Minnesota Purchase Invoice

Description

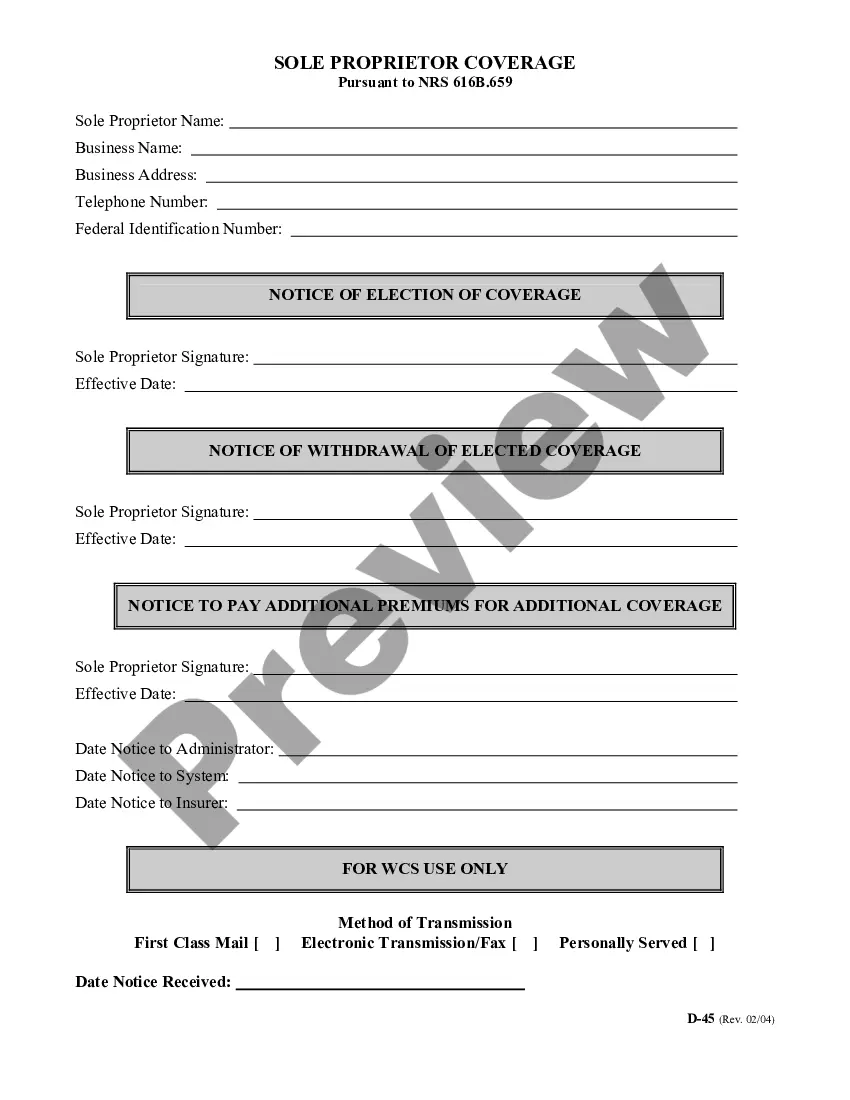

How to fill out Purchase Invoice?

If you require to complete, obtain, or print sanctioned document templates, utilize US Legal Forms, the most extensive assortment of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

A variety of templates for business and personal needs are categorized by types and states, or by keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to find the Minnesota Purchase Invoice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download button to obtain the Minnesota Purchase Invoice.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to check the form's details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Writing a Minnesota Purchase Invoice requires careful attention to detail. Start with a clear header that states 'Purchase Invoice' and includes your business name and contact information. Follow this with the buyer's details and an itemized list of products or services, along with their corresponding prices. Securely add the total amount and payment instructions to ensure a smooth transaction.

The process of creating a Minnesota Purchase Invoice includes several straightforward steps. First, you gather relevant details about the transaction, such as the buyer and seller information, items purchased, and prices. Next, you organize this information into a clear format, ensuring each section is easy to read. Finally, you send the invoice to the buyer for payment, keeping a copy for your records.

To properly fill out a Minnesota Purchase Invoice, start by entering your business information at the top. Include your name, address, and contact details. Next, provide the client's information and a unique invoice number for record-keeping. Finally, list the products or services you've provided, including quantities and prices, and calculate the total amount due.

To generate a Minnesota Purchase Invoice, you can utilize simple online tools or invoicing software designed for ease of use. Platforms like US Legal Forms allow you to fill in all necessary details quickly and accurately. Simply input your business information, products or services rendered, and payment instructions. This method not only speeds up the invoicing process, but also ensures your invoices are compliant and professional.

Typically, you will receive a Minnesota Purchase Invoice via email or through postal mail, depending on how the sender prefers to communicate. Many businesses also offer online platforms where invoices can be accessed directly, providing a convenient option. Using services like US Legal Forms ensures you receive invoices in a timely manner and keeps all your documents organized. Keeping track of these invoices helps you manage expenses effectively.

Creating a Minnesota Purchase Invoice is straightforward. You can start by using a template, which simplifies the process significantly. Choose a user-friendly platform like US Legal Forms, where you can fill in necessary information such as buyer details, item descriptions, and payment terms. Once you input all relevant information, you can easily generate a professional invoice ready for your transactions.

A purchase invoice is essentially a formal request for payment for goods or services, like the Minnesota Purchase Invoice. It provides both the seller and buyer with a clear record of the transaction, ensuring everyone is on the same page. This invoice includes vital details, such as item descriptions, quantities, prices, and payment instructions. Understanding its components can significantly improve your accounting procedures.

Receiving a Minnesota Purchase Invoice means you have been billed for goods or services rendered by a supplier or vendor. This document outlines what you owe, detailing every item included in the transaction. Upon receiving it, you should verify the content and ensure everything aligns with your records. This step helps maintain accurate financial tracking and a healthy business relationship.

Typically, a vendor or supplier issues a Minnesota Purchase Invoice to the buyer after delivering goods or services. This document acts as a payment request and includes details such as the transaction date, the items bought, and the total amount due. After receiving the invoice, the buyer can process the payment as required. Knowing who is responsible for sending this document helps clarify the flow of transactions.

A Minnesota Purchase Invoice is created by the seller to request payment from the buyer for goods or services delivered. In contrast, a sales invoice is issued to the buyer, detailing what they purchased and the amount owed. Essentially, the purchase invoice serves as a formal confirmation of the transaction from the seller's perspective, while the sales invoice is what the buyer receives. Understanding this difference can help streamline your accounting processes.