Minnesota Woodworking Services Contract - Self-Employed

Description

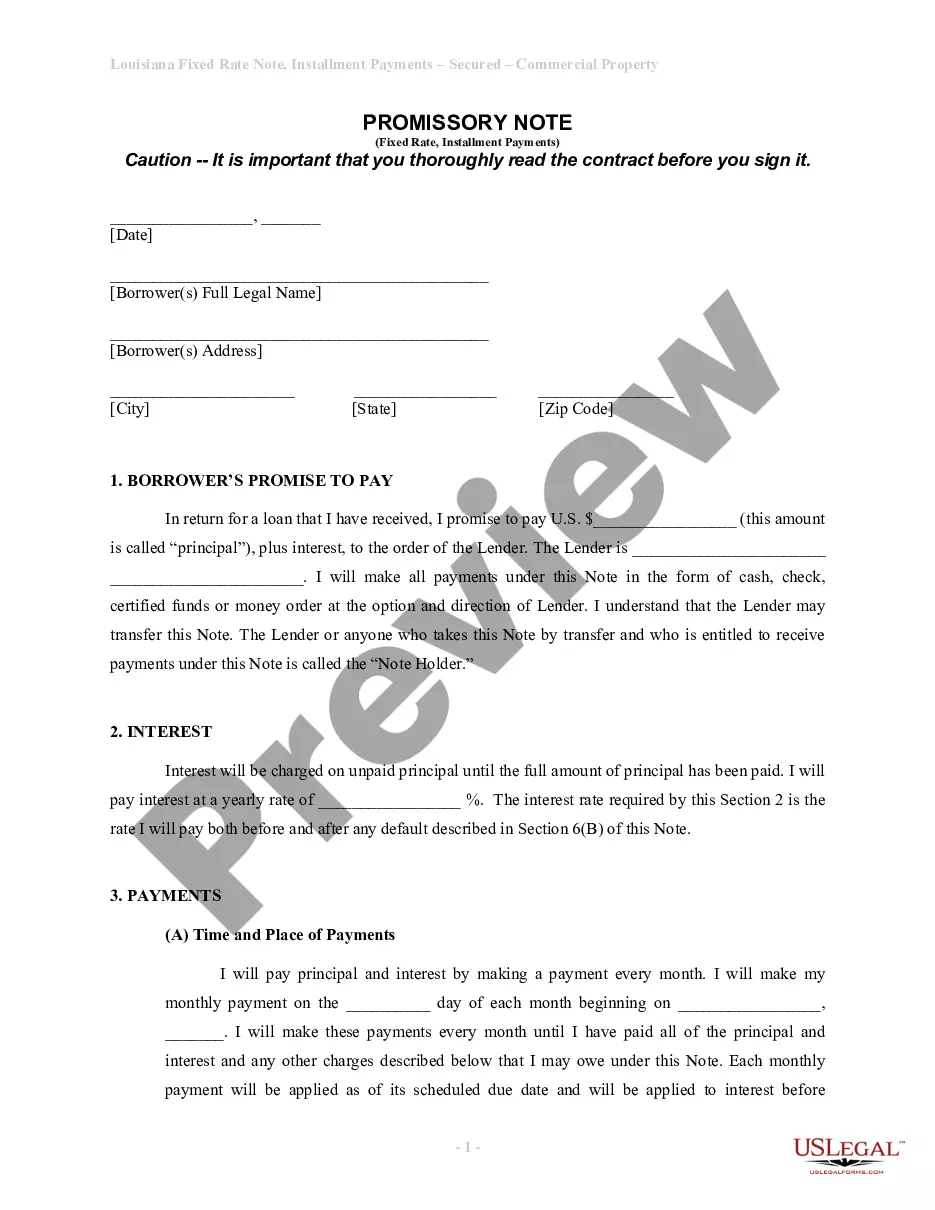

How to fill out Woodworking Services Contract - Self-Employed?

Selecting the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how can you locate the legal form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Minnesota Woodworking Services Contract - Self-Employed, that can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already a member, sign in to your account and click the Download button to obtain the Minnesota Woodworking Services Contract - Self-Employed. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, make sure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm this is the right one for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are sure that the form is correct, click the Buy now button to purchase the form. Choose the pricing plan you wish and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Minnesota Woodworking Services Contract - Self-Employed.

Utilize US Legal Forms for all your legal document needs and gain access to a comprehensive library of templates.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- Access a wide selection of templates for different legal needs.

- Ensure compliance with local laws through expert-reviewed documents.

- Easily retrieve your previous orders for convenience.

- Streamline your documentation process with user-friendly features.

Form popularity

FAQ

To be a subcontractor in Minnesota, you need to have the necessary skills relevant to the work you will undertake, and in some cases, a valid license. It is also important to have a good understanding of contracts, which includes your Minnesota Woodworking Services Contract - Self-Employed. Building a solid network and understanding the structure of the main contract is key. Consider leveraging uslegalforms to obtain sound contracts and guidelines that will help you succeed as a subcontractor.

You can issue a 1099 to someone even if they do not have a business license, as long as they are classified correctly as an independent contractor. However, the lack of a business license could indicate a potential risk. For a smooth operation under the Minnesota Woodworking Services Contract - Self-Employed, it is prudent to ensure that your contract and tax compliance are in order. Using uslegalforms can help make this process clearer and more efficient.

Subcontractors in Minnesota need a license depending on the specific trade they perform. For instance, someone subcontracting plumbing or electrical work would require a license, while general woodworking might not have such a requirement. It's advisable to verify licensing needs based on your Minnesota Woodworking Services Contract - Self-Employed. For clarity on subcontracting regulations, consult uslegalforms to streamline your process.

In Minnesota, some types of work can be performed without a contractor's license, including basic woodworking tasks or handyman services. However, the nature of the job and its complexity can influence whether a license is necessary. For your Minnesota Woodworking Services Contract - Self-Employed, it is wise to clarify job specifications and licensing needs. If in doubt, refer to uslegalforms for proper guidelines.

In Minnesota, not all contractors need a license; however, specific fields such as electrical and plumbing require proper licensing. If you are operating under a Minnesota Woodworking Services Contract - Self-Employed, it is crucial to know whether your trade falls under licensing regulations. Licensing assures clients of quality and compliance, so check local rules before commencing work. Always consider using uslegalforms to ensure you understand the licensing requirements relevant to your services.

The independent contractor test in Minnesota determines whether a worker qualifies as an independent contractor or an employee. This classification affects how income is reported and the obligations of both parties. Typically, the test considers factors such as the level of control exercised over the worker and their independence in executing tasks. Understanding this test is essential for anyone entering a Minnesota Woodworking Services Contract - Self-Employed.

In Minnesota, handymen typically need a license if they perform work that exceeds a certain monetary threshold. For legal peace of mind, consider all relevant regulations while drafting your Minnesota Woodworking Services Contract - Self-Employed. Ensuring you are properly licensed protects you and your clients, and navigating this with uslegalforms makes compliance straightforward.

To set up as an independent contractor, you need to register your business, secure any required licenses, and obtain liability insurance. It’s also wise to draft a Minnesota Woodworking Services Contract - Self-Employed that details your services, payment terms, and responsibilities. Using uslegalforms can help you create a professional contract that meets legal standards.

Legal requirements for independent contractors include obtaining necessary licenses and permits, maintaining proper insurance, and adhering to tax obligations. You should also clearly outline your services in a Minnesota Woodworking Services Contract - Self-Employed to avoid any misunderstandings. Compliance with both state and federal laws is key to maintaining your status as an independent contractor.

To be classified as an independent contractor, you must maintain control over how you perform your work. This means you decide on your methods, tools, and schedule without significant oversight from a client. For those providing services under a Minnesota Woodworking Services Contract - Self-Employed, understanding this distinction is crucial for your legal status.