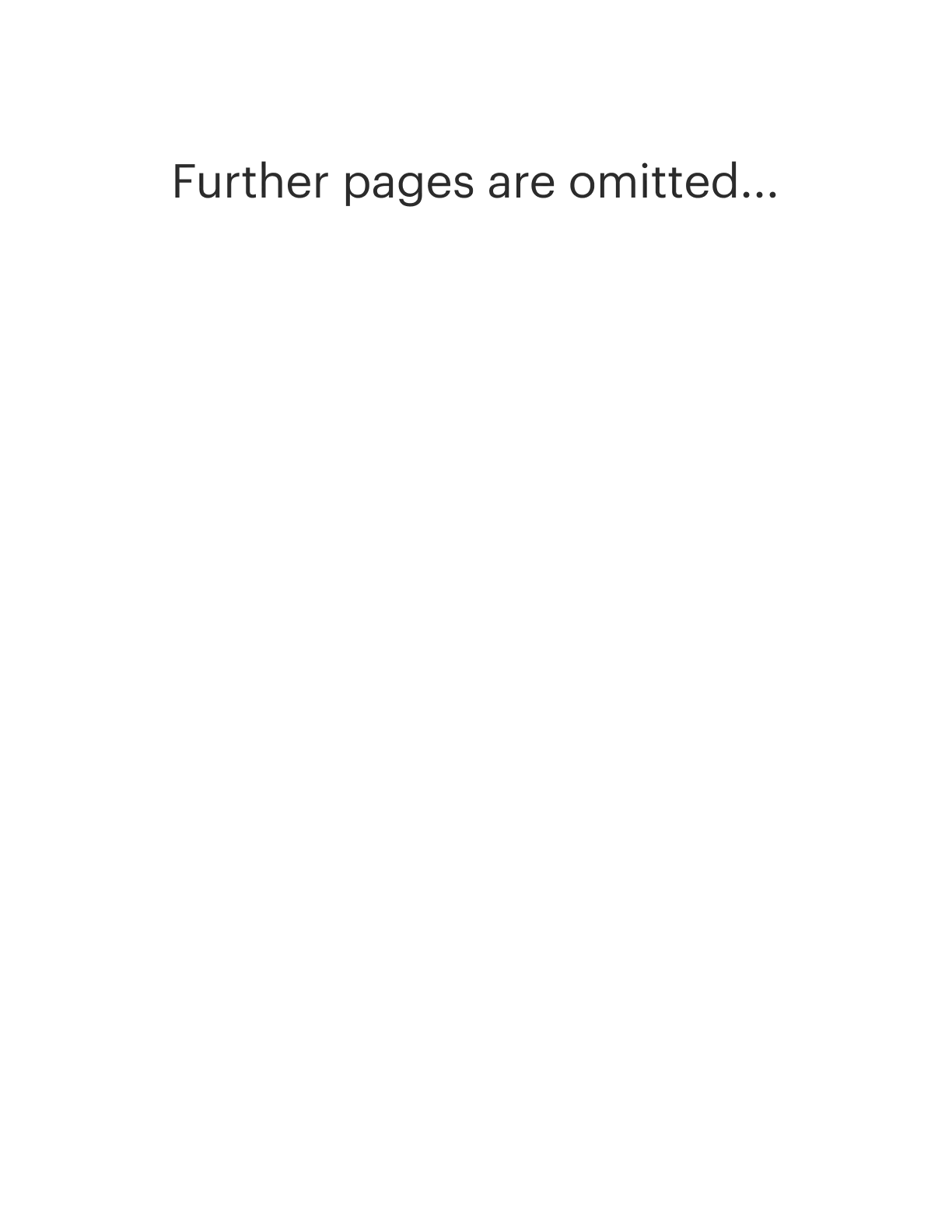

Minnesota Irrevocable Letter of Credit

Description

How to fill out Irrevocable Letter Of Credit?

If you want to total, obtain, or print lawful record layouts, use US Legal Forms, the greatest selection of lawful kinds, which can be found on the Internet. Make use of the site`s basic and convenient research to get the files you need. A variety of layouts for enterprise and person functions are categorized by classes and suggests, or search phrases. Use US Legal Forms to get the Minnesota Irrevocable Letter of Credit within a couple of mouse clicks.

Should you be previously a US Legal Forms consumer, log in in your accounts and click the Down load switch to find the Minnesota Irrevocable Letter of Credit. You can also access kinds you earlier downloaded from the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the form for your right metropolis/region.

- Step 2. Use the Review method to examine the form`s content. Do not forget about to learn the outline.

- Step 3. Should you be unsatisfied with all the type, use the Lookup area on top of the display screen to get other variations in the lawful type web template.

- Step 4. Upon having located the form you need, go through the Buy now switch. Choose the pricing plan you prefer and add your qualifications to register for the accounts.

- Step 5. Method the transaction. You should use your charge card or PayPal accounts to finish the transaction.

- Step 6. Choose the file format in the lawful type and obtain it on the device.

- Step 7. Comprehensive, revise and print or indicator the Minnesota Irrevocable Letter of Credit.

Each lawful record web template you acquire is your own property for a long time. You might have acces to every type you downloaded within your acccount. Select the My Forms segment and choose a type to print or obtain yet again.

Compete and obtain, and print the Minnesota Irrevocable Letter of Credit with US Legal Forms. There are thousands of professional and condition-distinct kinds you may use to your enterprise or person demands.

Form popularity

FAQ

Banks will usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit. For example, the bank may charge 0.75% of the amount that it's guaranteeing.

A sight LC becomes due as soon as the beneficiary presents the proof of delivery or proof of shipment, and other ancillary documents. On the other hand, a Time LC needs certain days to pass after submitting a letter of credit, proof of delivery or shipment, and other required documents, before the payment becomes due.

A buyer will typically pay anywhere between 0.75% and 1.5% of the transaction's value, depending on the locations of the issuing banks. Sellers may find that their fees are structured slightly differently.

For a secured revocable letter of credit, the buyer has to give a personal guarantee or mortgage security. For an unsecured revocable letter of credit, the bank checks the creditworthiness of the buyer. Please note in both instances, the bank can revoke the LC.

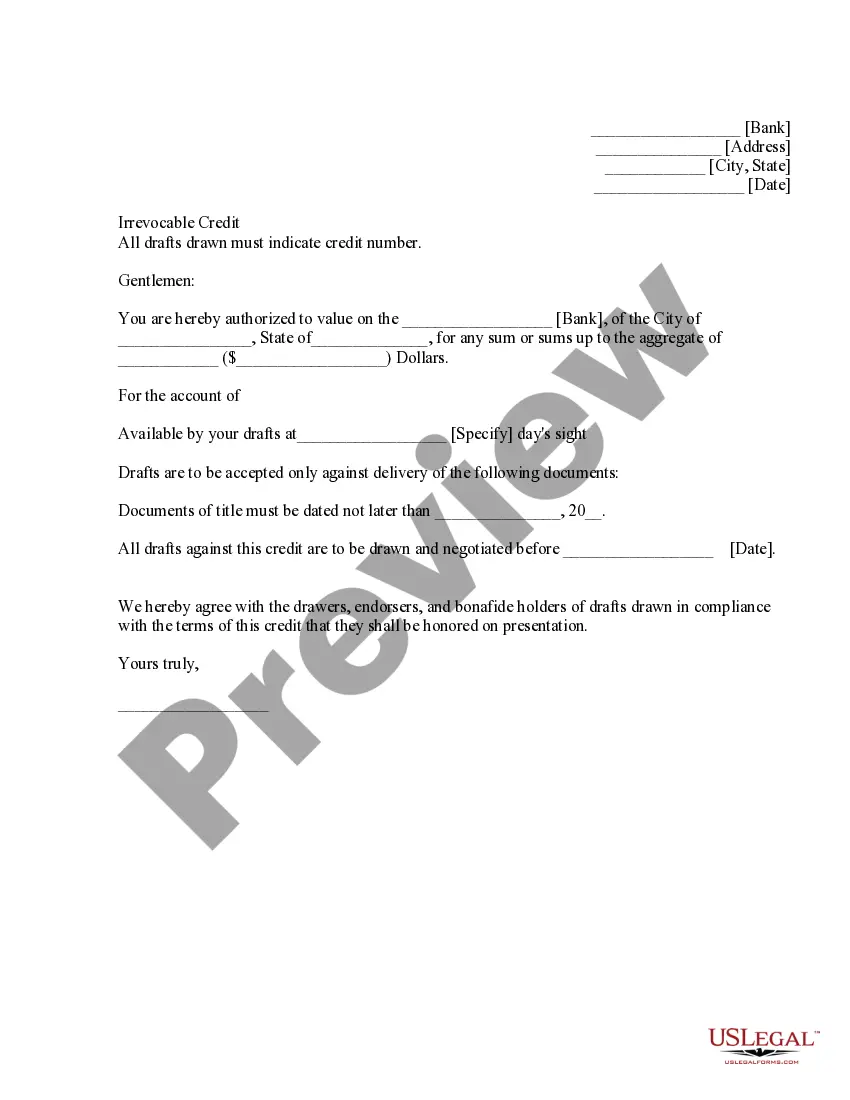

The most common types of letters of credit today are commercial letters of credit, standby letters of credit, revocable letters of credit, irrevocable letters of credit, revolving letters of credit, and red clause letters of credit, although there are several other types of letters of credit.

An irrevocable letter of credit should always be obtained from a commercial bank and not drafted by the importer or exporter.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

Letters of credit are similar to bank guarantees (BGs), with the difference being that bank guarantees are used for a variety of different situations ? while letters of credit are mainly used for import/export. A letter of credit is also known as a documentary credit (DC or D/C) and is a form of trade finance.