Minnesota Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

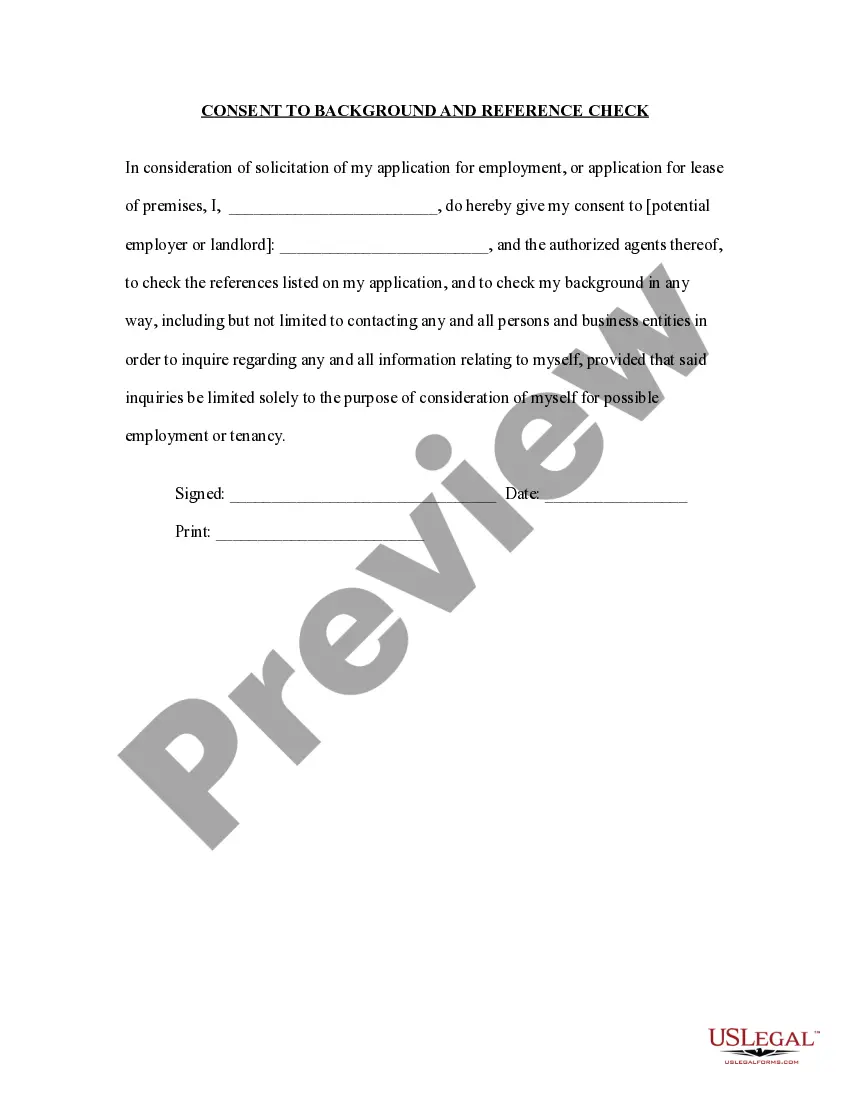

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

Finding the right authorized papers design can be quite a have a problem. Obviously, there are a variety of templates accessible on the Internet, but how will you obtain the authorized type you need? Use the US Legal Forms website. The support provides a large number of templates, such as the Minnesota Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder, that you can use for organization and personal demands. Every one of the types are checked out by professionals and meet up with federal and state needs.

In case you are already listed, log in to your accounts and click on the Obtain option to get the Minnesota Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder. Make use of accounts to look from the authorized types you may have ordered in the past. Proceed to the My Forms tab of your respective accounts and get yet another duplicate from the papers you need.

In case you are a whole new end user of US Legal Forms, allow me to share straightforward instructions that you should comply with:

- First, make certain you have chosen the proper type for the city/county. You can examine the shape making use of the Preview option and study the shape outline to make sure it will be the right one for you.

- In case the type will not meet up with your needs, utilize the Seach area to find the appropriate type.

- Once you are sure that the shape is proper, select the Purchase now option to get the type.

- Choose the pricing program you desire and type in the essential information and facts. Make your accounts and purchase the order making use of your PayPal accounts or credit card.

- Select the document format and acquire the authorized papers design to your product.

- Total, edit and print out and signal the attained Minnesota Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder.

US Legal Forms will be the greatest local library of authorized types for which you can find various papers templates. Use the company to acquire expertly-produced paperwork that comply with express needs.

Form popularity

FAQ

The alter ego test encompasses a host of factors: Listed as follows: Commingling of funds and other assets, failure to segregate funds of the separate entities and the unauthorized diversion of corporate funds or assets to other than corporate uses.

Defendants claim that alter ego liability is a question of law that the Court must determine. Plaintiffs claim just the opposite; that alter ego liability is a matter of fact, to be resolved by the trier of fact: the jury.

Alter ego refers not to a cause of action, but generally to a liability doctrine where an owner of a company can be held responsible for certain debts of the company.

The Alter Ego Doctrine was designed to be an equitable remedy and to prevent injustice. The Alter Ego Doctrine examines specific facts and is implemented on a case-by-case basis. The Alter Ego Doctrine is a two-prong test, and both prongs must be met to successfully pierce an entity's veil.

Alter ego is a legal doctrine whereby the court finds that a corporation lacks a separate identity from an individual or corporate shareholder. The court applies this rule to ignore the corporate status of a group of stockholders, officers, and directors of a corporation with respect to their limited liability.