A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that someone is an attorney or that any communication is from an attorney.

Minnesota Notice to Debt Collector - Misrepresenting Someone as an Attorney

Description

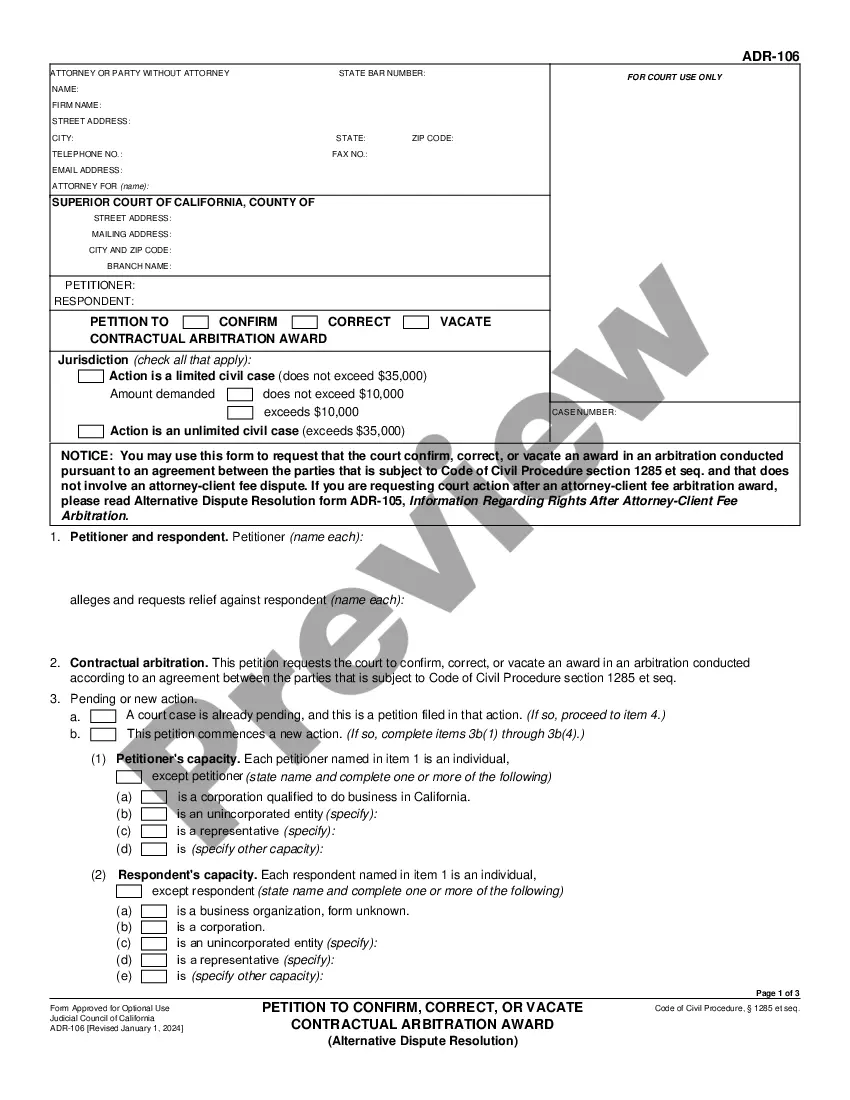

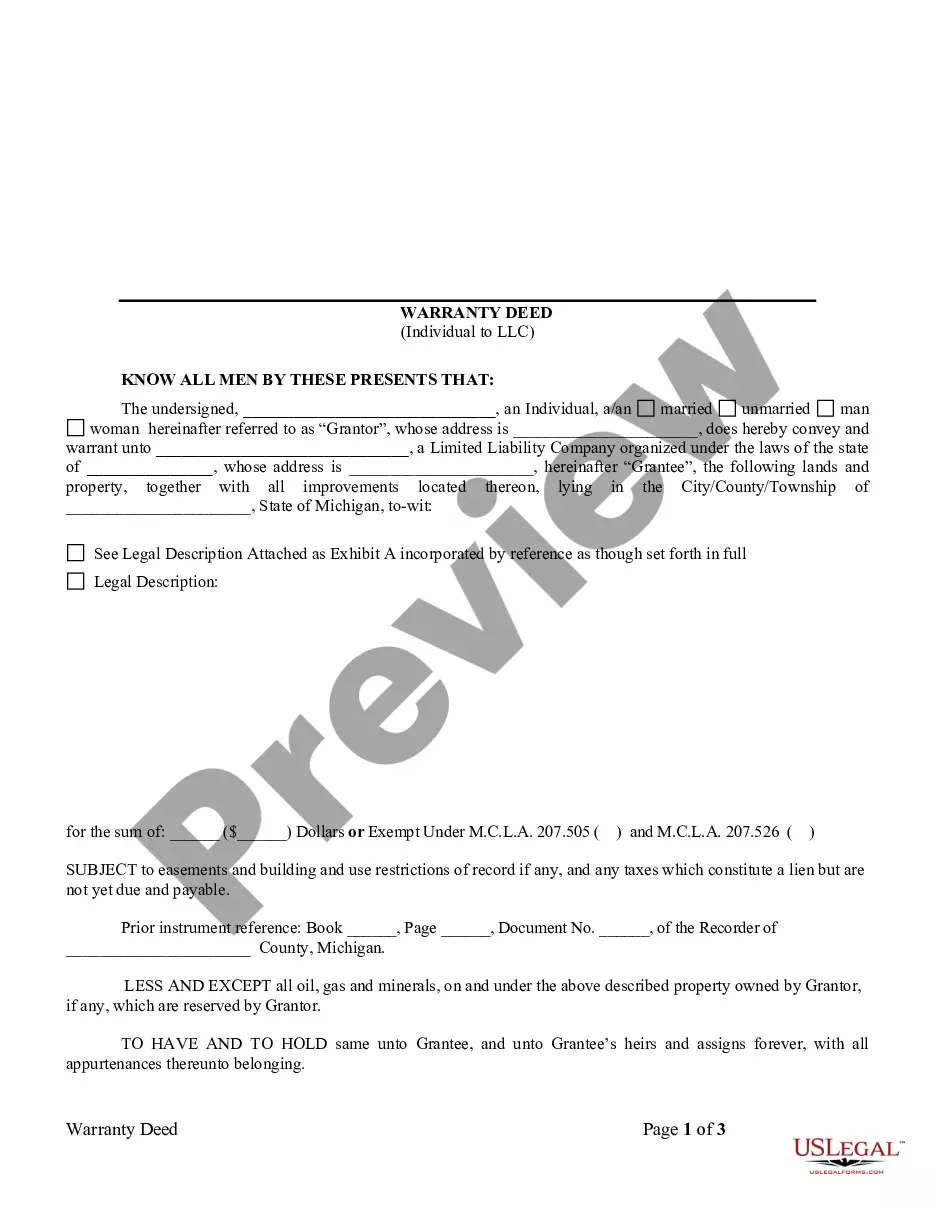

How to fill out Notice To Debt Collector - Misrepresenting Someone As An Attorney?

If you need to full, obtain, or printing legal document web templates, use US Legal Forms, the biggest collection of legal varieties, which can be found on the Internet. Take advantage of the site`s simple and easy hassle-free look for to obtain the documents you require. Various web templates for company and personal reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Minnesota Notice to Debt Collector - Misrepresenting Someone as an Attorney in a few mouse clicks.

In case you are currently a US Legal Forms client, log in to the account and then click the Obtain option to have the Minnesota Notice to Debt Collector - Misrepresenting Someone as an Attorney. Also you can entry varieties you in the past delivered electronically in the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the proper area/country.

- Step 2. Use the Review method to check out the form`s content material. Don`t overlook to see the information.

- Step 3. In case you are not satisfied with all the type, take advantage of the Look for field towards the top of the display to find other variations of your legal type design.

- Step 4. After you have identified the form you require, select the Get now option. Select the prices prepare you choose and add your qualifications to sign up for the account.

- Step 5. Process the deal. You should use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Find the format of your legal type and obtain it on your own product.

- Step 7. Complete, change and printing or indication the Minnesota Notice to Debt Collector - Misrepresenting Someone as an Attorney.

Every single legal document design you purchase is yours for a long time. You possess acces to every type you delivered electronically within your acccount. Click on the My Forms area and choose a type to printing or obtain once again.

Remain competitive and obtain, and printing the Minnesota Notice to Debt Collector - Misrepresenting Someone as an Attorney with US Legal Forms. There are thousands of professional and state-particular varieties you can use for the company or personal requirements.

Form popularity

FAQ

Tell the debt collector that they have the wrong person; Document you telling the collector they have the wrong person; and. If the collector continues to go after you, consider suing to put a stop to this type of needless and illegal abusive collection.

You have the right to tell a debt collector to stop contacting you. The Consumer Financial Protection Bureau (CFPB) provides sample response letters to a debt collector who is trying to collect a debt from the wrong person, as well as tips on how to use them.

Don't Give a Collector Your Personal Financial Information bank account numbers (unless you're actually making a payment?even then you might want to pay by some other method so the collector doesn't get your banking information) your Social Security number, or. the amount or value of property that you own.

The FDCPA prohibits debt collectors from publicizing your debts. That means they can't call your boss and say you're $11,000 upside down on your car and haven't made a payment in months. They can call you at work, but they can't identify themselves as a debt collector to the person answering the phone.

Once a debt collector knows they have called the wrong party, they have to stop calling that person. If you receive a debt collection phone call for someone else, and you tell the debt collector that you are not that consumer, the debt collector should stop calling you.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

6 Ways to Deal With Debt Collectors Check Your Credit Report. ... Make Sure the Debt Is Valid. ... Know the Statute of Limitations. ... Consider Negotiating. ... Try to Make the Payments You Owe. ... Send a Cease and Desist Letter.

Are debt collectors persistently trying to get you to pay what you owe them? Use this 11-word phrase to stop debt collectors: ?Please cease and desist all calls and contact with me immediately.? You can use this phrase over the phone, in an email or letter, or both.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.