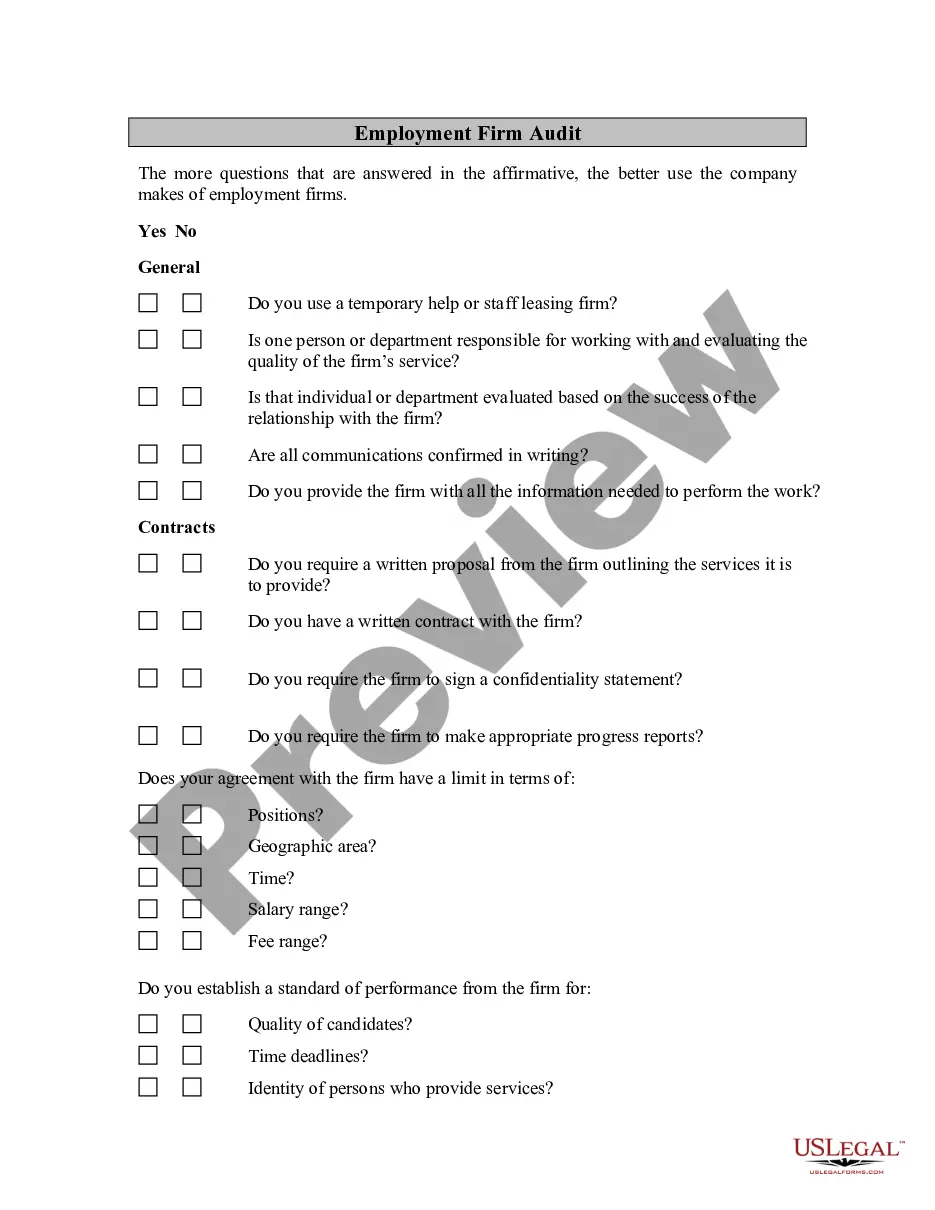

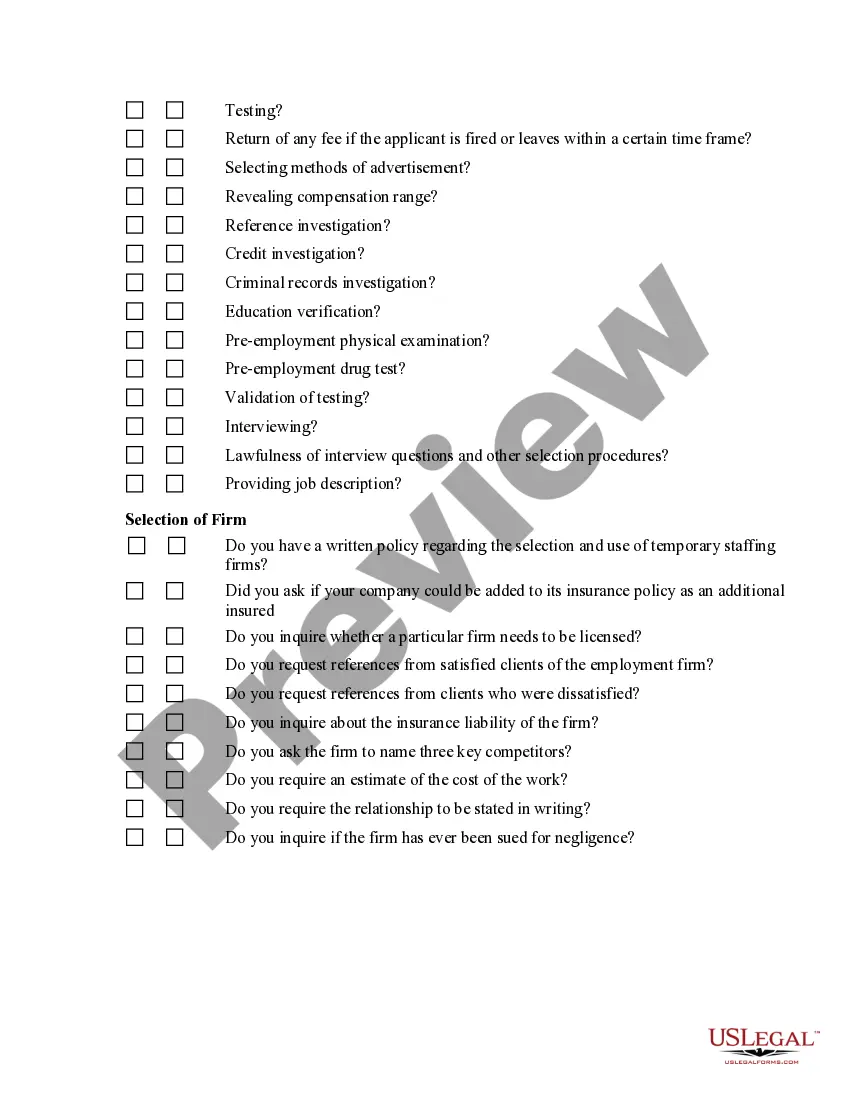

Minnesota Employment Firm Audit

Description

How to fill out Employment Firm Audit?

Finding the appropriate legal document template can be challenging.

Clearly, there are many templates accessible online, but how can you locate the legal form you require.

Make use of the US Legal Forms website. The service offers thousands of templates, such as the Minnesota Employment Agency Audit, that you can use for business and personal needs.

You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- All of the forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently signed up, Log In to your account and click the Download button to get the Minnesota Employment Agency Audit.

- Use your account to check out the legal forms you have obtained before.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have chosen the correct form for your city/region.

Form popularity

FAQ

The payroll tax audit EDD audit verifies compliance with the California Unemployment Insurance Code (CUIC), ensures workers are properly classified, payments made to employees are properly reported, and protects workers' rights to receive benefits.

A job audit is a formal review of the current duties and responsibilities assigned to a position to ensure appropriate classification within the classified pay program. An audit should be requested if the duties and responsibilities of a position have significantly changed.

In essence, an HR audit involves identifying issues and finding solutions to problems before they become unmanageable. It is an opportunity to assess what an organization is doing right, as well as how things might be done differently, more efficiently or at a reduced cost.

The Office of the State Auditor oversees local government financial activity in Minnesota by performing audits of local government financial statements and by reviewing documents, data, reports, and complaints reported to the Office.

A job audit is a formal procedure in which a compensation professional meets with the manager and employee to discuss and explore the position's current responsibilities.

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

The payroll tax audit EDD audit verifies compliance with the California Unemployment Insurance Code (CUIC), ensures workers are properly classified, payments made to employees are properly reported, and protects workers' rights to receive benefits.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

Key Takeaways. There are three main types of audits: external audits, internal audits, and Internal Revenue Service (IRS) audits.