Minnesota Checking Log

Description

How to fill out Checking Log?

You can spend hours online trying to locate the proper legal document template that complies with the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been vetted by experts.

You can conveniently download or print the Minnesota Checking Log from our platform.

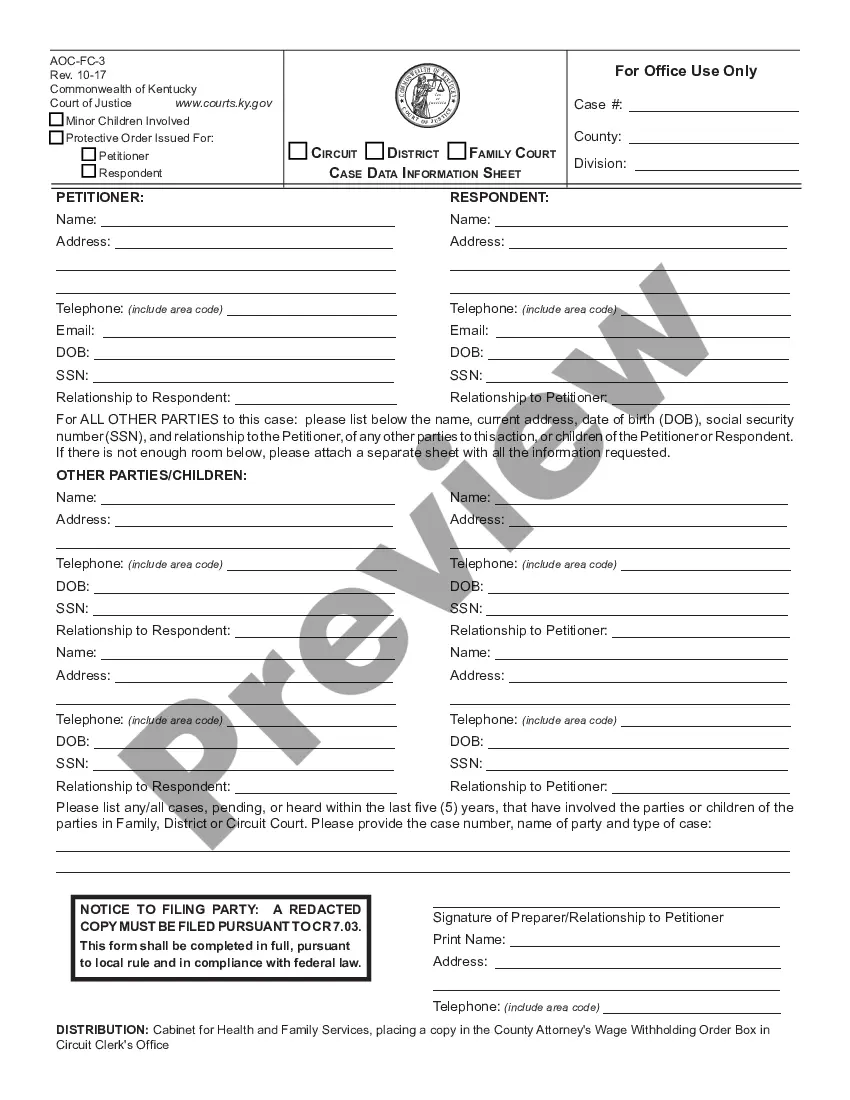

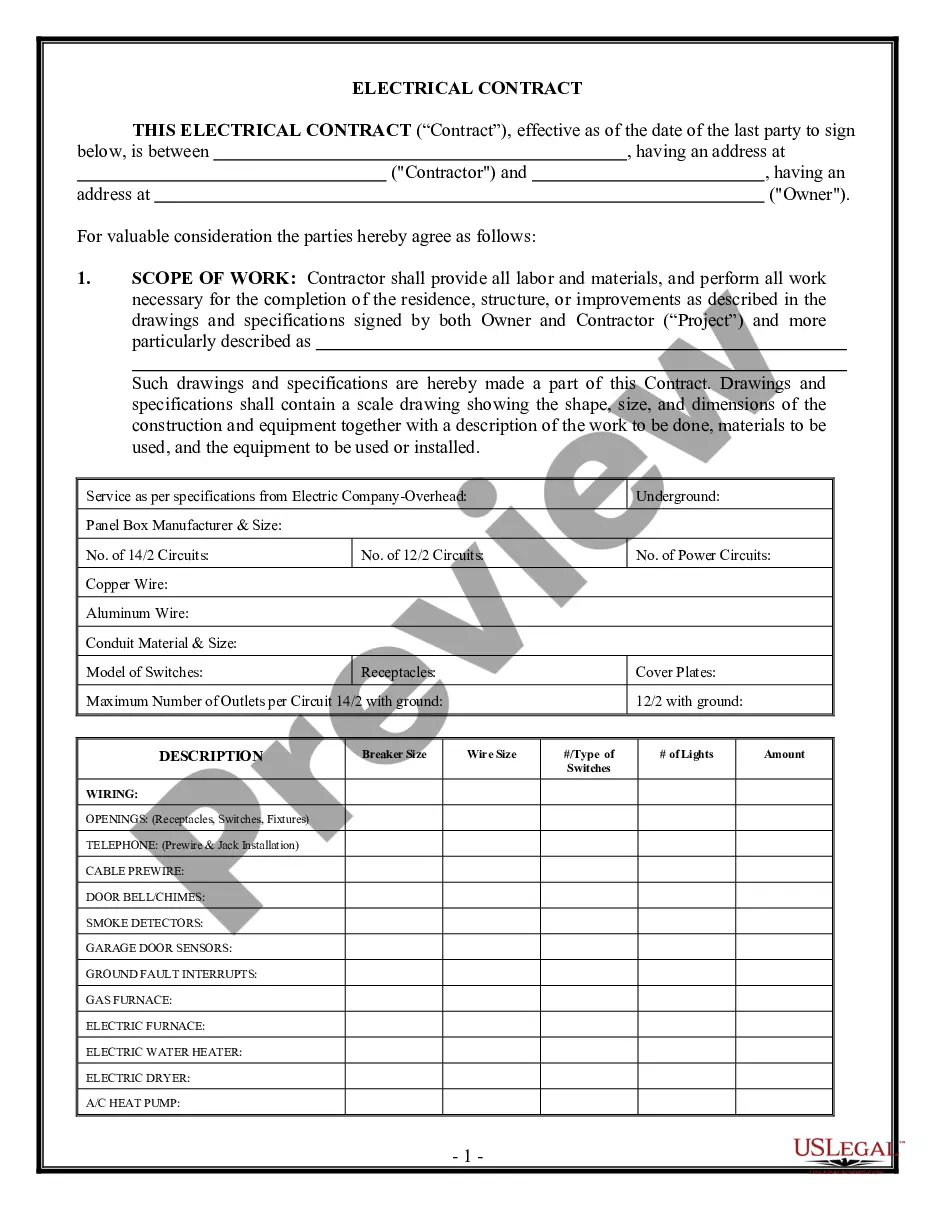

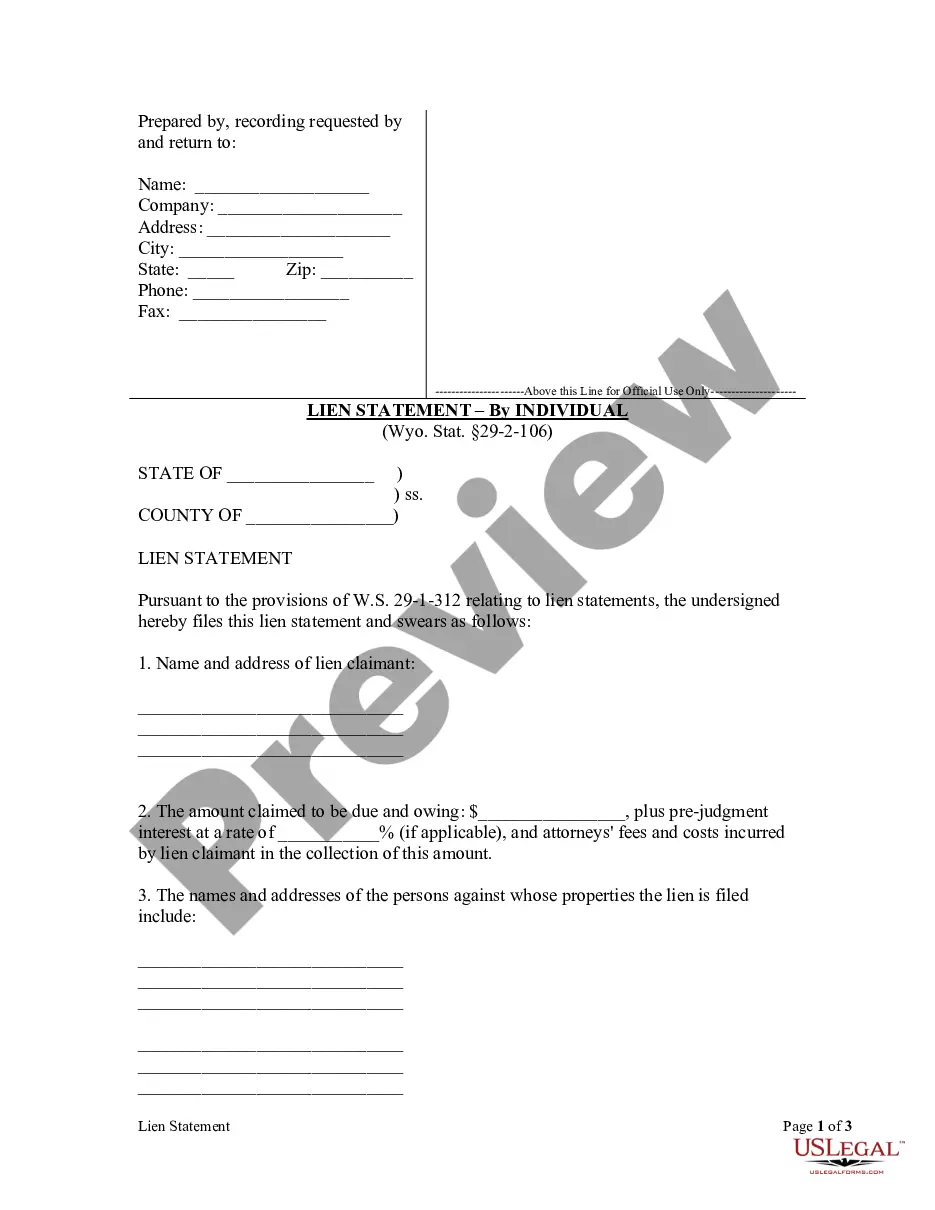

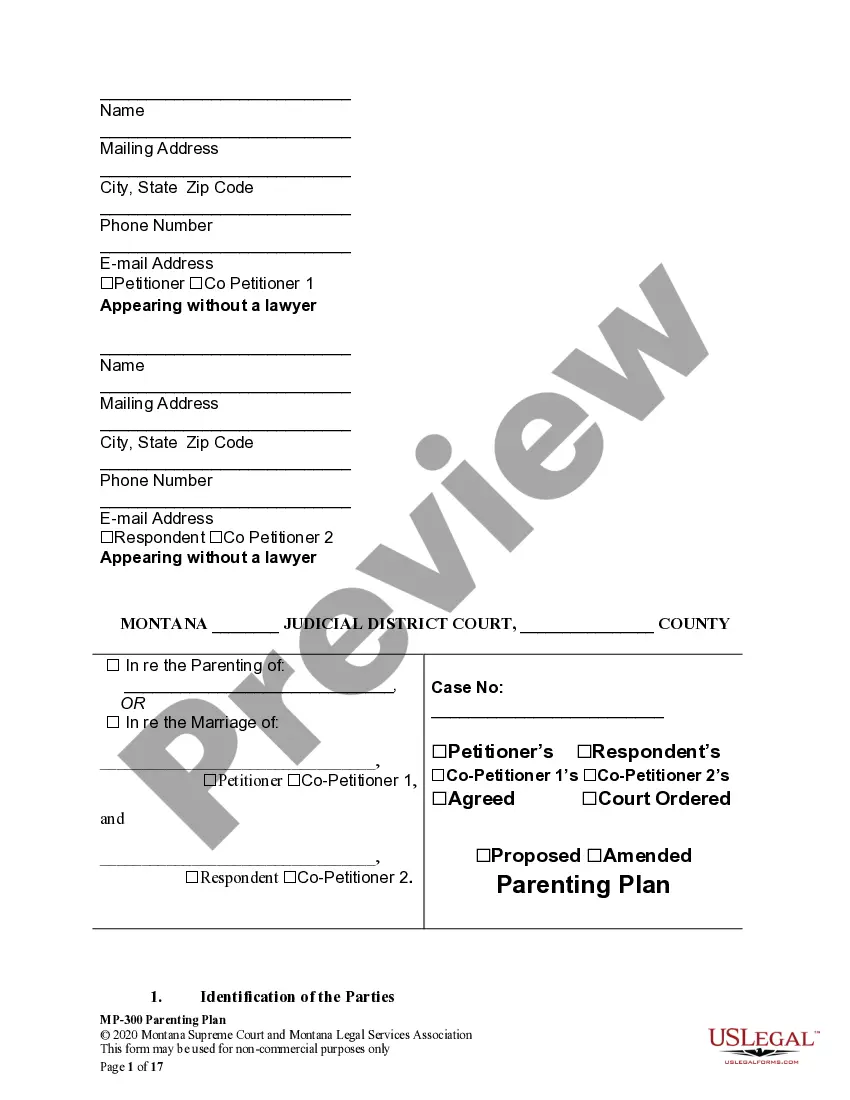

If available, use the Preview button to review the document template as well.

- If you have an account with US Legal Forms, you can sign in and click on the Download button.

- Then, you can fill out, edit, print, or sign the Minnesota Checking Log.

- Every legal document template you purchase is yours for life.

- To obtain another copy of a purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, be sure you have chosen the correct document template for the area/city you are selecting.

- Review the form description to ensure you have chosen the right form.

Form popularity

FAQ

To check your driving record in Minnesota, utilize the Minnesota Checking Log for a quick retrieval. You can either access this information through the Minnesota Department of Public Safety or explore reputable sites that offer driving record checks. These options make the process user-friendly and efficient.

An offer in compromise, with the IRS or MDR agreeing to reduce the amount of taxes owed. An installment agreement, allowing you to make timely payments. An appeal of the audit decision resulting in significantly more taxes due.

If you have employees, you generally need to apply for a State Withholding Number. This number is entered on state employment tax forms used to report state income taxes withheld from employee's pay. Some states, like Nevada, don't impose an income tax on individuals.

Wage withholding We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding.

We have 5 years to collect tax and other debts. In certain situations, we can extend that time.

Step-by-Step Guide to Running Payroll in MinnesotaStep 1: Set up your business as an employer.Step 2: Register with the State of Minnesota.Step 3: Set up your payroll process.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.Step 6: Calculate payroll and pay employees.More items...?

Contact us at 651-556-3003, 1-800-657-3909 (toll-free), or mdor.collection@state.mn.us for a payoff amount. payment options into the Search box or call 1-800-570-3329. We do not charge you for using this service. Pay by credit card or debit card.

You may do either of the following: Use the supplemental withholding rate of 6.25 percent. Have your employee or payee complete federal Form W-4 or Minnesota Form W-4MN. On Form W-4MN, they may specify a number of Minnesota exemptions or request a specific amount withheld from each payment.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.

If you're unable to pay the full amount, pay as much as you can by the due date to reduce further penalties and interest. After 60 days, we'll send you a bill for any unpaid tax, penalties, and interest you owe. You may pay the bill in full or request a payment agreement.