Minnesota Request for Accounting of Disclosures of Protected Health Information

Description

How to fill out Request For Accounting Of Disclosures Of Protected Health Information?

Selecting the appropriate authentic document template can be challenging. Clearly, there are numerous templates accessible online, but how can you secure the valid form you need? Visit the US Legal Forms website. This service offers thousands of templates, such as the Minnesota Request for Accounting of Disclosures of Protected Health Information, that you can utilize for professional and personal requirements. All of the documents are verified by specialists and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Minnesota Request for Accounting of Disclosures of Protected Health Information. Use your account to browse through the legitimate documents you have purchased previously. Check the My documents tab in your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can view the form using the Preview button and review the form description to confirm it's suitable for you. If the form does not meet your expectations, use the Search area to locate the appropriate form. When you are confident that the form is correct, click the Buy now button to obtain the form. Select the pricing plan you wish and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Minnesota Request for Accounting of Disclosures of Protected Health Information.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to acquire professionally prepared documents compliant with state regulations.

- Verify that you selected the correct form for your city/state.

- Use the Preview button to view the form and its description.

- If necessary, utilize the Search area to find an appropriate document.

- Click the Buy now button when ready to purchase the form.

- Select a pricing plan and enter the necessary details.

- Set up your account and complete payment through PayPal or credit card.

Form popularity

FAQ

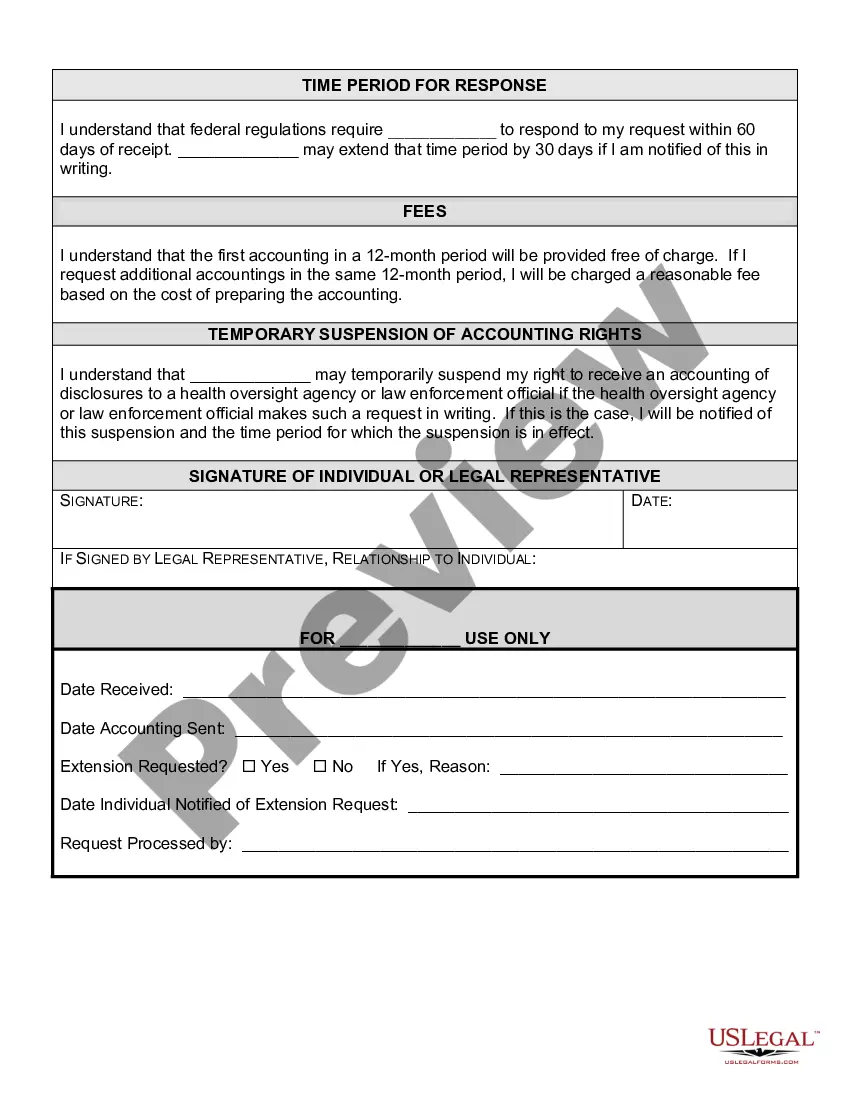

The information in a HIPAA disclosure accounting must be provided to the data subject upon request, usually covering the last six years, except for disclosures made for treatment, payment, or healthcare operations. This transparency allows patients to stay informed about who has accessed their information. If you seek this data for your own health records, initiating a Minnesota Request for Accounting of Disclosures of Protected Health Information is recommended.

A covered entity must provide the first accounting (during any 12 month period) free of charge. If an individual requests more than one accounting during a year, the covered entity may impose a cost-based fee on subsequent requests.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

With limited exceptions, the HIPAA Privacy Rule (the Privacy Rule) provides individuals with a legal, enforceable right to see and receive copies upon request of the information in their medical and other health records maintained by their health care providers and health plans.

A covered entity must produce records 30 days from the date of request. HIPAA allows a covered entity one 30-day extension if it provides written notice to the patient stating the reason for the delay and the expected date. This applies to both paper and electronic records.

Under the HIPAA Privacy Rule, a covered entity must act on an individual's request for access no later than 30 calendar days after receipt of the request.

The Privacy Rule does not require accounting for disclosures: (a) for treatment, payment, or health care operations; (b) to the individual or the individual's personal representative; (c) for notification of or to persons involved in an individual's health care or payment for health care, for disaster relief, or for

Patients (or their Personal Representatives see Yale Policy 5038 - Personal Representatives) may request an accounting of disclosures by submitting a request in writing using the Request for Accounting of Disclosures of Protected Health Information form, or other sufficient written documentation requesting the

Other instances necessitating Accounting of Disclosures (AOD) include: Those Required by Law (Court Orders, subpoenas, state reporting, emergencies) Public Health Activities (Prevention of disease, public health investigations) Victims of abuse, neglect, or domestic violence.

The Privacy Rule at 45 CFR 164.528 requires covered entities to make available to an individual upon request an accounting of certain disclosures of the individual's protected health information made during the six years prior to the request.