Full text and guidelines for the Victims of Terrorism Relief Act of 2001, IRC 5891 (STRUCTURED SETTLEMENT FACTORING TRANSACTIONS.)

Minnesota Victims of Terrorism Relief Act of 2001

Description

How to fill out Victims Of Terrorism Relief Act Of 2001?

Are you currently within a situation that you require papers for either organization or specific functions virtually every working day? There are plenty of legitimate file layouts available on the net, but finding versions you can rely on is not simple. US Legal Forms offers a large number of kind layouts, such as the Minnesota Victims of Terrorism Relief Act of 2001, which can be composed in order to meet federal and state requirements.

In case you are presently knowledgeable about US Legal Forms internet site and get a free account, basically log in. Following that, it is possible to obtain the Minnesota Victims of Terrorism Relief Act of 2001 format.

Unless you have an accounts and wish to start using US Legal Forms, adopt these measures:

- Discover the kind you want and make sure it is to the correct city/state.

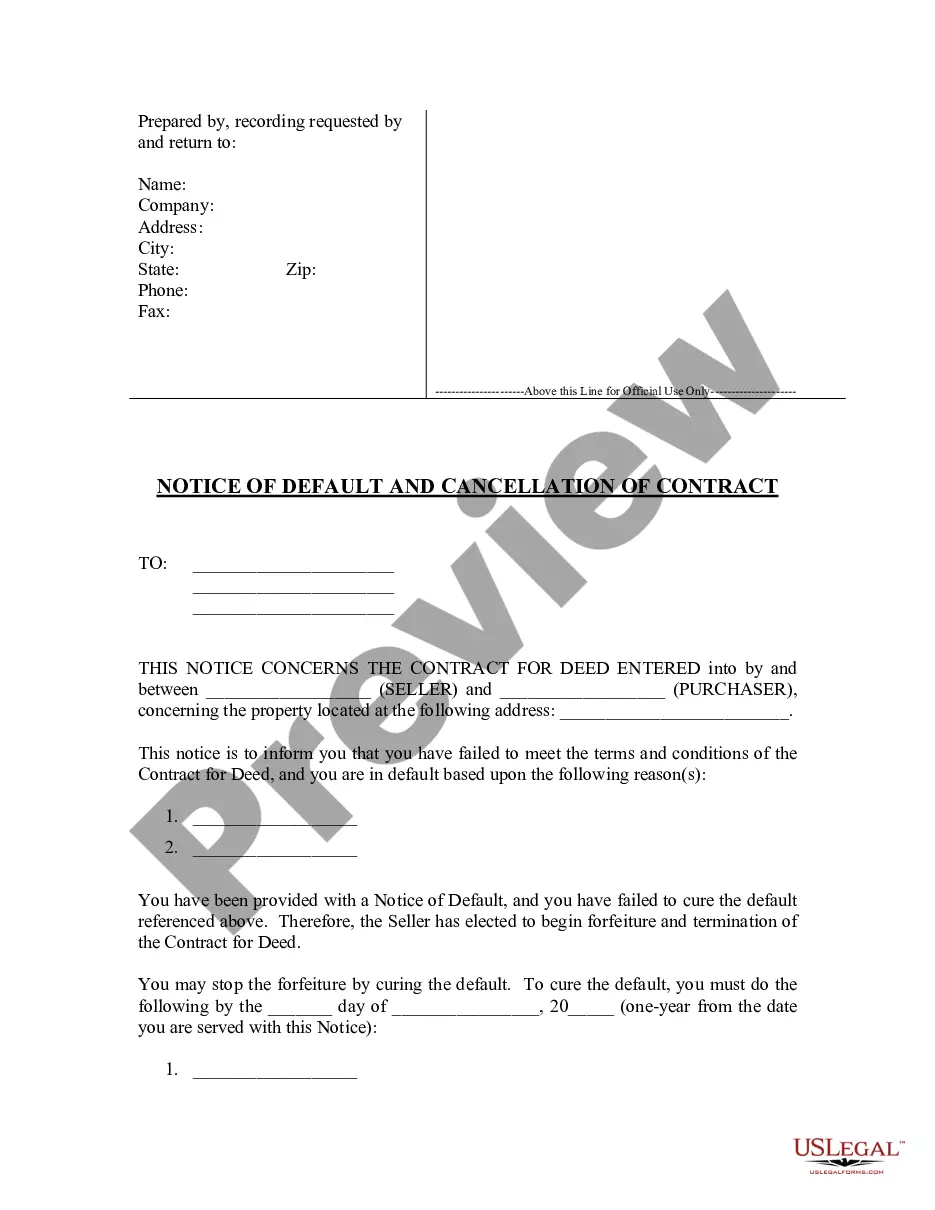

- Make use of the Preview key to examine the form.

- See the information to ensure that you have chosen the appropriate kind.

- If the kind is not what you are seeking, utilize the Research field to get the kind that meets your requirements and requirements.

- If you find the correct kind, simply click Get now.

- Opt for the costs prepare you need, complete the desired details to produce your account, and buy an order utilizing your PayPal or charge card.

- Choose a practical file structure and obtain your copy.

Get all of the file layouts you might have purchased in the My Forms food list. You can get a more copy of Minnesota Victims of Terrorism Relief Act of 2001 anytime, if required. Just click on the necessary kind to obtain or produce the file format.

Use US Legal Forms, by far the most substantial collection of legitimate forms, to save lots of efforts and avoid mistakes. The service offers professionally made legitimate file layouts which you can use for a range of functions. Create a free account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

IRS Publication 3920 is clear that any amounts awarded and paid by the VCF are not income subject to taxes: ?Payments from the September 11th Victim Compensation Fund of 2001 are not included in income.?

2 IRC § 692(a) applies to ?any individual who dies while in active service as a member of the Armed Forces of the United States, if such death occurred while serving in a combat zone (as determined under section 112) or as a result of wounds, disease, or injury incurred while so serving.? Under IRC § 112(c)(2), the ...

An act to amend the Internal Revenue Code of 1986 to provide tax relief for victims of the terrorist attacks against the United States, and for other purposes.

PL 107-134 Victims of Terrorism Relief Act of 2001 (enacted 1/23/02) Provides tax relief for victims of terrorists attacks. Also under this law, victims owe no Federal income or payroll taxes for the year in which they died and the immediately preceding year.