Full text and statutory guidelines for the Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Minnesota Post Assessment Property and Liability Insurance Guaranty Association Model Act

Description

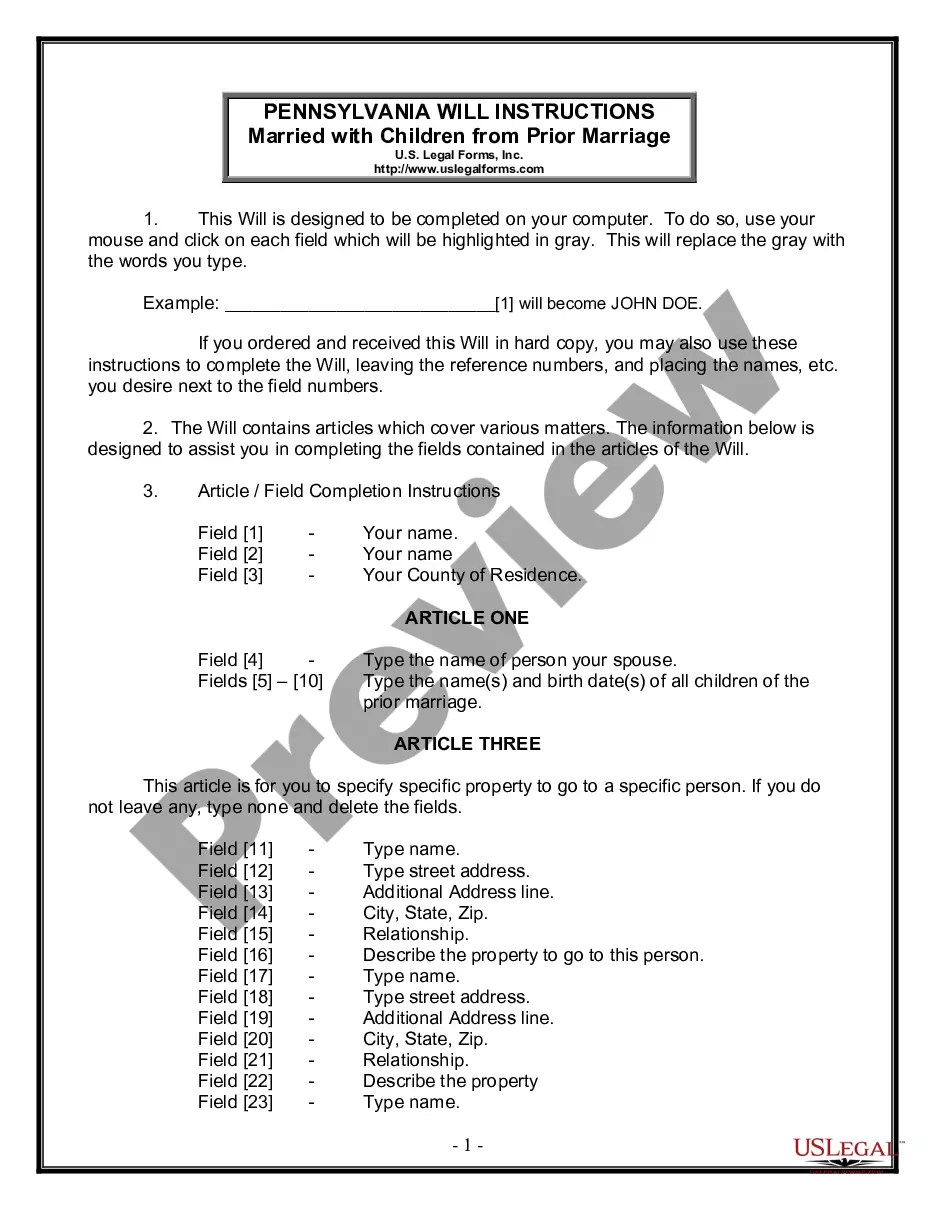

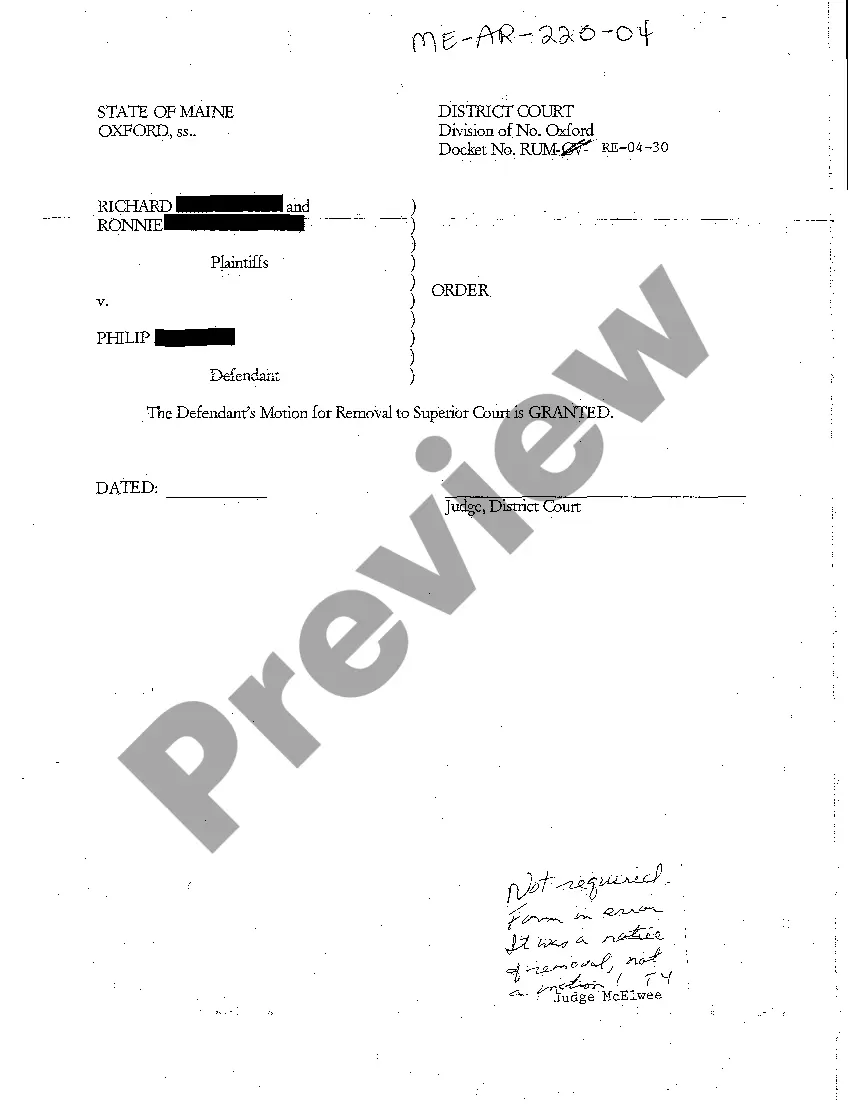

How to fill out Post Assessment Property And Liability Insurance Guaranty Association Model Act?

US Legal Forms - one of many largest libraries of authorized varieties in the States - gives a variety of authorized document themes it is possible to download or print out. Utilizing the internet site, you can get a large number of varieties for business and individual functions, categorized by types, says, or keywords.You will find the most recent versions of varieties much like the Minnesota Post Assessment Property and Liability Insurance Guaranty Association Model Act in seconds.

If you have a registration, log in and download Minnesota Post Assessment Property and Liability Insurance Guaranty Association Model Act through the US Legal Forms collection. The Download key will show up on each develop you perspective. You get access to all formerly delivered electronically varieties from the My Forms tab of your accounts.

If you want to use US Legal Forms the very first time, listed here are straightforward instructions to get you started:

- Make sure you have selected the right develop for your personal metropolis/region. Select the Review key to analyze the form`s content material. Browse the develop description to ensure that you have selected the correct develop.

- When the develop doesn`t suit your requirements, use the Research discipline near the top of the monitor to find the one which does.

- In case you are content with the form, confirm your selection by clicking the Acquire now key. Then, select the costs strategy you prefer and give your references to sign up on an accounts.

- Approach the transaction. Use your Visa or Mastercard or PayPal accounts to finish the transaction.

- Find the structure and download the form on your own device.

- Make changes. Fill out, revise and print out and indicator the delivered electronically Minnesota Post Assessment Property and Liability Insurance Guaranty Association Model Act.

Each design you put into your money does not have an expiration time and is also your own eternally. So, if you want to download or print out another copy, just visit the My Forms portion and click on the develop you need.

Obtain access to the Minnesota Post Assessment Property and Liability Insurance Guaranty Association Model Act with US Legal Forms, probably the most extensive collection of authorized document themes. Use a large number of professional and condition-certain themes that satisfy your business or individual requirements and requirements.

Form popularity

FAQ

Examples of the types of insurance that fall under the guaranty fund are automobile, homeowners, liability and workers' compensation insurance.

Once an insurer has been declared insolvent, the insurance department determines the value of the company's remaining assets. It then calculates the amount of money the guaranty association will need to pay claims. This amount is assessed by insurers.

The guaranty association's coverage of insurance company insolvencies is funded by post-insolvency assessments of the other guaranty association member companies. These assessments are based on each member's share of premium during the prior three years.

The maximum total amount the Guarantee Association will provide for any one individual for life insurance and annuity coverage is $300,000, even if that individual is covered by multiple life insurance policies and annuities. Is my claim against the insolvent insurer affected by the Guarantee Association? Yes.

The state insurance commissioner gives insurance guaranty associations their powers. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.

You say the guaranty funds pay these claims. Where do they get the money to pay them? Guaranty funds largely are funded by industry assessments, which are usually collected following insolvencies.

A state guaranty fund is administered by a U.S. state to protect policyholders in the event that an insurance company defaults on benefit payments or becomes insolvent. The fund only protects beneficiaries of insurance companies that are licensed to sell insurance products in that state.