Minnesota Estoppel Affidavit of Mortgagor

Description

How to fill out Estoppel Affidavit Of Mortgagor?

Are you presently in a location where you require documents for both business or specific needs on a daily basis.

There are numerous legal document templates available online, but finding ones you can trust is quite challenging.

US Legal Forms provides a vast array of template options, such as the Minnesota Estoppel Affidavit of Mortgagor, which is designed to comply with both federal and state regulations.

Once you find the appropriate form, click on Get now.

Choose the pricing plan you prefer, enter the required details to set up your account, and complete the payment using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Minnesota Estoppel Affidavit of Mortgagor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Review option to evaluate the form.

- Read the summary to confirm that you have selected the correct form.

- If the form is not what you seek, utilize the Search box to find the form that fits your needs and criteria.

Form popularity

FAQ

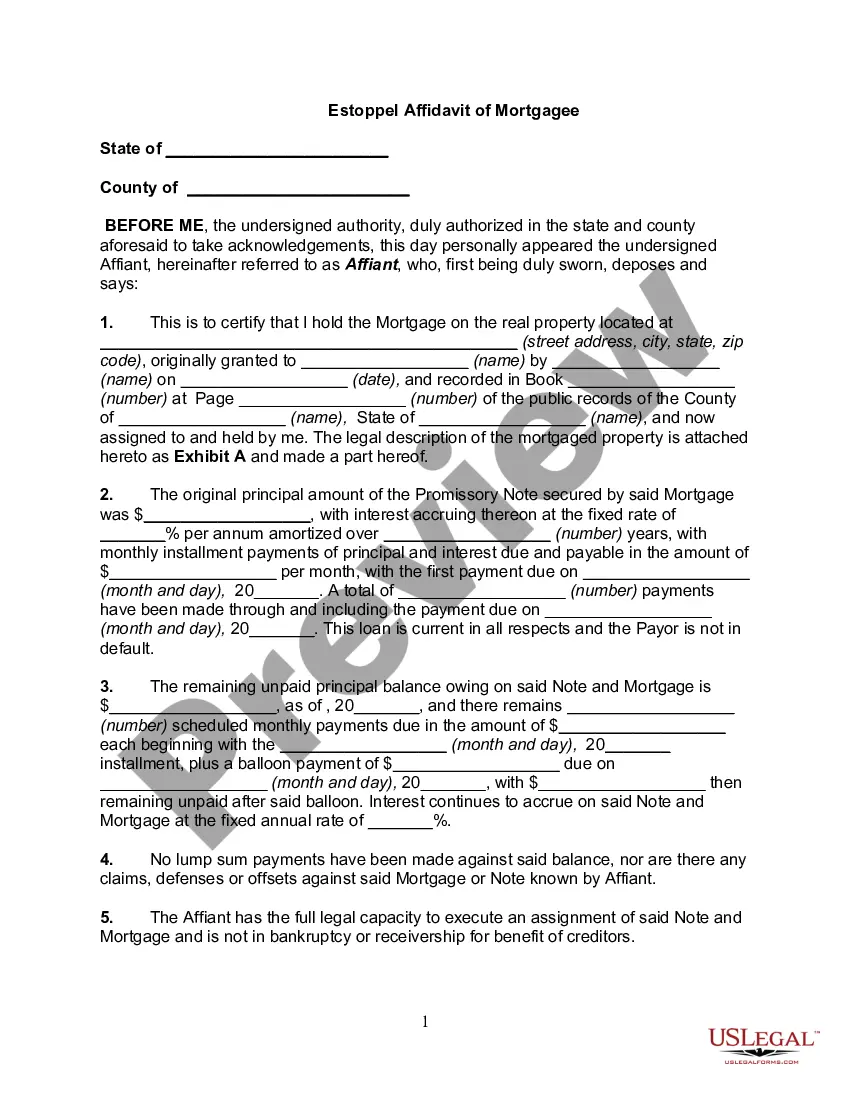

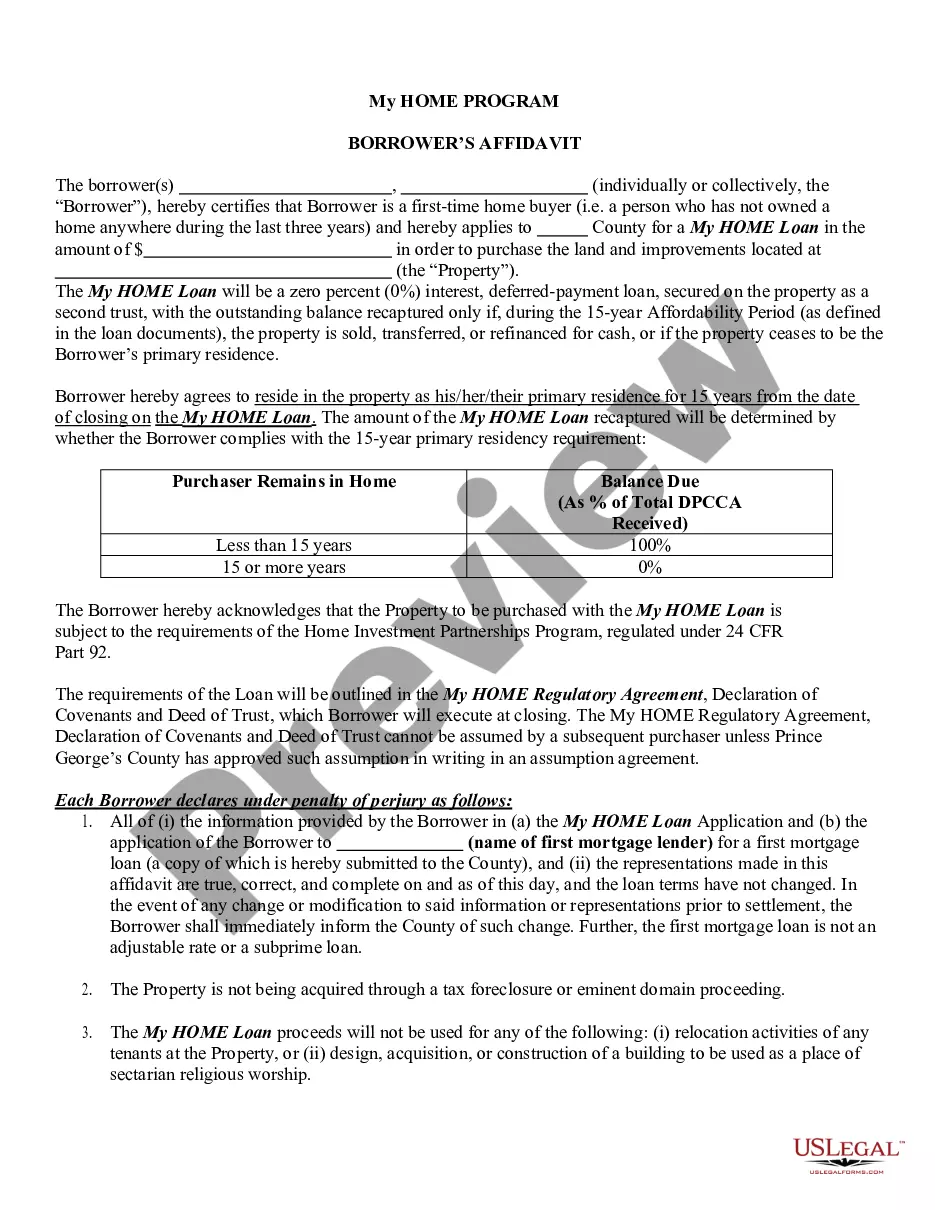

A mortgagor affidavit is a legal document that provides information about the mortgage and confirms the debt’s status. This affidavit can be beneficial for transparency and is often related to the Minnesota Estoppel Affidavit of Mortgagor. By utilizing such affidavits, homeowners can clarify obligations and rights regarding their property. It acts as a formal acknowledgment of the homeowner’s responsibilities.

To add a spouse to a deed in Minnesota, you must execute a new deed that includes both names. It’s advisable to use a Minnesota Estoppel Affidavit of Mortgagor, as it verifies the mortgage details and helps in clarifying ownership. After preparing the deed, you should have it notarized and recorded with your local county office. This process ensures that your spouse's ownership is legally recognized.

The Minnesota Estoppel Affidavit of Mortgagor serves a crucial function in validating claims related to property ownership and mortgage agreements. An affidavit is a written statement that individuals swear to be true, providing legal assurance to various parties involved in real estate transactions. By using this affidavit, mortgagors can clarify their rights and responsibilities, ensuring all parties are aware of the current mortgage status. This process promotes transparency and helps prevent future disputes.

A deed in lieu subject to means the new owner assumes the existing mortgage obligations, but the lender typically cannot pursue further claims against the borrower. This arrangement can simplify the transition of ownership, allowing borrowers to avoid the stress of foreclosure. When considering options like this, it's important to explore how documents such as the Minnesota Estoppel Affidavit of Mortgagor might play a role in clarifying mortgage responsibilities.

A deed in lieu of foreclosure in Virginia allows a home borrower to transfer ownership of their property to the lender to avoid foreclosure. This option can be a beneficial solution for both parties, as it often helps the borrower eliminate the debt and the lender to recover their investment without a lengthy legal process. While it might not directly relate to the Minnesota Estoppel Affidavit of Mortgagor, understanding such processes can provide essential insights when navigating mortgage complexities.

How to Obtain an Estoppel Certificate (4 steps)Step 1 Meet with the Tenant. The landlord will need to meet with the tenant and inform them that a new owner is purchasing the property.Step 2 Obtain the Original Lease.Step 3 Copies of Last 3 Months' Rent.Step 4 Get the Estoppel Notarized (by the tenant)

An estoppel letter sets forth the unpaid balance of a loan secured by the property.

What is the purpose of an estoppel letter? Estoppel letters protect new buyers from undisclosed financial obligations to the HOA left by the previous owner. Financial obligations are often included in negotiations to determine closing costs for the sale of a home.

Following are the most important details that you should include in a residential or commercial estoppel certificate form:Your name and the name of your tenant.The type of property (commercial or residential)The term of your lease.Details about the rent amount.The amount of the security deposit.

For instance, if a landlord agrees not to terminate a tenant's lease as long as the tenant spends money on improving the property, an estoppel certificate could prevent the landlord from going back on their word and terminating the lease, even when the promise may not have been written into a contract.