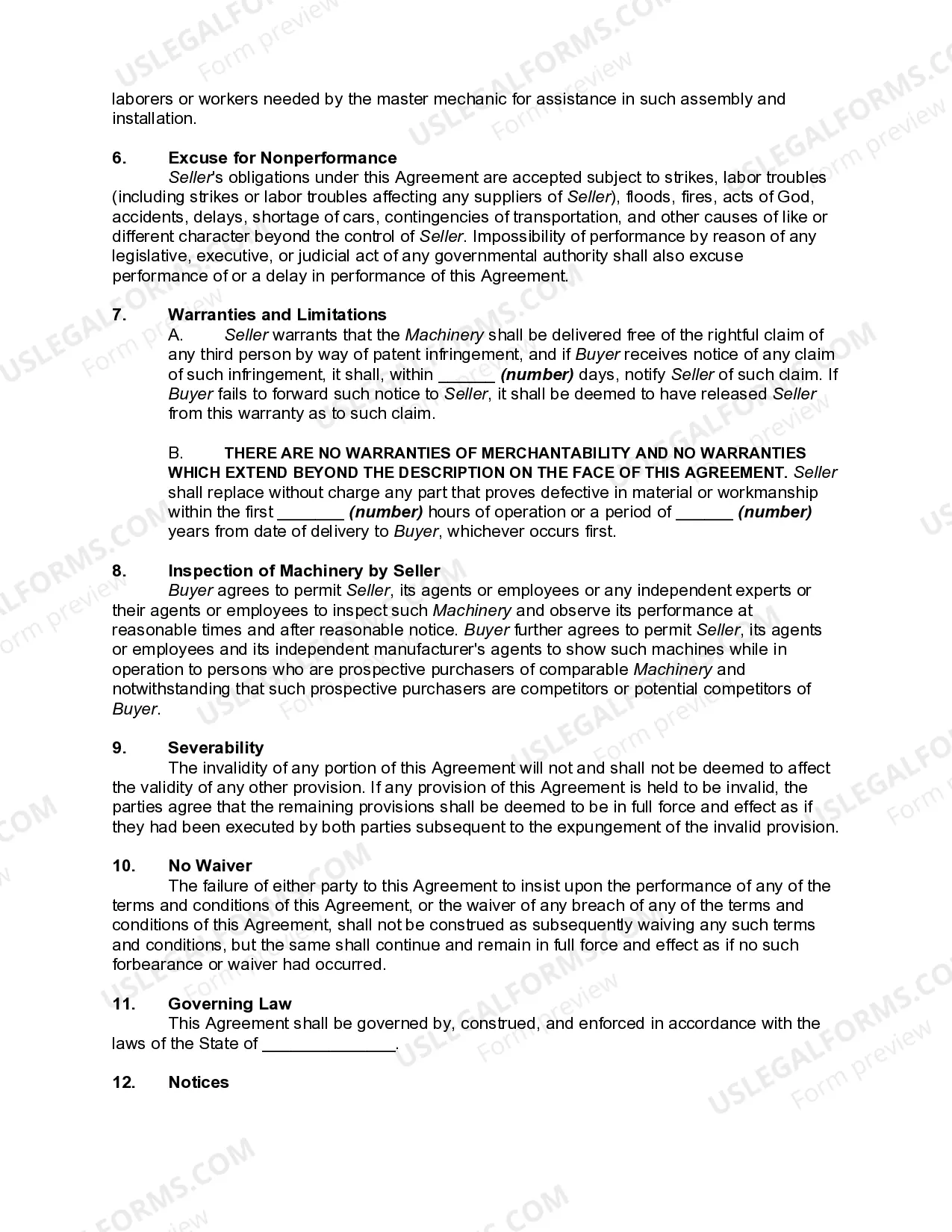

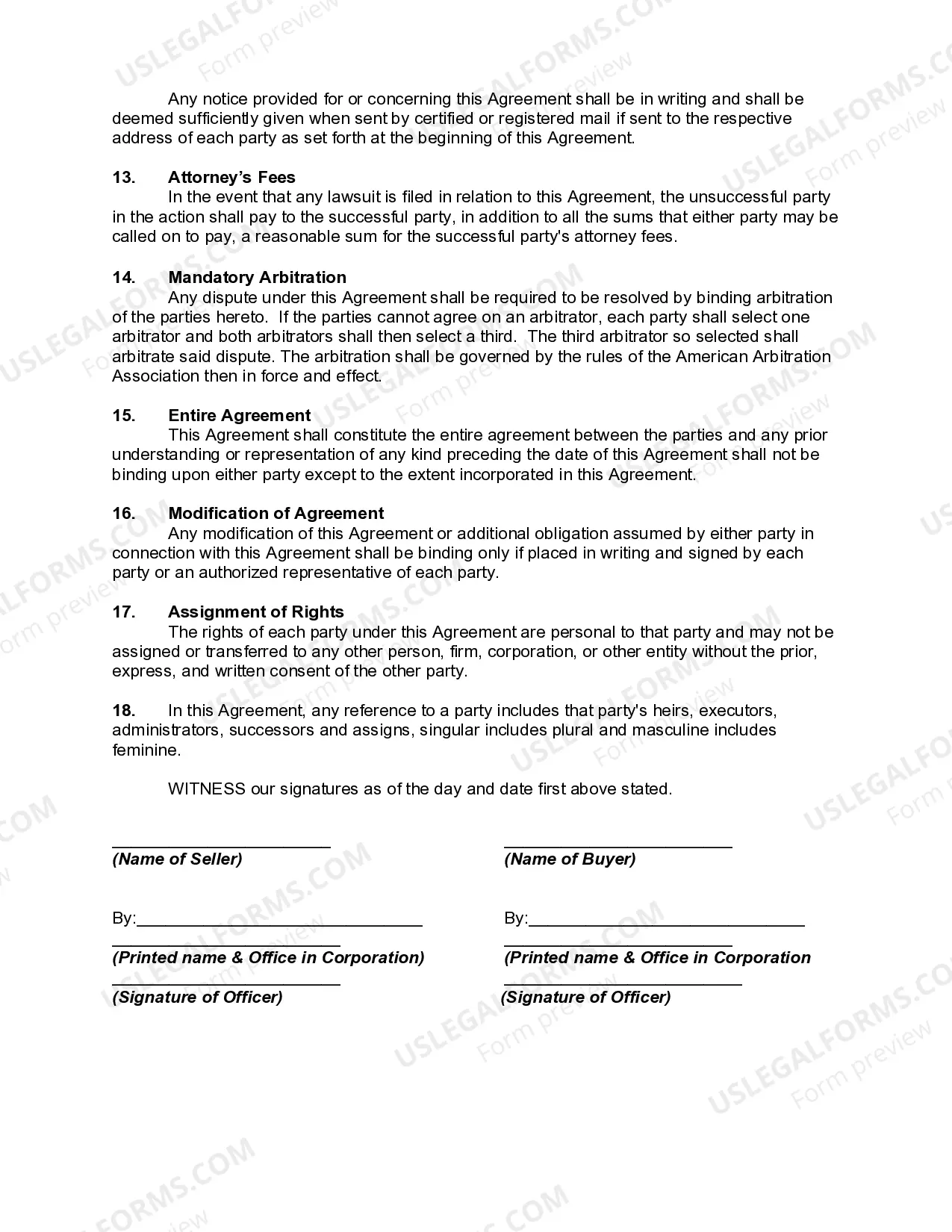

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Minnesota Agreement to Manufacture, Sell and Install Machinery

Description

How to fill out Agreement To Manufacture, Sell And Install Machinery?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal document templates that you can download or print. Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest templates, such as the Minnesota Agreement to Manufacture, Sell and Install Machinery, within moments.

If you already have a subscription, Log In and download the Minnesota Agreement to Manufacture, Sell and Install Machinery from the US Legal Forms library. The Download button will be available on each form you view. You can find all previously downloaded forms in the My documents section of your account.

Make edits. Fill in, modify, print, and sign the downloaded Minnesota Agreement to Manufacture, Sell and Install Machinery.

Every template you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Minnesota Agreement to Manufacture, Sell and Install Machinery with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- To use US Legal Forms for the first time, follow these straightforward instructions to get started.

- Ensure you have selected the correct form for your city/county. Click the Review button to view the form's details. Check the form description to confirm you've selected the right one.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- Once you're satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the subscription plan you prefer and provide your information to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the payment.

- Choose the format and download the form to your device.

Form popularity

FAQ

Manufacturing supplies can be taxable in Minnesota unless they meet certain criteria outlined in the Minnesota Agreement to Manufacture, Sell and Install Machinery. Supplies that become part of the finished product are usually exempt, while general office supplies are often taxable. Understanding these distinctions can significantly impact your bottom line, so it's advisable to consult tax professionals for specific guidance.

Yes, under specific circumstances, business equipment can be tax-exempt in Minnesota, especially when associated with the Minnesota Agreement to Manufacture, Sell and Install Machinery. Equipment used directly for manufacturing may qualify for this exemption, reducing your business's overall tax liability. This exemption aims to encourage investment in manufacturing, ultimately boosting the state's economy.

In Minnesota, the taxability of installation services largely depends on the context of the sale. Generally, if you are installing machinery under a Minnesota Agreement to Manufacture, Sell and Install Machinery, the installation may be considered part of the sale and could be subject to sales tax. However, exceptions exist based on the nature of the machinery and the installation service provided. For clarity, consider consulting resources from US Legal Forms to ensure compliance with local tax regulations.

In Minnesota, certain items may be exempt from sales tax under specific conditions. For example, machinery and equipment used in manufacturing might qualify for exemptions if they are directly used in production. Specifically, if you are operating under a Minnesota Agreement to Manufacture, Sell and Install Machinery, understanding these exemptions can benefit your business. It is essential to consult legal guidance or resources like US Legal Forms to navigate the details.

In Minnesota, installation labor is generally taxable unless specific exemptions apply. Therefore, when drafting a Minnesota Agreement to Manufacture, Sell and Install Machinery, consider how labor costs factor into your overall expenses. Consulting with a tax professional can clarify whether your installation labor qualifies for any exemptions.

Examples of capital equipment include manufacturing machinery, vehicles used for transportation of goods, and tools required for assembly. Under the Minnesota Agreement to Manufacture, Sell and Install Machinery, identifying these items can provide insight into your business's financial planning. Knowing what constitutes capital equipment helps ensure you take full advantage of tax exemptions available.

Capital equipment refers to long-term tangible assets that a business uses to produce goods and services. This includes machinery and tools that are necessary for production processes. Recognizing the significance of capital equipment, especially under the Minnesota Agreement to Manufacture, Sell and Install Machinery, allows businesses to plan budgets and maximize operational effectiveness.

Yes, manufacturing equipment is generally tax exempt in Minnesota, provided it meets specific criteria outlined in state law. This includes machinery employed in the production of goods for resale. By understanding these tax exemptions, businesses can leverage the Minnesota Agreement to Manufacture, Sell and Install Machinery to reduce expenses and enhance profitability.

Capital equipment typically includes machinery, tools, and other devices that are integral to production processes. Under the Minnesota Agreement to Manufacture, Sell and Install Machinery, items such as manufacturing equipment, computer systems, and specialized tools fall under this category. Properly identifying your capital equipment can lead to tax advantages and increased operational efficiency.

In Minnesota, three items commonly exempt from sales tax include machinery used for manufacturing, equipment used for certain production processes, and materials consumed in production. These exemptions are particularly relevant when drafting a Minnesota Agreement to Manufacture, Sell and Install Machinery. Knowing these tax exemptions can help you reduce overall costs and maximize your investment.