Minnesota Telemarketing Agreement - Self-Employed Independent Contractor

Description

How to fill out Telemarketing Agreement - Self-Employed Independent Contractor?

Have you been in a situation that you will need paperwork for sometimes enterprise or individual uses almost every day time? There are tons of legitimate document templates available on the Internet, but finding types you can depend on isn`t straightforward. US Legal Forms gives a huge number of kind templates, just like the Minnesota Telemarketing Agreement - Self-Employed Independent Contractor, that are created in order to meet state and federal demands.

If you are previously informed about US Legal Forms internet site and have a merchant account, just log in. After that, you are able to obtain the Minnesota Telemarketing Agreement - Self-Employed Independent Contractor format.

Unless you come with an bank account and want to begin using US Legal Forms, follow these steps:

- Find the kind you will need and ensure it is for that proper area/area.

- Make use of the Preview button to review the form.

- Browse the explanation to actually have selected the correct kind.

- If the kind isn`t what you are seeking, utilize the Search discipline to obtain the kind that fits your needs and demands.

- If you obtain the proper kind, click Get now.

- Select the rates plan you need, complete the specified details to generate your bank account, and pay money for your order utilizing your PayPal or credit card.

- Pick a handy file format and obtain your backup.

Find each of the document templates you might have bought in the My Forms food list. You may get a extra backup of Minnesota Telemarketing Agreement - Self-Employed Independent Contractor any time, if needed. Just select the needed kind to obtain or printing the document format.

Use US Legal Forms, by far the most considerable selection of legitimate kinds, to conserve some time and stay away from mistakes. The service gives skillfully created legitimate document templates which you can use for an array of uses. Produce a merchant account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

Wage & Hour LawIndependent contractors are not considered employees under the Fair Labor Standards Act and therefore are not covered by its wage and hour provisions. Generally, an independent contractor's wages are set pursuant to his or her contract with the employer.

Reporting Requirements You must report independent contractor information to the EDD within 20 days of either making payments totaling $600 or more or entering into a contract for $600 or more or entering with an independent contractor in any calendar year, whichever is earlier.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

In September of 2019, Governor Newsom signed Assembly Bill (AB) 5 into law. The new law addresses the employment status of workers when the hiring entity claims the worker is an independent contractor and not an employee.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

More affordable Although you may pay more per hour for an independent contractor, your overall costs are likely to be less. You don't have to withhold taxes, pay for unemployment and workers comp insurance or provide healthcare benefits, nor do you have to cover the cost of office space or equipment.

The Minnesota Department of Employment and Economic Development (DEED) announced today that the agency has begun making Pandemic Unemployment Assistance (PUA) payments to people who are self-employed, independent contractors, and other eligible recipients who are not eligible for regular unemployment benefits.

The CUIAB has generally held that telemarketers are employees and not independent contractors in cases where they work under some or all of the following circumstances: The telemarketers are given a sheet to follow when arranging appointments.

Independent contractors perform independently; whereas, under an employer/employee relationship the employer retains the right to direct and control the work being performed, as well as control over the details or techniques of the work to be performed. 3.

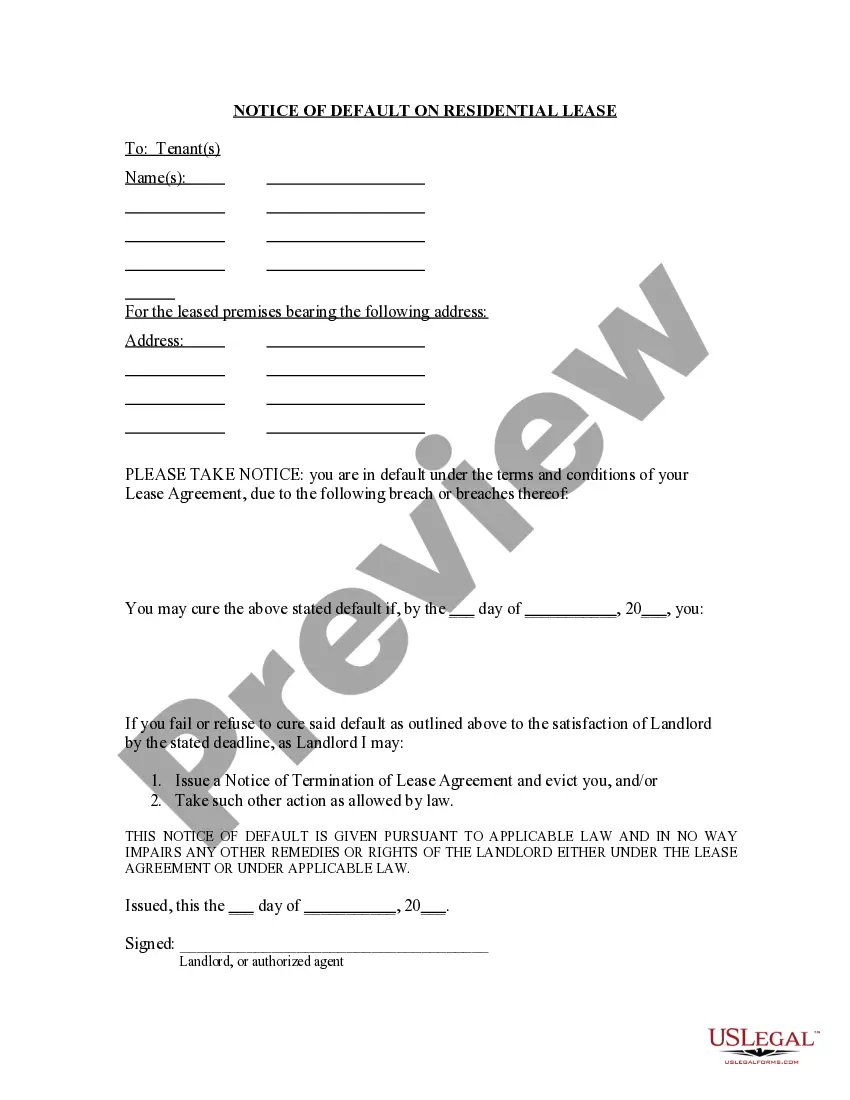

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.