necessary form to download or print the document template.

Form popularity

FAQ

The independent contractor test in Minnesota determines whether a worker qualifies as an independent contractor rather than an employee. This test assesses various factors, including the level of control exerted over the worker's tasks. Understanding this test is crucial, and having a Minnesota Skip Tracer Services Contract - Self-Employed can provide clarity regarding your role and responsibilities.

Deciding between self-employed and independent contractor often depends on context. While both terms convey independence, 'independent contractor' specifically relates to contractual work. Using the phrase Minnesota Skip Tracer Services Contract - Self-Employed clearly communicates your professional standing, which can be beneficial in client interactions.

employed person can be referred to as an independent contractor, freelancer, or sole proprietor. Each term highlights different aspects of selfemployment, but they all share a commonality: independence in their work. Engaging with a Minnesota Skip Tracer Services Contract SelfEmployed can help define your role in this landscape.

Yes, a 1099 employee is considered self-employed. This label applies to individuals who receive a Form 1099 for services rendered, rather than a W-2 for traditional employment. For those working under contracts like the Minnesota Skip Tracer Services Contract - Self-Employed, this classification allows greater flexibility and tax advantages.

Yes, an independent contractor is essentially a self-employed individual. Both terms refer to those who operate their own businesses and do not work under a traditional employment structure. When you engage in a Minnesota Skip Tracer Services Contract - Self-Employed, you affirm your status as self-employed, taking control of your earnings and professional journey.

To establish yourself as an independent contractor, you should first determine your skills and services that you can offer. Next, create a business plan, register your business if required, and consider a contract like the Minnesota Skip Tracer Services Contract - Self-Employed. This contract outlines your services, payment terms, and responsibilities, helping you solidify your status.

No, an independent contractor cannot be called an employee. While both serve important roles in various industries, they differ in terms of relationship and obligations. An independent contractor operates independently under a contract, such as a Minnesota Skip Tracer Services Contract - Self-Employed, while an employee works under an employer's direction and control.

Showing proof of self-employment involves compiling comprehensive documentation of your business activities. This may include tax returns, invoices sent to clients, and any formal agreements you have in place, such as the Minnesota Skip Tracer Services Contract - Self-Employed. Maintaining organized records will help you effectively demonstrate your self-employed status.

To validate your independent contractor status, you need to gather relevant documents demonstrating your business activities. This includes invoices, contracts, business licenses, and any communications with clients. Utilizing the Minnesota Skip Tracer Services Contract - Self-Employed can bolster your proof of independence and strengthen your professional credibility.

Yes, Minnesota imposes a self-employment tax on income earned by independent contractors. This tax helps fund Social Security and Medicare, similar to payroll taxes for employees. It’s vital to consider this tax when calculating your earnings from the Minnesota Skip Tracer Services Contract - Self-Employed to ensure accurate tax compliance.