Are you inside a place that you will need documents for either company or specific reasons nearly every time? There are plenty of lawful document web templates available online, but getting ones you can rely isn`t easy. US Legal Forms delivers a huge number of kind web templates, like the Minnesota Alimony Trust in Lieu of Alimony and all Claims, that are written in order to meet federal and state demands.

When you are previously knowledgeable about US Legal Forms internet site and also have your account, basically log in. Following that, you may download the Minnesota Alimony Trust in Lieu of Alimony and all Claims template.

If you do not offer an bank account and want to start using US Legal Forms, abide by these steps:

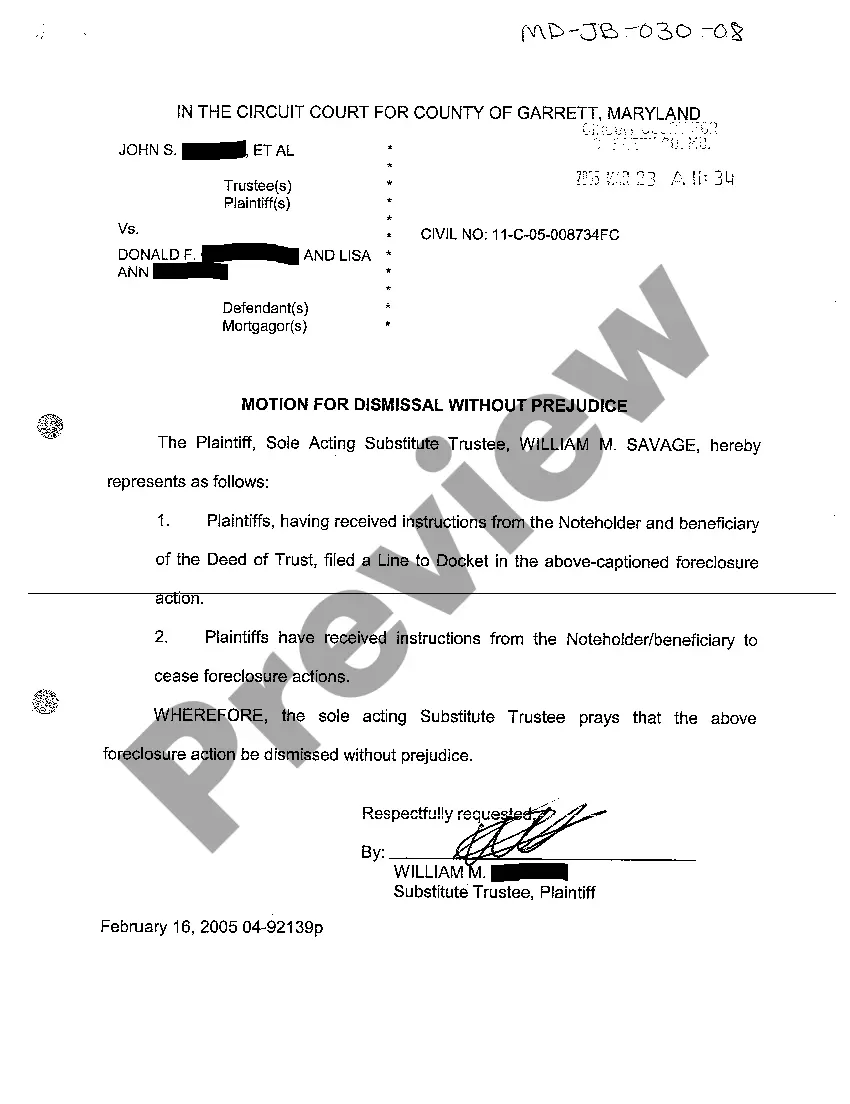

- Obtain the kind you will need and ensure it is for the appropriate area/area.

- Utilize the Preview option to review the form.

- See the explanation to actually have selected the right kind.

- In case the kind isn`t what you are searching for, make use of the Look for field to obtain the kind that meets your needs and demands.

- If you find the appropriate kind, click Purchase now.

- Pick the rates strategy you would like, fill in the necessary information to generate your money, and purchase the order making use of your PayPal or charge card.

- Choose a convenient document structure and download your duplicate.

Find all of the document web templates you have purchased in the My Forms food list. You can get a further duplicate of Minnesota Alimony Trust in Lieu of Alimony and all Claims whenever, if required. Just click on the essential kind to download or produce the document template.

Use US Legal Forms, probably the most comprehensive collection of lawful forms, in order to save some time and avoid errors. The service delivers skillfully manufactured lawful document web templates which you can use for a selection of reasons. Produce your account on US Legal Forms and commence making your life a little easier.