Minnesota Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

US Legal Forms - one of several largest libraries of legal kinds in the States - offers a variety of legal papers templates you may download or print out. Making use of the website, you will get a huge number of kinds for business and personal reasons, sorted by types, claims, or search phrases.You will discover the newest models of kinds much like the Minnesota Summary of Terms of Proposed Private Placement Offering in seconds.

If you have a subscription, log in and download Minnesota Summary of Terms of Proposed Private Placement Offering from the US Legal Forms local library. The Obtain button will show up on each develop you see. You gain access to all in the past acquired kinds inside the My Forms tab of the account.

In order to use US Legal Forms the first time, allow me to share easy guidelines to help you get started off:

- Be sure to have selected the right develop for the town/area. Select the Preview button to check the form`s articles. Look at the develop description to actually have chosen the right develop.

- In case the develop does not fit your specifications, make use of the Search discipline towards the top of the display to obtain the one which does.

- If you are content with the shape, confirm your decision by visiting the Buy now button. Then, select the costs prepare you want and supply your accreditations to sign up for the account.

- Procedure the purchase. Use your Visa or Mastercard or PayPal account to perform the purchase.

- Find the structure and download the shape on the product.

- Make alterations. Fill up, edit and print out and indication the acquired Minnesota Summary of Terms of Proposed Private Placement Offering.

Every single format you put into your bank account does not have an expiration time and it is yours forever. So, if you want to download or print out yet another backup, just go to the My Forms portion and click on about the develop you will need.

Get access to the Minnesota Summary of Terms of Proposed Private Placement Offering with US Legal Forms, probably the most substantial local library of legal papers templates. Use a huge number of expert and status-particular templates that meet up with your organization or personal requirements and specifications.

Form popularity

FAQ

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

PPM (Parts per million) is a measurement used today by many customers to measure quality performance. To calculate: For example, let's say you had 25 pieces defective in a shipment of 1,000 pieces. 25/1000= . 025 or 2.5% defective. .

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

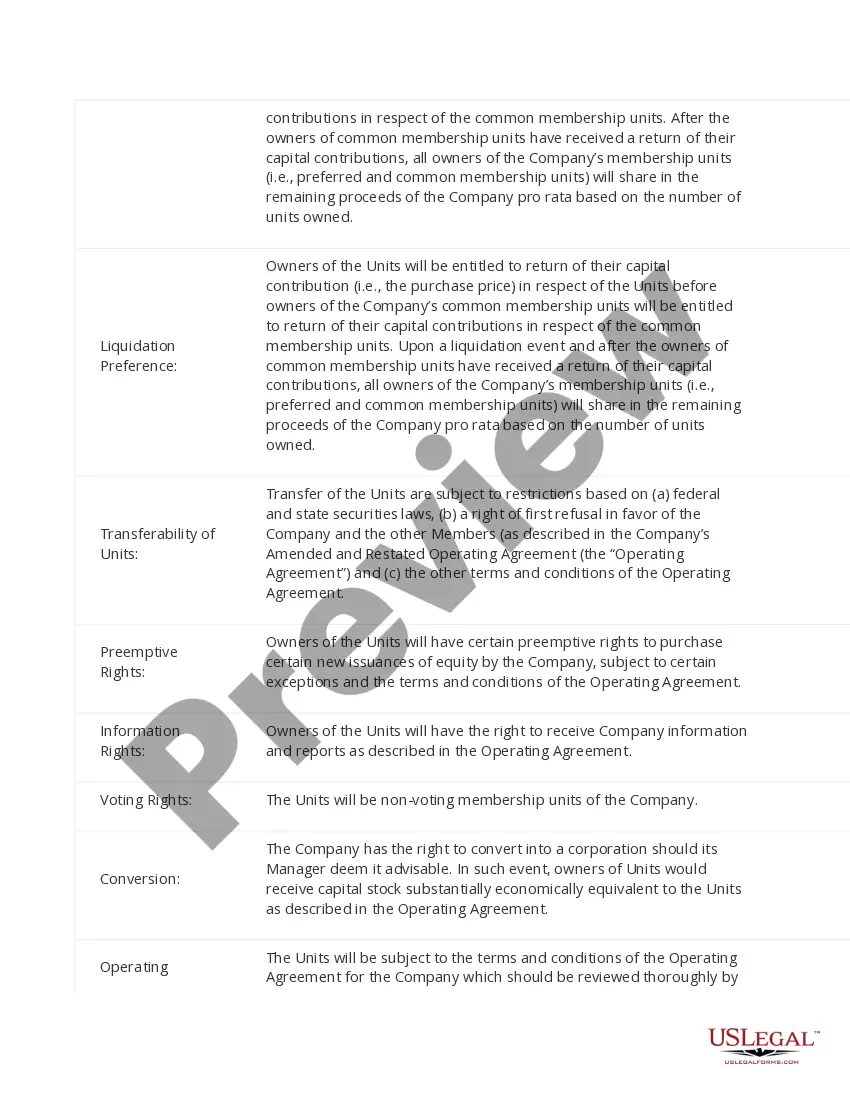

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

An offering memorandum is a document issued to potential investors in a private placement deal. The offering memorandum spells out the private placement's objectives, risks, financials, and deal terms.