Minnesota Sale or Return

Description

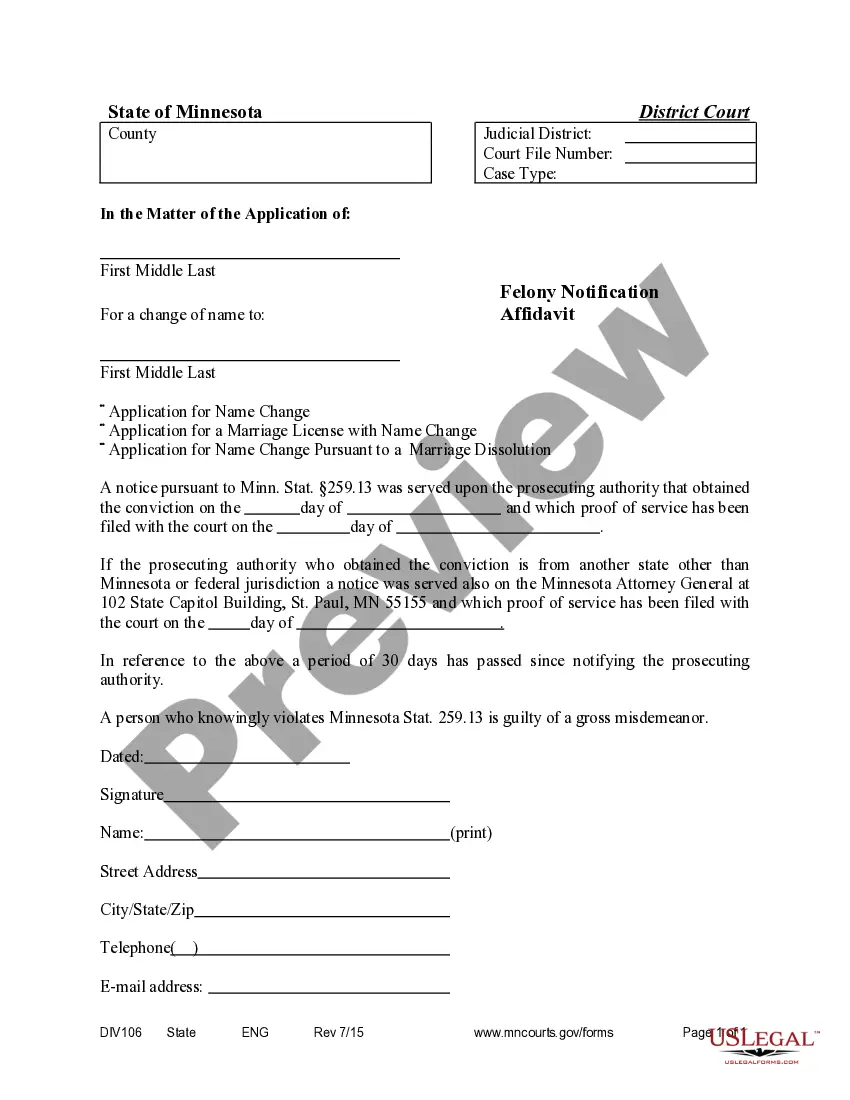

How to fill out Sale Or Return?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms provides thousands of legal documents that are evaluated by experts.

You can conveniently download or print the Minnesota Sale or Return document from the services.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Next, you can fill out, edit, print, or sign the Minnesota Sale or Return.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any acquired document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the area/city of your preference.

- Check the document description to make sure you have selected the correct form.

Form popularity

FAQ

The 3-day right of rescission in Minnesota grants consumers the ability to cancel certain transactions within three days of signing a contract. This right applies primarily to specific types of sales, ensuring that buyers make informed decisions. Utilizing the Minnesota Sale or Return option can further protect your interests during such transactions.

To qualify for a tax exemption in Minnesota, an individual or entity must meet specific requirements set by the state. Common exemptions include purchases for resale or items utilized in production. Understanding the criteria for Minnesota Sale or Return exemptions helps ensure compliance and avoids unnecessary fees.

In Minnesota, the return policy may vary by retailer, but generally, consumers have a right to return unwanted items. Under the Minnesota Sale or Return agreement, you can return items within a specified period, usually within three days. This policy helps protect you, ensuring satisfaction with your purchases.

The Minnesota state tax exemption allows certain purchases to be made without incurring sales tax. This exemption applies to qualified buyers who meet specific criteria. To benefit from the Minnesota Sale or Return program, it is essential to understand what qualifies for these exemptions so you can optimize your purchases.

To obtain a resale certificate in Minnesota, start by ensuring you hold a valid seller's permit. Then, you can either obtain the certificate from your suppliers or download it from the Minnesota Department of Revenue’s website. By using uslegalforms, you can access templates and expert assistance to streamline the process and ensure your application is in line with Minnesota Sale or Return best practices.

A resale certificate in Minnesota does not have a set expiration date but remains valid as long as the seller's permit is active and the resale intentions are genuine. Regularly review your status to ensure compliance with state requirements. For details about maintaining this certificate, refer to resources available on uslegalforms.

In Minnesota, you can get a resale certificate by submitting a request to the Minnesota Department of Revenue or directly from your suppliers. It's crucial to include the reason for the certificate and the specific products you plan to buy for resale. Utilize uslegalforms to ensure that you fill out the required documentation accurately and efficiently.

Getting a seller's permit in Minnesota involves applying through the Minnesota Department of Revenue. You will need to provide information about your business, including its legal structure and anticipated sales. Consider uslegalforms to simplify the application process with ready-to-use templates and expert advice tailored to Minnesota Sale or Return.

To obtain a certificate of resale in Minnesota, you need to complete the appropriate application form provided by the Minnesota Department of Revenue. Make sure to include all required information, such as your business details and the type of products you intend to resell. You can also use uslegalforms to find the proper forms and guidance tailored to your situation.

Income from an estate sale can be taxable, depending on the type of items sold and the total income. If you sell items for more than your adjusted basis, the gain may be subject to taxation. Understanding the nuances of the Minnesota Sale or Return laws can help you clarify your tax obligations. U.S. Legal Forms offers useful guides on reporting and taxation for estate sales.