Minnesota Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor

Description

How to fill out Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor?

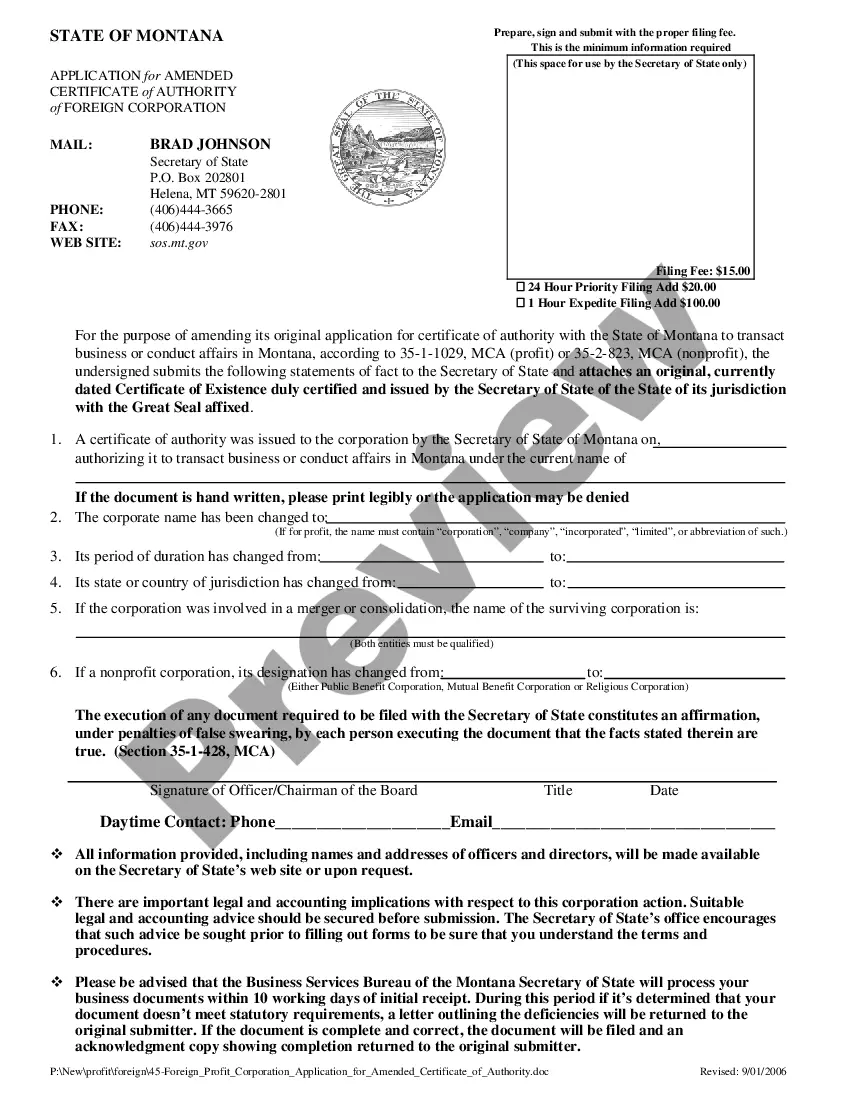

Finding the right legal record template can be quite a battle. Naturally, there are a variety of templates available on the Internet, but how can you obtain the legal form you want? Use the US Legal Forms internet site. The services delivers 1000s of templates, including the Minnesota Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor, that you can use for company and personal demands. All of the varieties are checked by specialists and satisfy federal and state specifications.

In case you are already authorized, log in to the bank account and click the Obtain switch to get the Minnesota Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor. Make use of bank account to search throughout the legal varieties you have acquired earlier. Check out the My Forms tab of the bank account and get yet another backup of the record you want.

In case you are a whole new user of US Legal Forms, allow me to share basic directions that you should comply with:

- Very first, make certain you have chosen the proper form for your personal town/county. It is possible to look through the shape while using Preview switch and browse the shape explanation to make sure it is the right one for you.

- When the form will not satisfy your preferences, make use of the Seach area to discover the correct form.

- Once you are certain that the shape would work, click on the Get now switch to get the form.

- Opt for the prices program you need and type in the essential info. Design your bank account and pay money for an order using your PayPal bank account or bank card.

- Opt for the submit formatting and obtain the legal record template to the system.

- Comprehensive, revise and print and signal the attained Minnesota Jury Instruction - Concealment Of Property Belonging To Bankruptcy Estate Of Debtor.

US Legal Forms may be the most significant library of legal varieties that you can see various record templates. Use the company to obtain expertly-produced papers that comply with express specifications.

Form popularity

FAQ

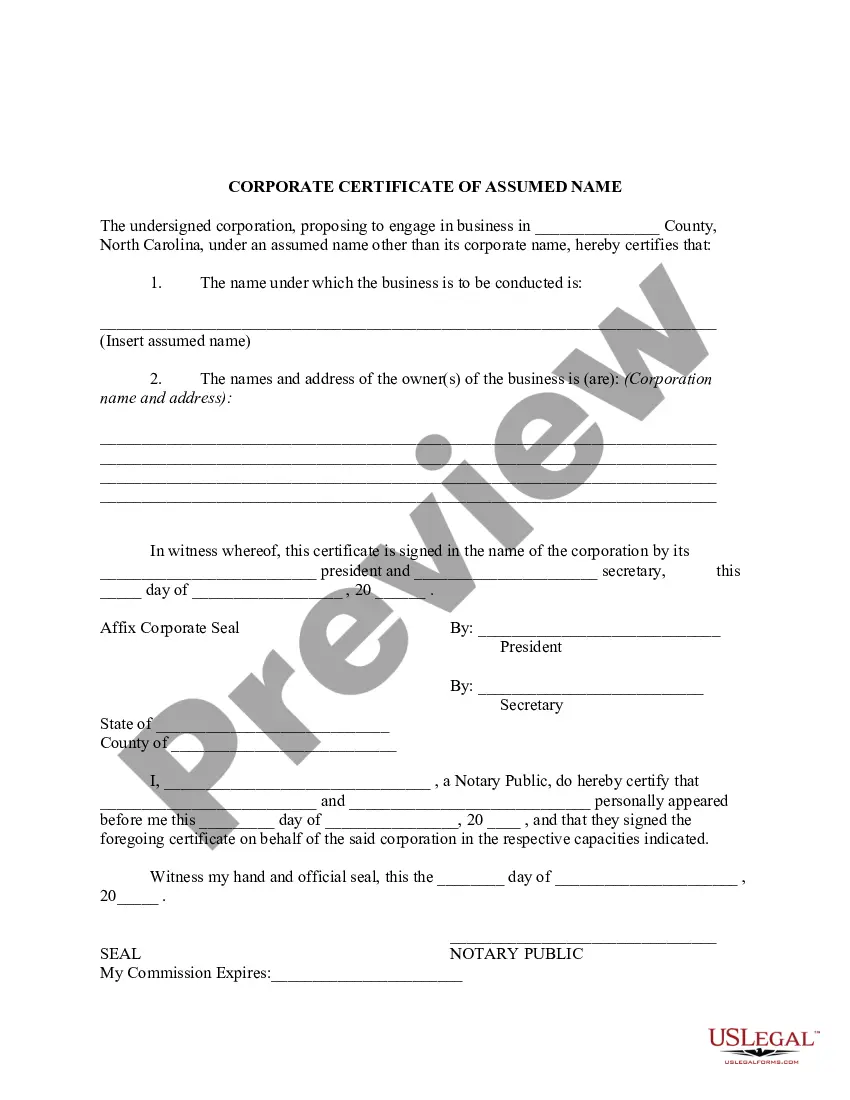

Examples of assets in bankruptcy filings include: Business-related property. Financial assets, such as investments or deposit accounts. Land or a primary or secondary home. Personal and household items. Property related to farming and commercial fishing. Vehicles. Any other property otherwise not stated.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

The estate includes all property in which the debtor has an interest, even if it is owned or held by another person - like obvious and tangible assets, or intangible things: stock options, the right to inheritances received within 6 months after the bankruptcy is filed, tax refunds for prepetition years, and ...

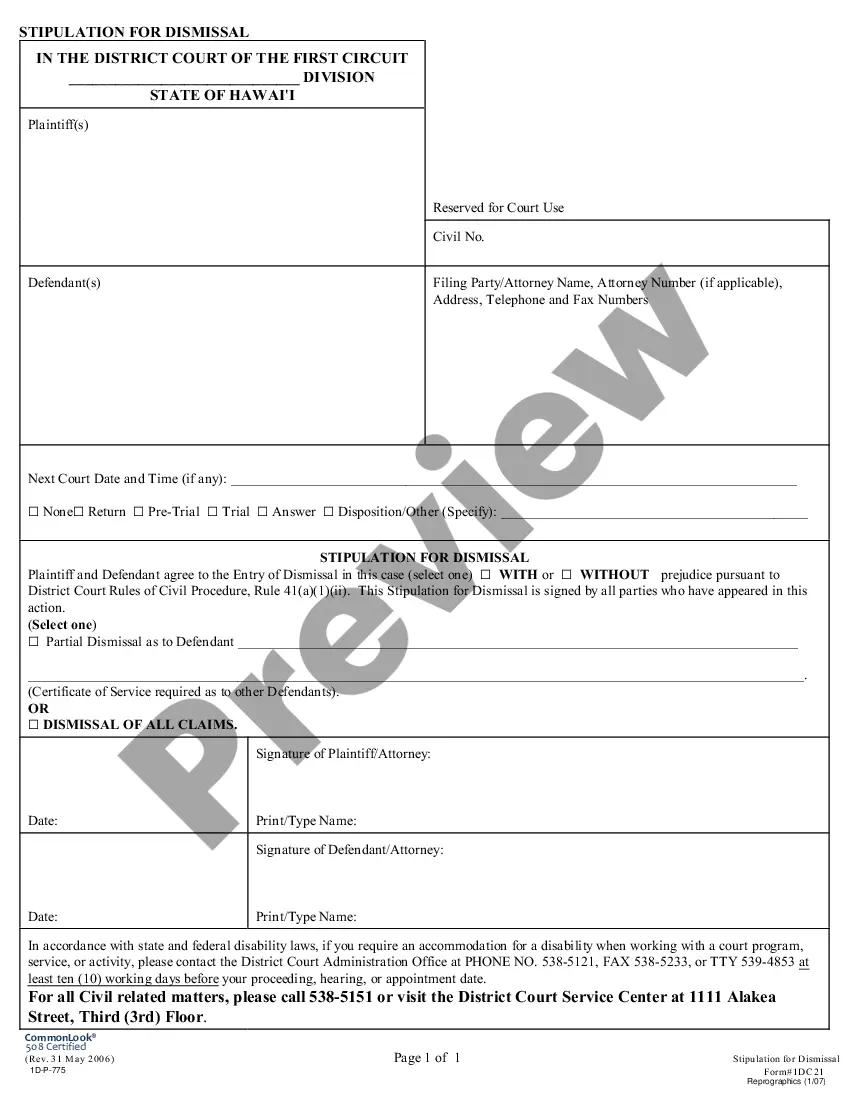

You are a Debtor if... You are a person or institution who owes money to a creditor. You cannot repay the money owed by the time it is due and are filing for bankruptcy.

The bankruptcy trustee files a Form 1041 for the bankruptcy estate. However, when a debtor in a chapter 11 bankruptcy case remains a debtor-in-possession, the debtor must file both a Form 1040 or 1040-SR individual return and a Form 1041 estate return for the bankruptcy estate (if return filing requirements are met).

Upon a debtor's filing of a bankruptcy case, the bankruptcy ?estate? is immediately formed. It is constituted of all of the debtor's property, both tangible and intangible, as of the filing of the petition. The debtor in a Chapter 7 and 13 case can exempt certain property from entering the estate.