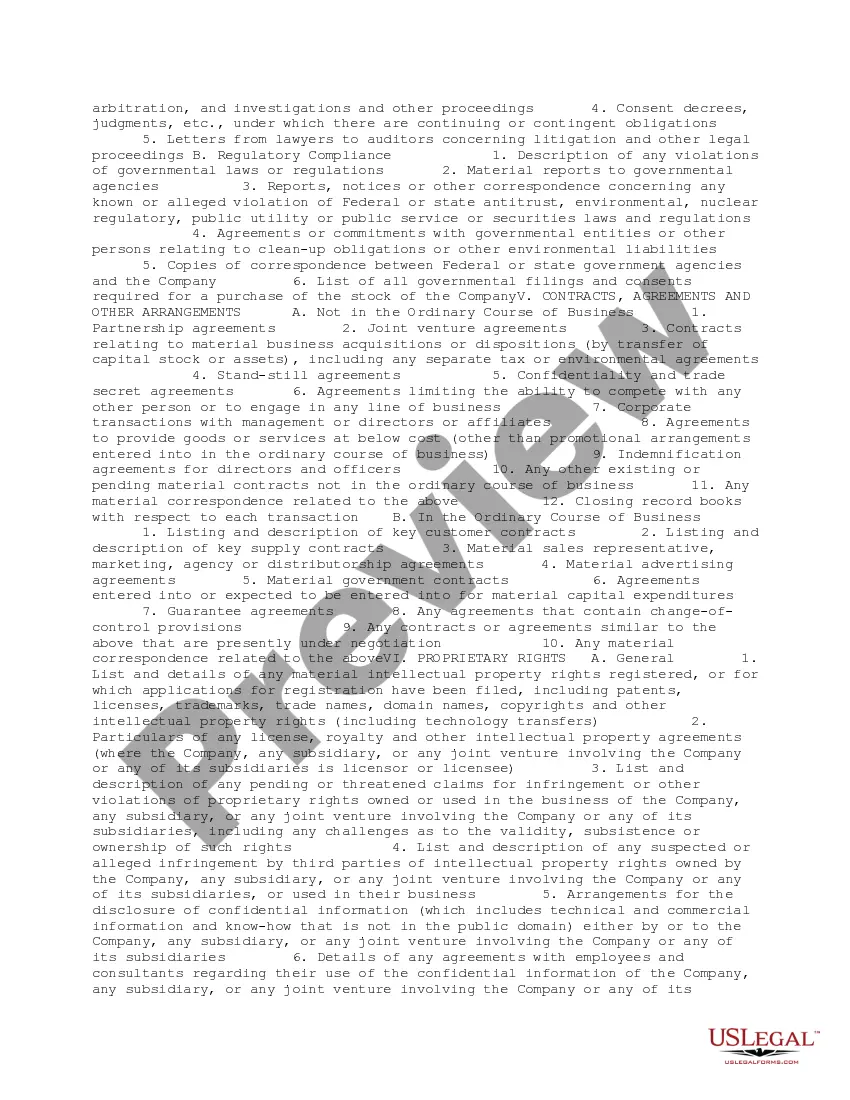

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Minnesota Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

Finding the appropriate legal document template can be challenging. Clearly, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Minnesota Request for Due Diligence Documents from a Technology Company, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state standards.

If you are already registered, Log In to your account and click the Download button to access the Minnesota Request for Due Diligence Documents from a Technology Company. Use your account to review the legal forms you have previously purchased. Visit the My documents section of your account and obtain another copy of the documents you require.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Minnesota Request for Due Diligence Documents from a Technology Company. US Legal Forms is the premier repository of legal forms where you can find various document templates. Leverage the service to download professionally crafted paperwork that adheres to state regulations.

- First, make sure you have selected the appropriate form for your city/region.

- You can view the form using the Review button and read the form description to ensure it is the correct one for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident the form is suitable, click on the Acquire now button to access the form.

- Choose your desired payment plan and enter the required information.

- Create your account and complete the order payment through your PayPal account or credit card.

Form popularity

FAQ

To file a complaint against a business in Minnesota, you can contact the relevant state agency or use online complaint forms provided by those agencies. It is helpful to have any supporting documentation ready, such as your Minnesota Request for Due Diligence Documents from a Technology Company, to strengthen your case. Be sure to follow the guidelines provided by the specific agency for a smoother process.

Yes, you can file for divorce online in Minnesota through various legal platforms designed for this purpose. This approach offers a structured and user-friendly way to manage the complexities of your case. If you find yourself needing to prepare due diligence documents in conjunction with your divorce process, platforms like US Legal Forms are here to assist you.

Due diligence documents include records and materials that a company or individual must prepare when conducting research or evaluations. These documents help parties understand risk, compliance, and the overall health of a business relationship. For a technology company in Minnesota requesting due diligence documents, clarity in preparation is key to ensuring a successful transaction.

Online filing of documents refers to the electronic submission of legal forms and paperwork through designated websites or platforms. This method streamlines the process, reducing paperwork and allowing for quicker access to services. When dealing with a Minnesota Request for Due Diligence Documents from a Technology Company, utilizing online filing can save you time and effort.

Yes, you can file various documents online in Minnesota, including legal filings. This process enhances convenience and efficiency, particularly for requests involving due diligence documents. Utilizing a platform like US Legal Forms simplifies the submission of your Minnesota Request for Due Diligence Documents from a Technology Company.

In simple terms, due diligence is the process of thoroughly investigating a company, especially before making an investment or partnership decision. It involves reviewing various aspects of the business, such as financials, legal matters, and operational systems. A Minnesota Request for Due Diligence Documents from a Technology Company helps individuals or organizations collect relevant information to understand potential risks and benefits. Ultimately, due diligence allows you to make more informed and confident business decisions.

To apply for due diligence, you can start by drafting a Minnesota Request for Due Diligence Documents from a Technology Company that outlines your specific needs and the documents you seek. It’s essential to communicate clearly with the company to ensure they understand your intentions and the type of information that will best serve you. Submitting your request through a platform like uslegalforms can streamline the process and provide you with the necessary templates and guidelines. This ensures you receive comprehensive documentation to assist in your evaluation.

Technology due diligence refers to the process of evaluating the technology assets, processes, and systems of a company before making a significant investment or acquisition. This process involves reviewing software, hardware, and IT infrastructure, as well as assessing compliance with legal regulations. A Minnesota Request for Due Diligence Documents from a Technology Company will help you gather this crucial information. Understanding these aspects can mitigate risks and enhance the strategic value of your decision.

When you submit a Minnesota Request for Due Diligence Documents from a Technology Company, you should ask for specific documents such as financial statements, legal compliance records, intellectual property details, and customer contracts. These documents provide insights into the company's operations, financial health, and potential risks. Having this information helps you make informed decisions about your investment or partnership. Always ensure that you clearly outline your requirements to receive the most relevant documentation.

When proving due diligence, consider documentation, timing, and the thoroughness of your investigation. Documentation serves as evidence of your efforts and provides insight into the decision-making process. Timing reflects how quickly information was gathered and actions taken. A Minnesota Request for Due Diligence Documents from a Technology Company assists in these considerations by ensuring that all necessary documents are collected systematically and promptly.