Minnesota Contract with Independent Contractor for Systems Programming and Related Services

Description

How to fill out Contract With Independent Contractor For Systems Programming And Related Services?

Are you currently in a situation where you require documents for both business or personal reasons almost all the time.

There are numerous legal document templates available online, but finding trustworthy ones isn't simple.

US Legal Forms offers a vast array of form templates, such as the Minnesota Agreement with Independent Contractor for Systems Programming and Related Services, designed to meet federal and state regulations.

Once you find the correct form, simply click Buy now.

Choose the payment plan you prefer, fill out the necessary details to create your account, and complete the purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Agreement with Independent Contractor for Systems Programming and Related Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and make sure it is for your correct city/region.

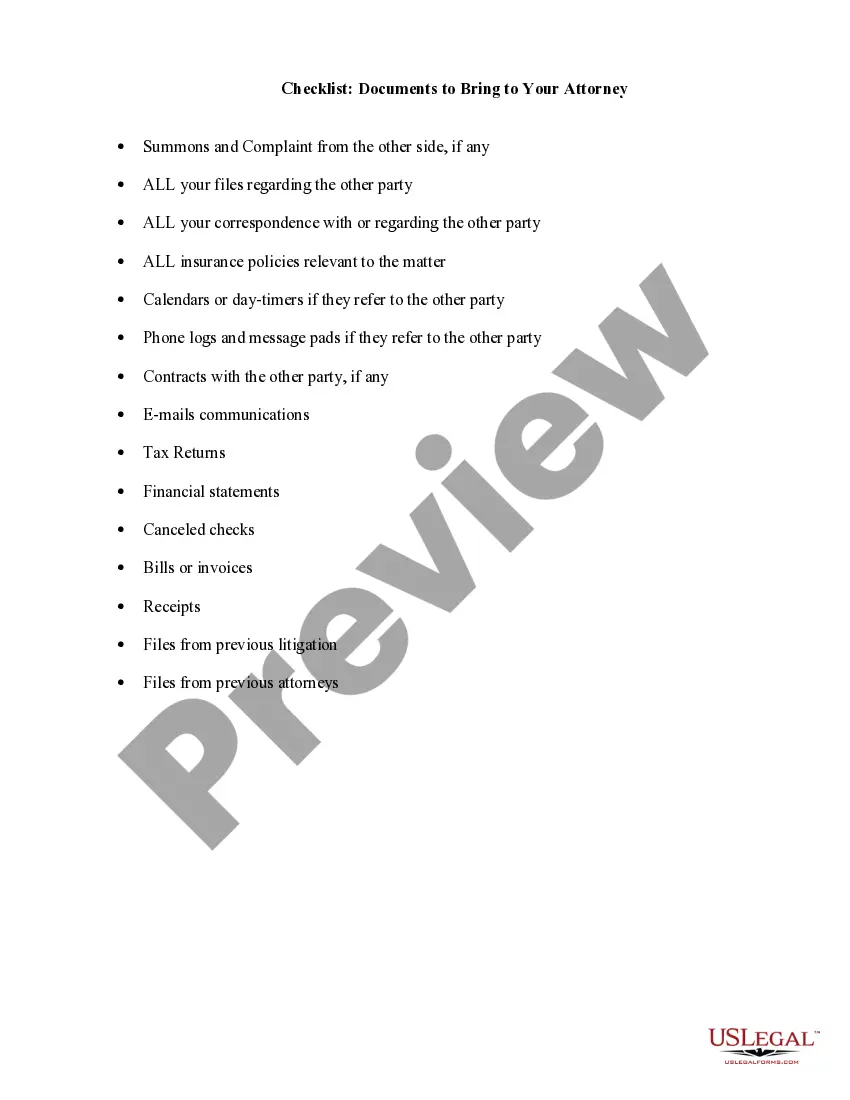

- Use the Review button to examine the form.

- Check the outline to confirm that you have selected the suitable form.

- If the form isn't what you are looking for, use the Lookup field to find the document that fits your needs and requirements.

Form popularity

FAQ

In Minnesota, the self-employment tax is calculated based on your net earnings from self-employment. This tax includes both Social Security and Medicare taxes. When engaging in projects under a Minnesota Contract with Independent Contractor for Systems Programming and Related Services, it is important to factor in this tax to determine your overall earnings and financial obligations.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

There are a few subtle distinctions between the two definitions. The definition of a contractor seems to be broader; it is anyone to whom a business makes available consumers' personal information for a business purpose, as opposed to a service provider who must "process information" for a business.

While the occasional family member/friend helping out as a server on a busy day, or an attorney who comes in once or twice a year to update corporate documents or assist with legal matters are typically classified as independent contractors, regular servers, bartenders, and even cooks usually fall under the employee

Understanding your new tax obligations is particularly important if you hire gig workers, like restaurant delivery workers, that are classified as independent contractors. You do not need to file the 1099-NEC form for any of your employees. They have their own dedicated form, Form W-2, that reports their wages.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

While the occasional family member/friend helping out as a server on a busy day, or an attorney who comes in once or twice a year to update corporate documents or assist with legal matters are typically classified as independent contractors, regular servers, bartenders, and even cooks usually fall under the employee

No, not if you received a W-2, which you should have as a server. If you received tips, there is a specific spot to enter those in TurboTax Online. Although, tips are not considered self-employment income.