Minnesota Employee Lending Agreement

Description

How to fill out Employee Lending Agreement?

You may spend hrs on the web searching for the legal record web template that meets the state and federal requirements you will need. US Legal Forms gives a large number of legal forms which can be examined by professionals. It is simple to obtain or printing the Minnesota Employee Lending Agreement from your service.

If you already possess a US Legal Forms profile, you can log in and click the Obtain key. Following that, you can comprehensive, revise, printing, or indicator the Minnesota Employee Lending Agreement. Every legal record web template you acquire is your own eternally. To get yet another duplicate of any purchased develop, check out the My Forms tab and click the corresponding key.

If you work with the US Legal Forms website initially, adhere to the basic instructions beneath:

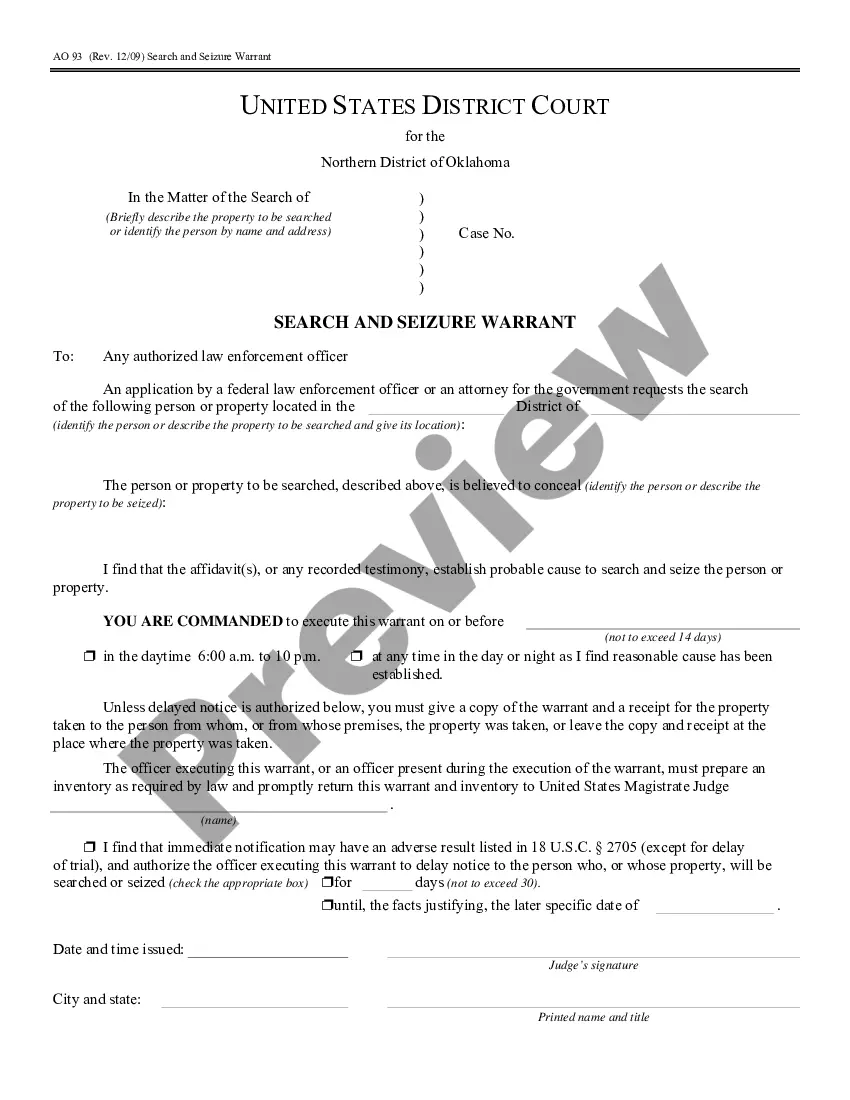

- Initial, be sure that you have selected the correct record web template for your state/area that you pick. Read the develop information to ensure you have picked out the correct develop. If offered, utilize the Preview key to look throughout the record web template at the same time.

- If you wish to locate yet another version of your develop, utilize the Search industry to get the web template that meets your needs and requirements.

- After you have found the web template you need, simply click Purchase now to continue.

- Find the rates prepare you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You should use your charge card or PayPal profile to pay for the legal develop.

- Find the structure of your record and obtain it in your gadget.

- Make changes in your record if possible. You may comprehensive, revise and indicator and printing Minnesota Employee Lending Agreement.

Obtain and printing a large number of record templates using the US Legal Forms web site, which provides the most important selection of legal forms. Use specialist and condition-certain templates to tackle your organization or individual requirements.

Form popularity

FAQ

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Loan agreements are an important part of borrowing money; they protect both the borrower and the lender. A loan agreement spells out the details of the transaction, including the loan amount, the interest rate, and the terms.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Employment contracts generally have specific contract terms such as effective date, type of employment, notice, termination, dispute process, applicable law and severability.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

How to Write a Loan AgreementStep 1 Loan Amount, Borrower, and Lender.Step 2 Payment.Step 3 Interest.Step 4 Expenses.Step 5 Governing Law.Step 6 Signing.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.