This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation

Description

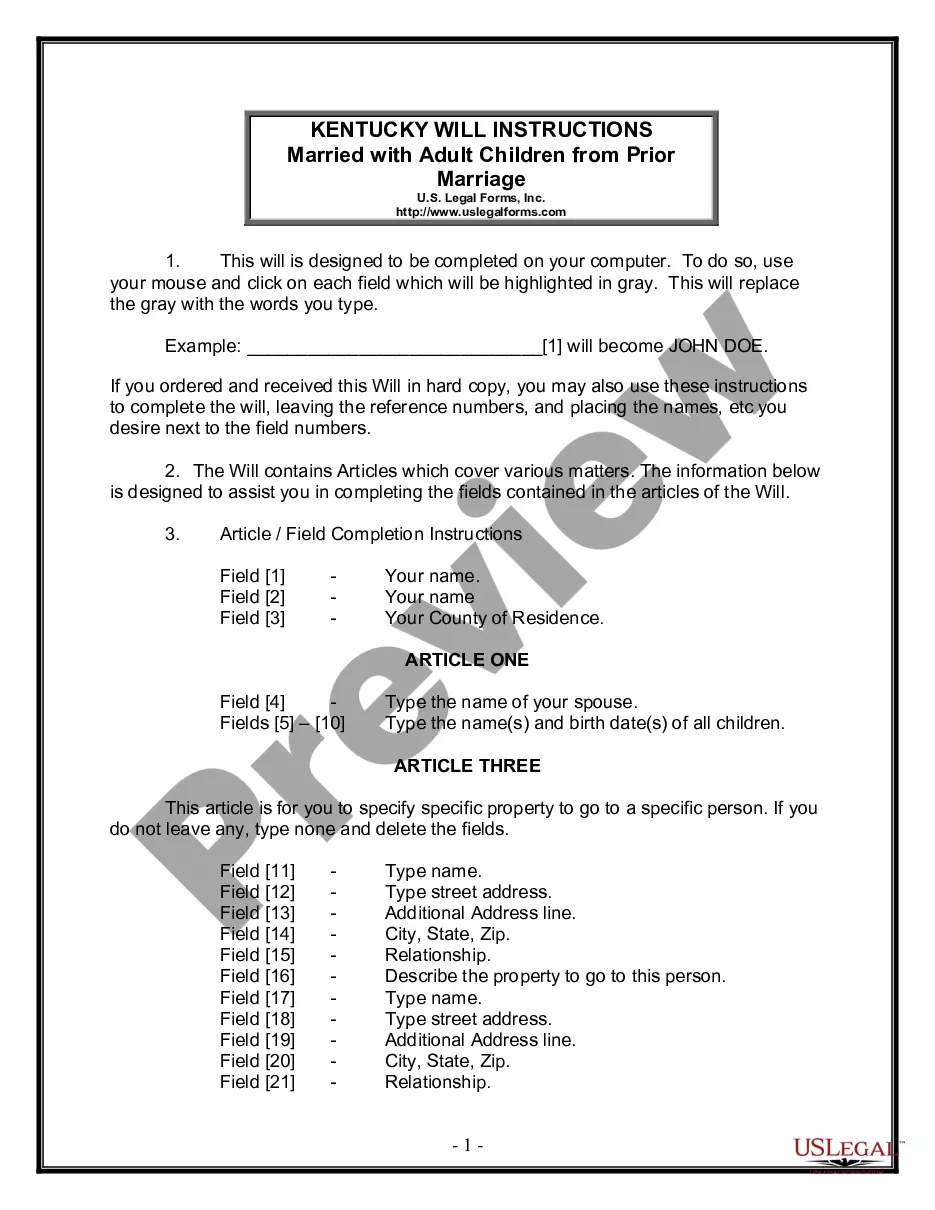

How to fill out Agreement To Incorporate To Erect Commercial Builder With Builder And Marketing Agent To Become Shareholders In The Corporation And The Building To Be Transferred To New Corporation?

Selecting the optimal approved document format can be quite challenging.

Obviously, there are numerous templates accessible online, but how can you find the official form you need.

Utilize the US Legal Forms website. This platform offers a multitude of templates, including the Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, which you can leverage for both business and personal purposes.

Initially, ensure you have selected the correct form for your city/region. You can review the form using the Review button and examine the form description to confirm that it is indeed the right one for your needs.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to receive the Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

- Utilize your account to search through the legal forms you have obtained previously.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

Form popularity

FAQ

To start an S Corporation in Minnesota, you need to file the appropriate paperwork with the state, including the Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation. Additionally, you must apply for S Corporation status with the IRS after forming your corporation. Using services like uslegalforms can streamline this process, ensuring you meet all legal requirements for your new business venture.

The 2% rule for S Corporations refers to the tax implications related to shareholder expenses. If an S Corporation does not provide a specific service or item to shareholders, then those costs can be scrutinized for tax deduction eligibility. By understanding this rule, you can ensure you set up your Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation in a way that complies with IRS regulations, ultimately benefitting your business.

Yes, you can set up an S Corporation on your own in Minnesota. However, it's important to ensure you follow all necessary steps, including filing the Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation. While you may manage this process alone, consulting experts or utilizing platforms like uslegalforms can simplify your journey and help you avoid common pitfalls.

In Minnesota, merger law governs the process by which two or more corporations join to form a new entity. This legal framework ensures that all parties involved, including shareholders of the merging corporations, are protected during the transition. When considering a Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, it is crucial to understand these laws. Consulting with legal professionals or utilizing platforms like uslegalforms can streamline the process and ensure compliance with state regulations.

Changing your registered agent in Minnesota requires you to submit a form either online or via mail to the Secretary of State’s office. You must provide information about your current registered agent and the one you wish to appoint. This change can help streamline your legal correspondence and is an essential part of maintaining effective operations under your Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

To change your registered agent in Minnesota, you need to file the appropriate form with the Secretary of State. This process usually involves providing the details of the new registered agent and paying any associated fees. By keeping your registered agent current, you uphold the integrity of your Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

Setting up an S Corp in Minnesota generally involves first forming a corporation and then filing Form 2553 with the IRS. Ensure that you meet the eligibility criteria set by the IRS, which typically includes having a limited number of shareholders and only one class of stock. This strategy is beneficial when intending to execute projects under a Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

To transfer ownership of an LLC in Minnesota, you should follow a structured approach that involves reviewing your operating agreement for any specific stipulations. You will typically need to prepare and file an amendment with the Secretary of State, reflecting the new ownership structure. Utilizing a clear and effective framework like the Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation can simplify this process.

Yes, you can serve as your own registered agent in Minnesota, provided you have a physical address in the state. Acting as your own registered agent can save you some costs, but you must be available during business hours to receive important documents. This option may work well when establishing your Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation.

In Minnesota, a corporation can only have one registered agent at a time. This agent serves as the official point of contact for legal documents, and having two can lead to confusion in correspondence. To ensure clarity and compliance within your Minnesota Agreement to Incorporate to Erect Commercial Builder with Builder and Marketing Agent to become Shareholders in the Corporation and the Building to be Transferred to New Corporation, designate one reliable registered agent.