Minnesota Pipeline Service Contract - Self-Employed

Description

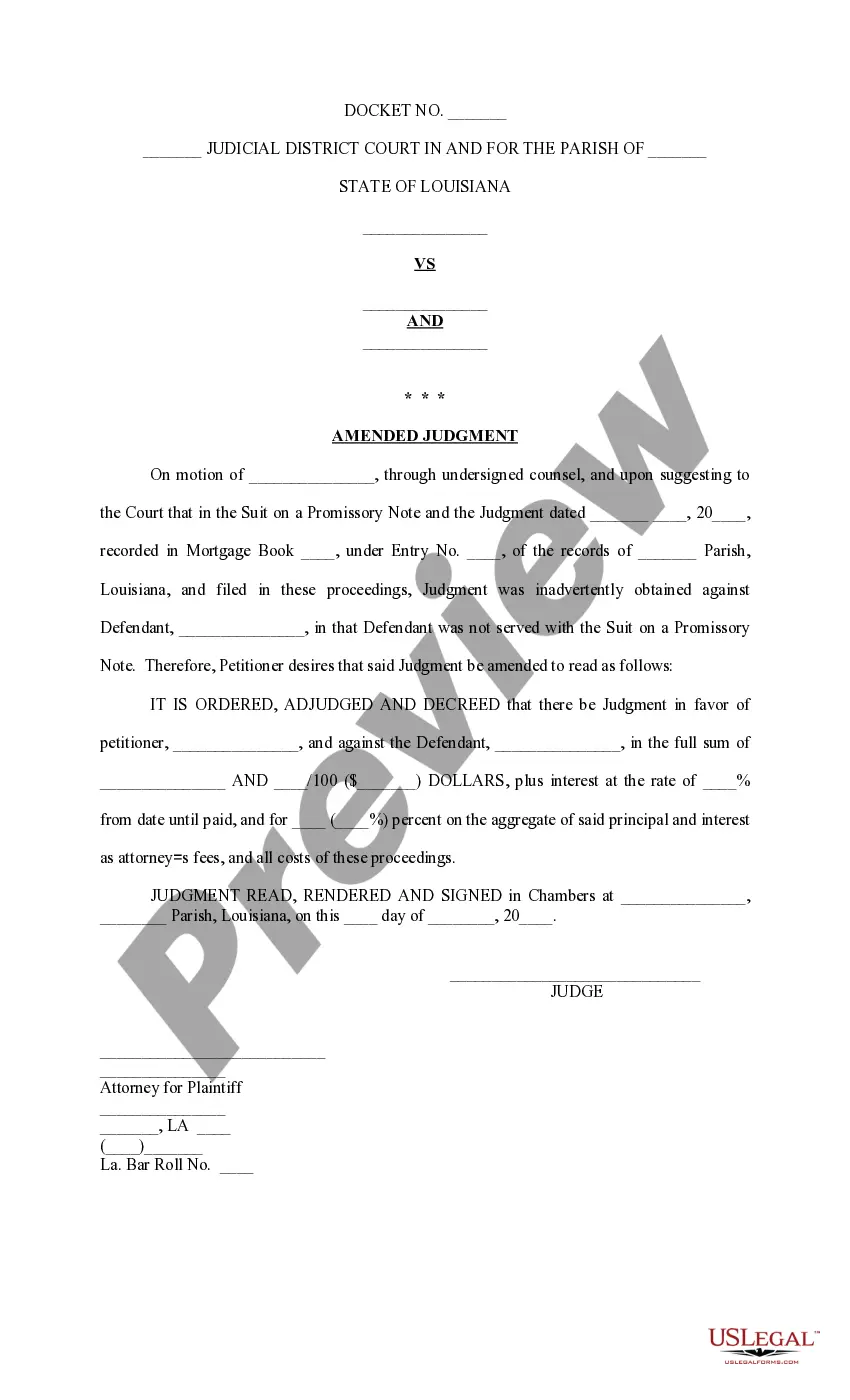

How to fill out Pipeline Service Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Minnesota Pipeline Service Contract - Self-Employed in moments.

If you already have an account, Log In and download the Minnesota Pipeline Service Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your information to register for an account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Select the file format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Minnesota Pipeline Service Contract - Self-Employed. Each form you added to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Make sure you have selected the correct form for your location.

- Click the Preview button to review the form's content.

- Check the description of the form to ensure you have chosen the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

To establish yourself as an independent contractor, you first need to determine your business structure, such as a sole proprietorship or LLC. Next, obtain any necessary licenses and permits specific to your field, especially for services under the Minnesota Pipeline Service Contract - Self-Employed. Additionally, it's crucial to set up a separate business bank account to manage your finances effectively. Finally, consider using platforms like US Legal Forms to create and manage your contracts, ensuring you meet all legal requirements.

Legal requirements for independent contractors often include obtaining necessary business licenses, filing taxes correctly, and not being classified as an employee by the IRS. Those working under a Minnesota Pipeline Service Contract - Self-Employed should understand their rights and obligations to maintain compliance. Consulting a legal professional may provide clarity on specific local regulations.

Certainly! If you're self-employed, having a contract is not only permissible, but also advisable. A well-structured Minnesota Pipeline Service Contract - Self-Employed outlines the terms of your work, including payment schedules and deliverables. This protects both you and your clients by setting clear expectations.

Yes, you can absolutely be self-employed and have a contract. In fact, a Minnesota Pipeline Service Contract - Self-Employed is a common way for individuals to formalize their work relationships. Having a contract can clarify expectations between you and the client, which helps ensure fair treatment and prompt payment for your services.

New rules regarding self-employment often focus on taxation and reporting requirements. For instance, the recent updates may require additional documentation for those using the Minnesota Pipeline Service Contract - Self-Employed to ensure compliance with IRS guidelines. Staying informed about these changes can help you navigate your self-employment journey more easily.

Yes, contract work definitely qualifies as self-employment. When you enter a Minnesota Pipeline Service Contract - Self-Employed, you are effectively working for yourself, not an employer. This means you have the freedom to set your schedule, but you are also responsible for securing your own benefits and handling your tax obligations.

The terms self-employed and independent contractor are often used interchangeably, but they can convey slightly different meanings. When you mention independent contractor, it specifically indicates a contractual relationship typically linked to a client or company, like those outlined in a Minnesota Pipeline Service Contract - Self-Employed. For clarity in professional contexts, consider the nature of your work and the perspective you want to share.

Yes, Minnesota imposes a self-employment tax on individuals who operate as independent contractors, including those under the Minnesota Pipeline Service Contract - Self-Employed. This tax applies to net earnings and is typically calculated along with federal self-employment taxes. Make sure you set aside a portion of your income to cover this tax obligation, as it can be significant.

To prove you are an independent contractor under the Minnesota Pipeline Service Contract - Self-Employed, gather documents such as your business license, tax returns, and any contracts you have with clients. These documents showcase your self-employment status and help clarify your independence in your work. Keep in mind, consistency in how you refer to your income and services also strengthens your position.

For a contract to be legally binding in Minnesota, it must include an offer, acceptance, and consideration. All parties must also have the capacity to enter into a contract, and the agreement must be lawful. Additionally, written contracts, especially in business, help provide clarity and enforceability. When creating a Minnesota Pipeline Service Contract - Self-Employed, ensuring these elements are present can protect your interests and provide a solid foundation for your agreements.